Nature of life insurance contract information

Home » Trending » Nature of life insurance contract informationYour Nature of life insurance contract images are available. Nature of life insurance contract are a topic that is being searched for and liked by netizens today. You can Get the Nature of life insurance contract files here. Download all royalty-free images.

If you’re searching for nature of life insurance contract images information linked to the nature of life insurance contract keyword, you have visit the right blog. Our website frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly search and find more enlightening video content and images that fit your interests.

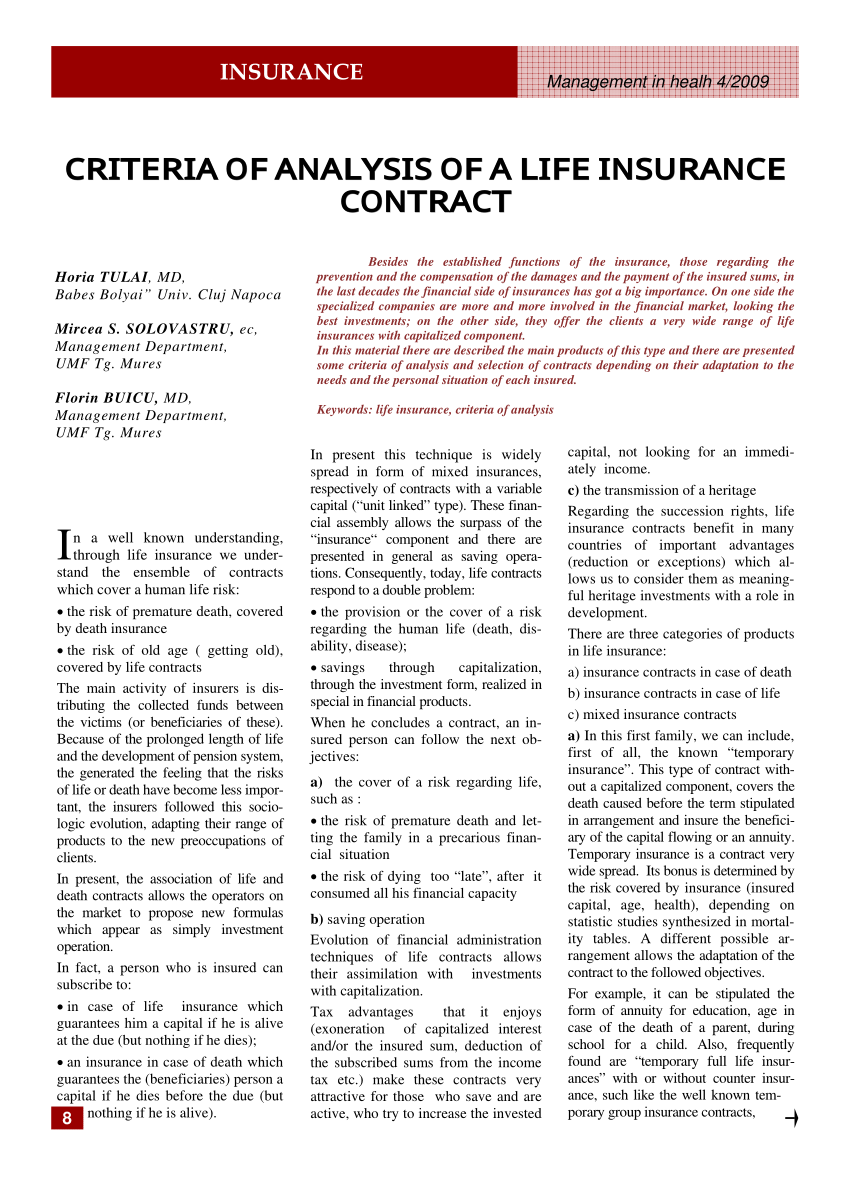

Nature Of Life Insurance Contract. The concept of insurance developed from the need to minimize the adverse effects of risk associated with the probability of financial loss. It is a contingent contract where the event death is certain to take place but it is a question of time. Life insurance contracts are valued contracts. The event, the death, in life insurance is certain, but the only uncertainty is the time when death will occur.

