National insurance sick pay Idea

Home » Trending » National insurance sick pay IdeaYour National insurance sick pay images are available in this site. National insurance sick pay are a topic that is being searched for and liked by netizens now. You can Download the National insurance sick pay files here. Get all free images.

If you’re searching for national insurance sick pay pictures information linked to the national insurance sick pay keyword, you have visit the right site. Our site frequently provides you with hints for seeing the maximum quality video and image content, please kindly surf and find more enlightening video articles and images that fit your interests.

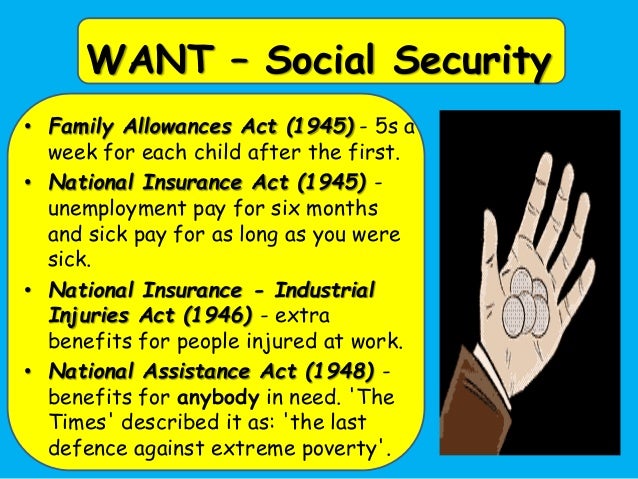

National Insurance Sick Pay. You are not currently claiming jobseekers’ allowance (jsa). You are not currently claiming statutory sick pay or statutory maternity pay through an employer. Sick pay is paid at a standard rate of £81.60 a week. The employer paid 3 pence, and general taxation paid 2 pence (lloyd george called it the ninepence for fourpence).

Changes to Statutory Sick Pay From porterdodson.co.uk

All workers who earned under £160 a year had to pay 4 pence a week to the scheme; • increase the rate of sick pay to the rate of a week’s pay at the national living wage (currently £8.21 per hour); Class 1a national insurance contributions are due on the amount of termination awards paid to employees which exceed £30,000 and on the amount of sporting testimonial payments paid by independent. You must start making ssp payments when an employee has been incapable of working for four consecutive days (including weekends and holidays) due to illness. Your insurer will pay the injury and sickness allowance for a period no longer than 1 year and 6 months. Before leaving the uk you paid a set amount in national insurance contributions for 3 years or more.

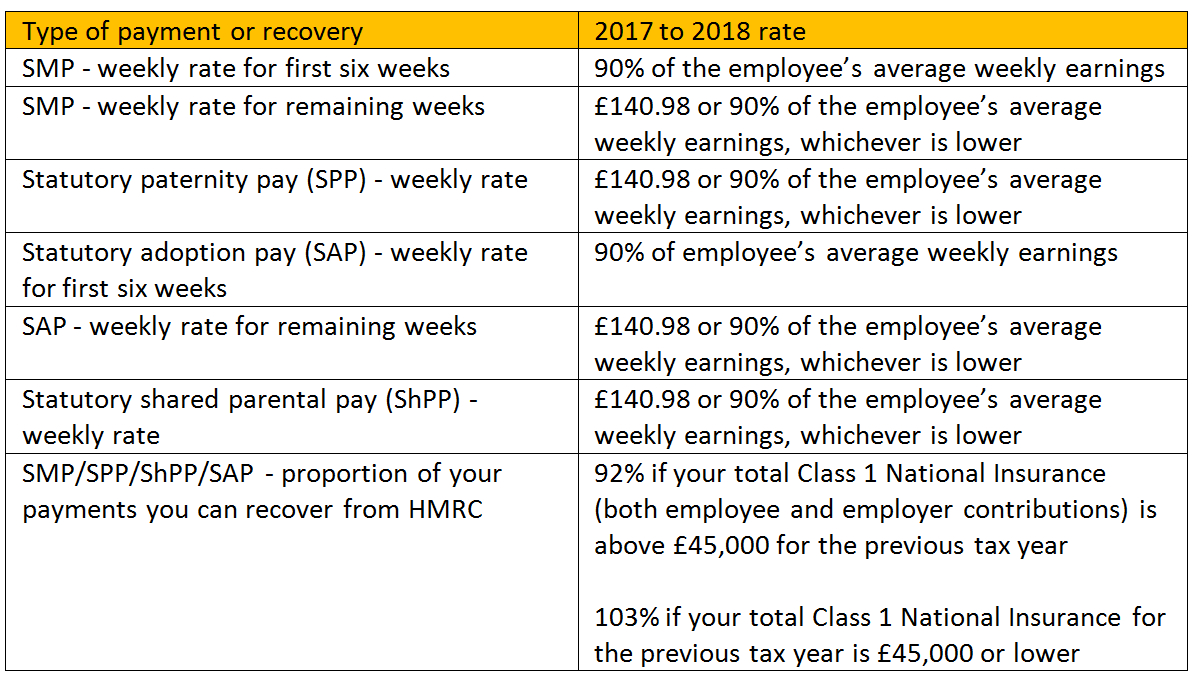

National insurance contributions statutory sick pay statutory maternity pay written by david william williams, published by anonim which was released on 05 february 1991.

Your statutory sick pay will be paid in the same way as your normal wages. Download national insurance contributions statutory sick pay statutory maternity pay books now! • increase the rate of sick pay to the rate of a week’s pay at the national living wage (currently £8.21 per hour); Benefit is paid at the rate of 60 percent of the claimant�s average weekly insurable wage, up to the ceiling of $250; You pay mandatory national insurance if you’re 16 or over and are either: However, this does not mean that you can get the allowance for every day during the 1.5 years.

Source: brightpay.co.uk

Source: brightpay.co.uk

If your ssp has ended, or you don�t qualify for it, your employer must fill in and give you form ssp1. Great britain (1) the social security administration act 1992 (c. Up to 5th april 2019: Produce an employer payment record that works out how much you need to pay hmrc contain calculators to help you to work out statutory payments such as statutory sick pay employer for less than 3 years, phone employer for 3 years or more, phone if you have a hearing or speech impairment and use a textphone, phone help and guidance Available in pdf, epub, mobi format.

Source: pinterest.com

Source: pinterest.com

National insurance provided welfare provision for workers (but not their families). Produce an employer payment record that works out how much you need to pay hmrc contain calculators to help you to work out statutory payments such as statutory sick pay employer for less than 3 years, phone employer for 3 years or more, phone if you have a hearing or speech impairment and use a textphone, phone help and guidance Payment of sickness benefit is made by way of benefit payment vouchers, which can be encashed at any of the national insurance offices, post offices and commercial banks. When do you have to begin paying statutory sick pay? Your insurer will pay the injury and sickness allowance for a period no longer than 1 year and 6 months.

Source: bburecruit.com

Source: bburecruit.com

Sick pay is paid at a standard rate of £81.60 a week. The act provided for sick pay and unemployment in some industries. Statutory sick pay and statutory maternity pay 9 compliance regime for statutory sick pay and statutory maternity pay: If your ssp has ended, or you don�t qualify for it, your employer must fill in and give you form ssp1. Class 2 ni is cheaper than class 3 and comes with all the benefits.

Source: pinterest.com

Source: pinterest.com

Download national insurance contributions statutory sick pay statutory maternity pay books now! You are not currently claiming jobseekers’ allowance (jsa). National insurance provided welfare provision for workers (but not their families). This form explains why ssp has not been paid or why it is ending, as well as the last date of payment. It acts as a form of social security, since payment of ni contributions establishes entitlement to certain state benefits for workers and their families.