Life insurance concept, nature & use of life insurance From slideshare.net

Life insurance concept, nature & use of life insurance From slideshare.net

In life insurance an offer can be made either by the insurance company or the applicant (proposer) & the acceptance will follow. It seeks to indemnify the assured for the loss suffered by him on the happening of an uncertain event. The parties are insurer and insured. As above said insurance is a contract and all fundamental principles of a valid contract under the indian contract act, 1872 are applicable for the formation of life insurance contract. Basic principles of life and health insurance and annuities; Meaning of life insurance life insurance is a contract to a certain sum of money on the death of a person in consideration of the certain annuity for his life calculated according to the probable duration of life.

In simple words, insurance is a contract, a legal agreement between two parties, i.e., the individual named insured and the insurance company called insurer.

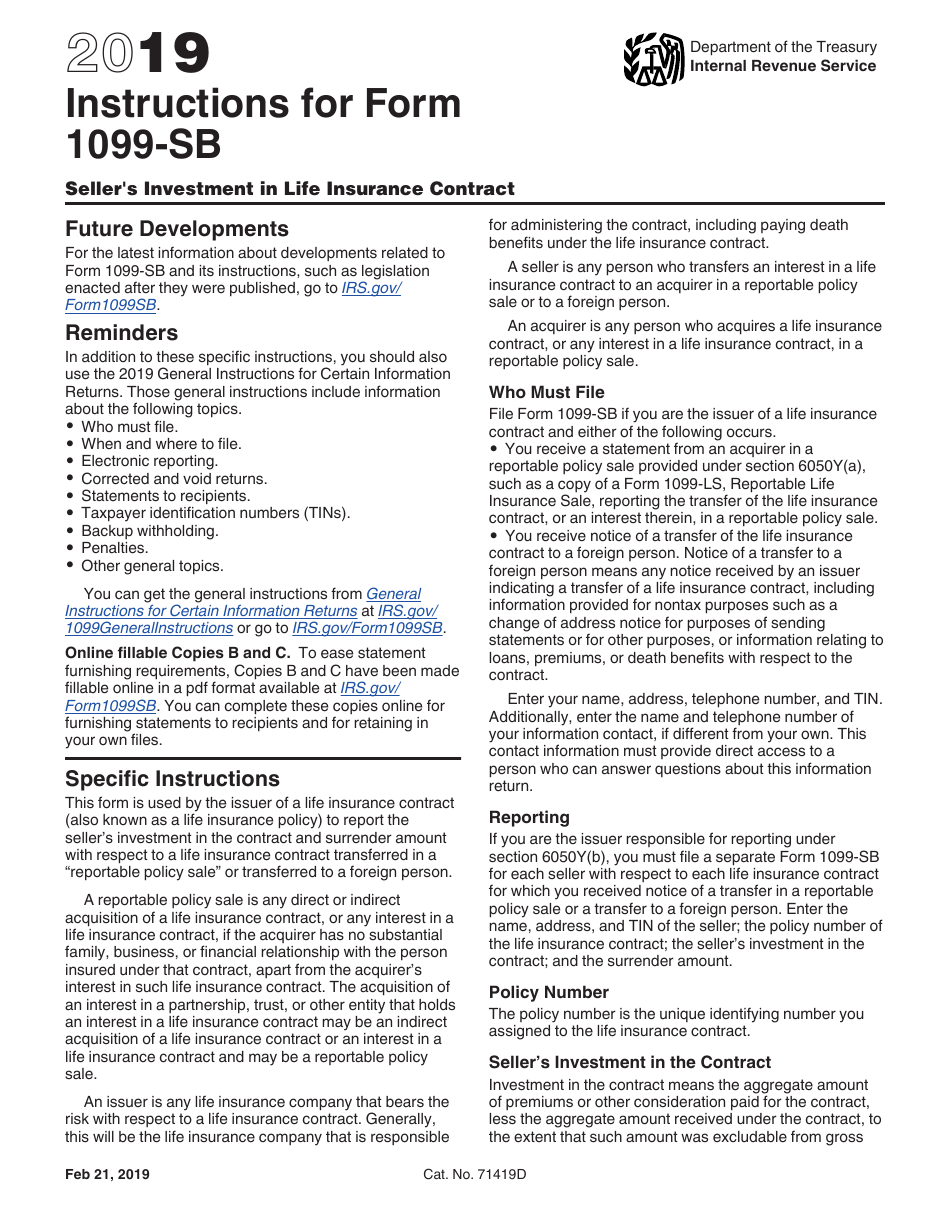

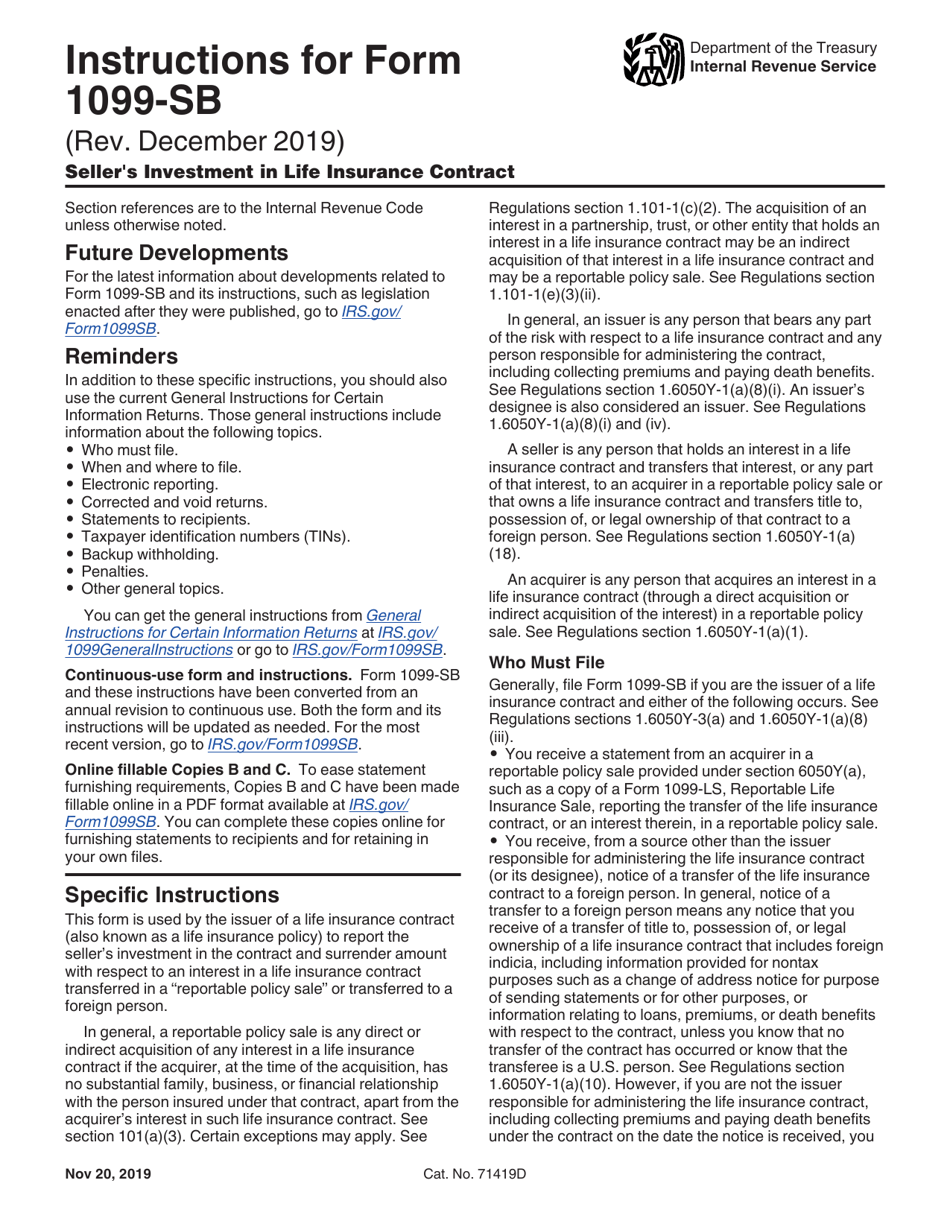

Life insurance contract part i | nature of life insurance contract | lectures on insurance law. Life insurance contract may be defined as the contract, whereby the insurer in consideration of a premium undertakes to pay a certain sum of money either on the death of the insured or on the expiry of a fixed period. The definition of the life insurance contract is enlarged by section 2 (ii) of the insurance act 1938 by including annuity business. One of the basic factors in life and health premiums is the interest earned by the insurance company on the premiums it receives and subsequently invests. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. In this agreement, the insurer promises to help with the losses of the insured on the happening contingency.

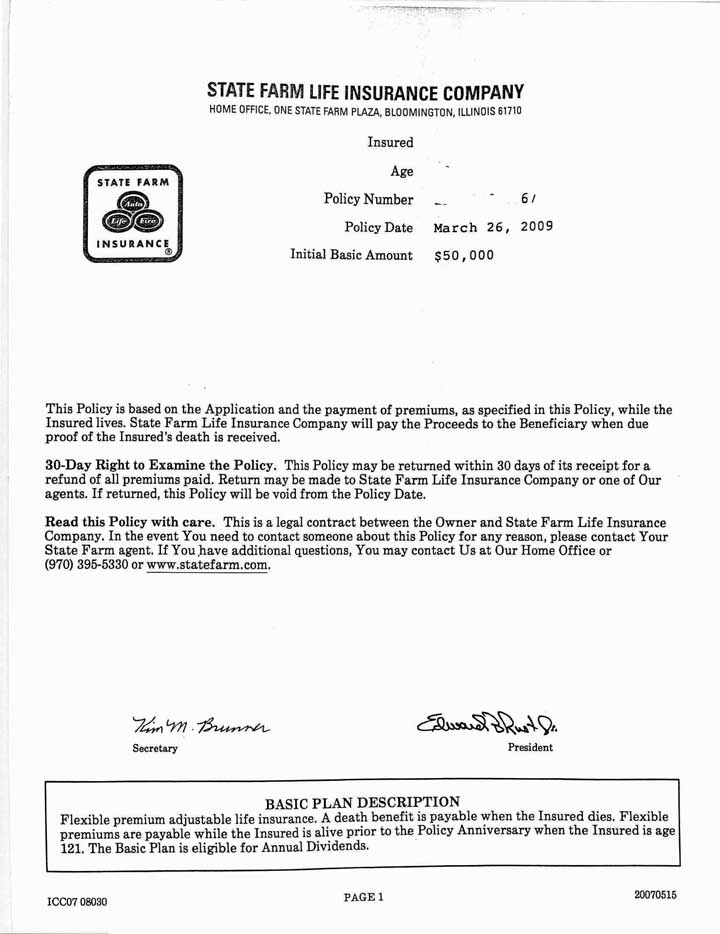

Source: templateroller.com

Source: templateroller.com

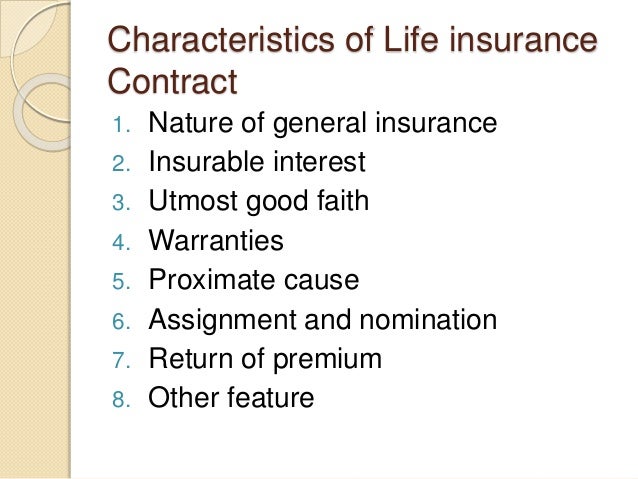

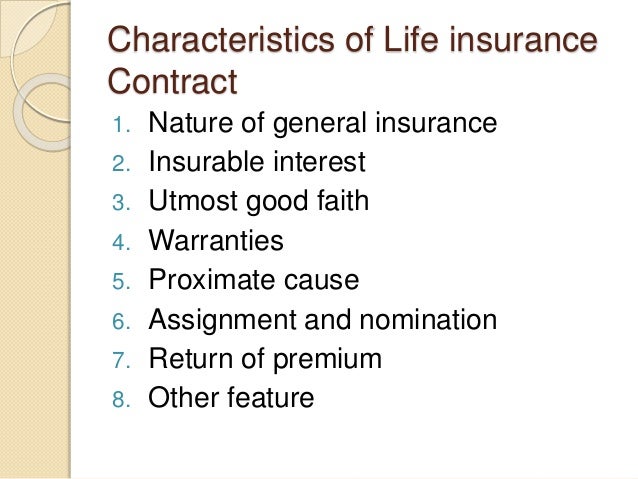

A valued contract pays a stated sum regardless of the actual loss incurred. Features of life insurance contract nature of general contract insurable interest utmost good faith warranties proximate cause assignment nomination return of premium other features A contract of insurance is an agreement whereby one party, called the insurer, undertakes, in return for an agreed consideration, called the premium, to pay the other party, namely the insured, a sum of money or its equivalent in kind, upon the occurrence of a specified event resulting in a loss to him. Life insurance is a contract in which the insured agrees to pay certain sums, called premiums, at specified times and in consideration, thereof the insurer agrees to pay a certain sum of money on certain conditions and in a specified way, upon happening of a particular event contingent upon the duration of human life. 1.in case of wagering agreement,.

Source: sec.gov

Source: sec.gov

A life insurance is a contract in which one party agrees to pay a given sum of money upon the happening of a particular event. Insurer guarantees compensation in occurrence of any contingency to insured and insured pays premium to insurer for protection. The parties are insurer and insured. The event, the death, in life insurance is certain, but the only uncertainty is the time when death will occur. A valued contract pays a stated sum regardless of the actual loss incurred.

Source: templateroller.com

Source: templateroller.com