Source: brightpay.co.uk

Source: brightpay.co.uk

The employer paid 3 pence, and general taxation paid 2 pence (lloyd george called it the ninepence for fourpence). Introduced by the national insurance act 1911 and expanded by the labour government in 1948, the system has been subjected to. Up to 5th april 2019: Sick pay is paid at a standard rate of £81.60 a week. How is statutory sick pay paid?

Source: slideshare.net

Source: slideshare.net

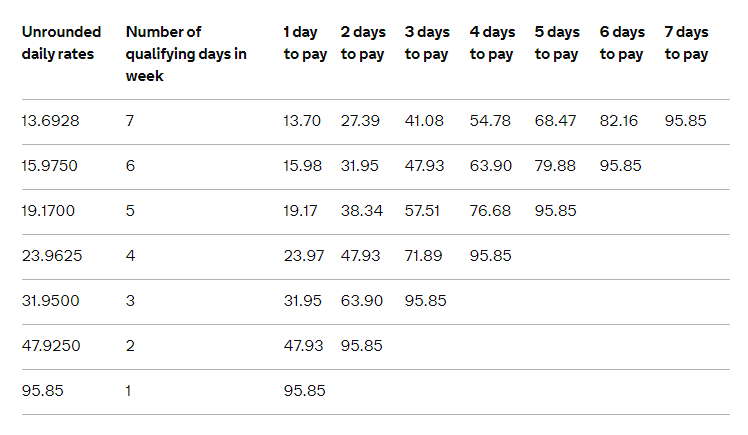

(2) in section 130 (duties of employers: You pay mandatory national insurance if you’re 16 or over and are either: Your statutory sick pay will be paid in the same way as your normal wages. The payment rate is £18.41 per day. You must start making ssp payments when an employee has been incapable of working for four consecutive days (including weekends and holidays) due to illness.

Source: centerforhealthjournalism.org

Source: centerforhealthjournalism.org

Download national insurance contributions statutory sick pay statutory maternity pay books now! Generally the rates and thresholds of the different ‘classes’ of nics are set annually by means of secondary legislation. Statutory sick pay and claims for other benefits), after subsection (4) insert— “ (5) regulations made with the concurrence of the. Class 1a national insurance contributions are due on the amount of termination awards paid to employees which exceed £30,000 and on the amount of sporting testimonial payments paid by independent. The minimum payment for sickness benefit is $66.42 per week, and the maximum is $300 per week (as of january 1, 2011).

Source: nefl.us

Source: nefl.us

Sickness benefit is not paid for illness caused by the Claimant earns $560 per week and claims sickness benefit for 6 days contributions used prior to claim = 13 weeks average weekly insurable earnings = total insurable earnings/13 = ($560 x 13 weeks)/13 = ($7280)/13 = $560.00 daily rate = ($560.00 x 65%)/6 = $60.70 benefit payable: You pay mandatory national insurance if you’re 16 or over and are either: Workers would receive 10 shillings per week for the first 13 weeks of sickness. Payment of sickness benefit is made by way of benefit payment vouchers, which can be encashed at any of the national insurance offices, post offices and commercial banks.

Source: hrzone.com

Source: hrzone.com

The minimum payment for sickness benefit is $66.42 per week, and the maximum is $300 per week (as of january 1, 2011). You are not currently claiming jobseekers’ allowance (jsa). The minimum payment for sickness benefit is $66.42 per week, and the maximum is $300 per week (as of january 1, 2011). Benefit is paid at the rate of 60 percent of the claimant�s average weekly insurable wage, up to the ceiling of $250; If your ssp has ended, or you don�t qualify for it, your employer must fill in and give you form ssp1.