Insurance contracts are usually personal agreements between the insurance company and the insured individual, and are not transferable to another person without the insurer�s consent. The essentials of any insurance contract are discussed as under with reference to the life insurance only. Nature of insurance contract : In simple words, insurance is a contract, a legal agreement between two parties, i.e., the individual named insured and the insurance company called insurer. A contract of insurance is an agreement whereby one party, called the insurer, undertakes, in return for an agreed consideration, called the premium, to pay the other party, namely the insured, a sum of money or its equivalent in kind, upon the occurrence of a specified event resulting in a loss to him.

Source: researchgate.net

Source: researchgate.net

Meaning of life insurance life insurance is a contract to a certain sum of money on the death of a person in consideration of the certain annuity for his life calculated according to the probable duration of life. Insurer guarantees compensation in occurrence of any contingency to insured and insured pays premium to insurer for protection. Nature of life insurance contract. Basic principles of life and health insurance and annuities; Insurance contracts are usually personal agreements between the insurance company and the insured individual, and are not transferable to another person without the insurer�s consent.

Source: slideshare.net

Source: slideshare.net

In life insurance an offer can be made either by the insurance company or the applicant (proposer) & the acceptance will follow. Insurance contracts are usually personal agreements between the insurance company and the insured individual, and are not transferable to another person without the insurer�s consent. If an individual acquires a life insurance policy insuring her life for $500,000, that is the amount payable at death. 1.3 the nature of insurance. The concept of insurance developed from the need to minimize the adverse effects of risk associated with the probability of financial loss.

Source: slideshare.net

Source: slideshare.net

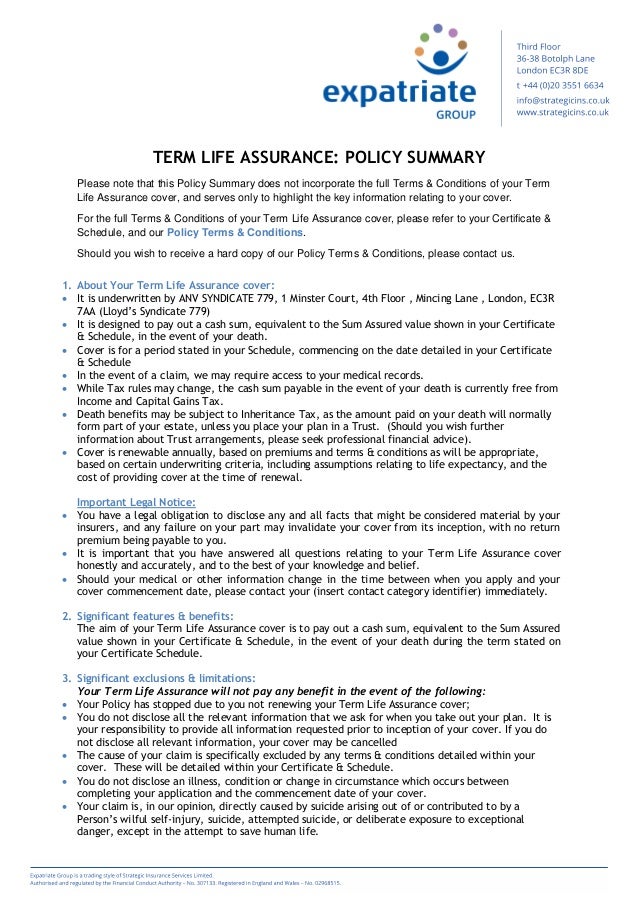

Nature of life insurance contract. One of the basic factors in life and health premiums is the interest earned by the insurance company on the premiums it receives and subsequently invests. Nature of insurance contract : In simple words, insurance is a contract, a legal agreement between two parties, i.e., the individual named insured and the insurance company called insurer. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: noclutter.cloud

Source: noclutter.cloud

Basic principles of life and health insurance and annuities; The concept of insurance developed from the need to minimize the adverse effects of risk associated with the probability of financial loss. In simple words, insurance is a contract, a legal agreement between two parties, i.e., the individual named insured and the insurance company called insurer. The definition of the life insurance contract is enlarged by section 2 (ii) of the insurance act 1938 by including annuity business. Contract of insurance ( except life, accident and sickness insurances) is a contract of indemnity.

Source: slideshare.net

Source: slideshare.net

The insurance contract may be divided into two forms — first life insurance contract and the second contract of indemnity. Meaning of life insurance life insurance is a contract to a certain sum of money on the death of a person in consideration of the certain annuity for his life calculated according to the probable duration of life. Life insurance contracts are valued contracts. The insurance contract may be divided into two forms — first life insurance contract and the second contract of indemnity. A life insurance is a contract in which one party agrees to pay a given sum of money upon the happening of a particular event.