Source: om.uk

Source: om.uk

Produce an employer payment record that works out how much you need to pay hmrc contain calculators to help you to work out statutory payments such as statutory sick pay employer for less than 3 years, phone employer for 3 years or more, phone if you have a hearing or speech impairment and use a textphone, phone help and guidance The act provided for sick pay and unemployment in some industries. Produce an employer payment record that works out how much you need to pay hmrc contain calculators to help you to work out statutory payments such as statutory sick pay employer for less than 3 years, phone employer for 3 years or more, phone if you have a hearing or speech impairment and use a textphone, phone help and guidance The rates for most people for the 2021 to 2022 tax year are: Statutory sick pay and claims for other benefits), after subsection (4) insert— “ (5) regulations made with the concurrence of the.

Source: vjhaccountancy.co.uk

Source: vjhaccountancy.co.uk

Statutory sick pay can be paid for up to 28 weeks. Class 2 ni is cheaper than class 3 and comes with all the benefits. When do you have to begin paying statutory sick pay? Statutory sick pay can be paid for up to 28 weeks. If they are sick for ten working days statutory sick pay ssp is 7 days x £18.41 = £128.87.

Source: livelifesimply-mari.blogspot.com

• increase the rate of sick pay to the rate of a week’s pay at the national living wage (currently £8.21 per hour); The rates for most people for the 2021 to 2022 tax year are: Class 1a national insurance contributions are due on the amount of termination awards paid to employees which exceed £30,000 and on the amount of sporting testimonial payments paid by independent. Introduced by the national insurance act 1911 and expanded by the labour government in 1948, the system has been subjected to. When do you have to begin paying statutory sick pay?

Source: happinessman.co.uk

Source: happinessman.co.uk

It�s paid by your employer but, if your employer goes bust, hmrc will pay your ssp instead. The tuc has launched a campaign calling for ‘sick pay for all’. Produce an employer payment record that works out how much you need to pay hmrc contain calculators to help you to work out statutory payments such as statutory sick pay employer for less than 3 years, phone employer for 3 years or more, phone if you have a hearing or speech impairment and use a textphone, phone help and guidance (2) in section 130 (duties of employers: National insurance contributions statutory sick pay statutory maternity pay written by david william williams, published by anonim which was released on 05 february 1991.

Source: abcorg.net

Source: abcorg.net

All workers who earned under £160 a year had to pay 4 pence a week to the scheme; Up to 5th april 2019: This amount will be increased to $400 weekly as of january, 1999. Great britain (1) the social security administration act 1992 (c. • increase the rate of sick pay to the rate of a week’s pay at the national living wage (currently £8.21 per hour);

Source: porterdodson.co.uk

You must start making ssp payments when an employee has been incapable of working for four consecutive days (including weekends and holidays) due to illness. However, this does not mean that you can get the allowance for every day during the 1.5 years. When do you have to begin paying statutory sick pay? Statutory sick pay can be paid for up to 28 weeks. Your statutory sick pay will be paid in the same way as your normal wages.

Source: pennyhills.com

Source: pennyhills.com

However, this does not mean that you can get the allowance for every day during the 1.5 years. The payment rate is £18.41 per day. $60.70 x 3 days = $182.00 (3 waiting days have been deducted) Statutory sick pay and statutory maternity pay 9 compliance regime for statutory sick pay and statutory maternity pay: You are not currently claiming jobseekers’ allowance (jsa).

Source: johnmtaylor.co.uk

Source: johnmtaylor.co.uk

£184 to £967 a week (£797 to £4,189 a month). If your ssp has ended, or you don�t qualify for it, your employer must fill in and give you form ssp1. If they are sick for ten working days statutory sick pay ssp is 7 days x £18.41 = £128.87. It�s paid by your employer but, if your employer goes bust, hmrc will pay your ssp instead. You are not currently claiming statutory sick pay or statutory maternity pay through an employer.

Source: mfw.co.uk

Source: mfw.co.uk

Class 1 national insurance rate. You are not currently claiming statutory sick pay or statutory maternity pay through an employer. You can get £96.35 a week statutory sick pay (ssp) for up to 28 weeks. Great britain (1) the social security administration act 1992 (c. National insurance provided welfare provision for workers (but not their families).

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title national insurance sick pay by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.