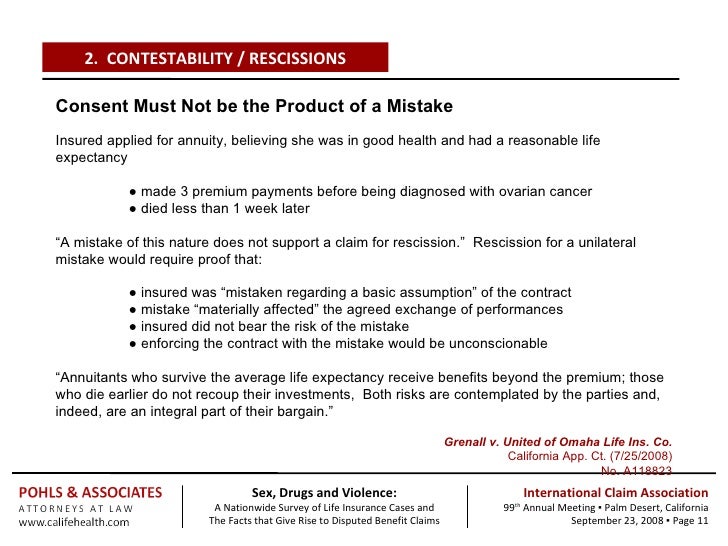

The event, the death, in life insurance is certain, but the only uncertainty is the time when death will occur. However, life insurance has many unique characteristics that may make it an appropriate solution for a variety of uses in addition to the death benefit protection. ( life insurance and some maritime insurance policies are notable exceptions to this standard.) An insurance contract is either a valued contract or an indemnity contract. Hence, the insurance company cannot guarantee against death or prevent death but can agree to pay a stipulated sum in the event of death happening at an earlier date than agreed upon.

Source: slideshare.net

Source: slideshare.net

Life insurance contract part i | nature of life insurance contract | lectures on insurance law. 1.in case of wagering agreement,. Nature or characteristics of insurance on the basis of the definitions of insurance discussed above, one can observe the following nature or characteristics: Nature of insurance, risk, perils and hazards. Features of life insurance contract nature of general contract insurable interest utmost good faith warranties proximate cause assignment nomination return of premium other features

Source: commercemates.com

Source: commercemates.com

In simple words, insurance is a contract, a legal agreement between two parties, i.e., the individual named insured and the insurance company called insurer. Contract of insurance ( except life, accident and sickness insurances) is a contract of indemnity. As above said insurance is a contract and all fundamental principles of a valid contract under the indian contract act, 1872 are applicable for the formation of life insurance contract. Nature of insurance contract : Life insurance contract part i | nature of life insurance contract | lectures on insurance law.

Source: sec.gov

Source: sec.gov

Life insurance/assurance is a contract by which the insurer/assuror undertakes to pay the person for whose benefit the cover is effected, or to his personal representative, a certain sum of money on the happening of a given event, or on the death of the person whose life is assured. The event, the death, in life insurance is certain, but the only uncertainty is the time when death will occur. Features of life insurance contract nature of general contract insurable interest utmost good faith warranties proximate cause assignment nomination return of premium other features Contract of insurance ( except life, accident and sickness insurances) is a contract of indemnity. A contract of insurance is an agreement whereby one party, called the insurer, undertakes, in return for an agreed consideration, called the premium, to pay the other party, namely the insured, a sum of money or its equivalent in kind, upon the occurrence of a specified event resulting in a loss to him.

Source: slideshare.net

Source: slideshare.net

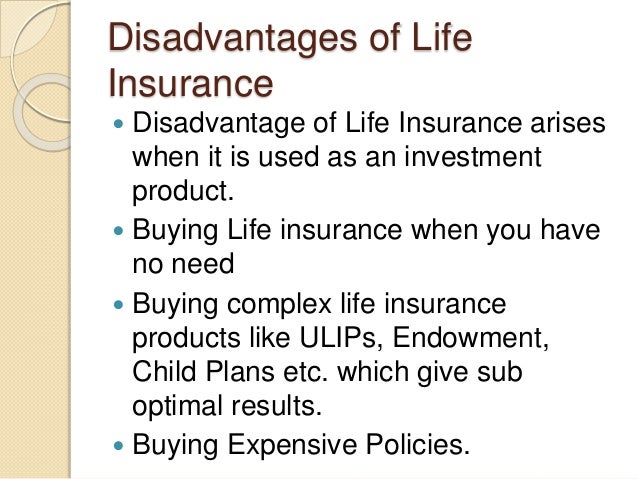

Nature of life insurance life insurance provides payment of a death benefit at the death of the insured(s). However, life insurance has many unique characteristics that may make it an appropriate solution for a variety of uses in addition to the death benefit protection. Nature or characteristics of insurance on the basis of the definitions of insurance discussed above, one can observe the following nature or characteristics: Nature of life insurance life insurance provides payment of a death benefit at the death of the insured(s). An insurance contract is either a valued contract or an indemnity contract.

Source: pinterest.com

Source: pinterest.com

Nature of insurance contract : Meaning of life insurance life insurance is a contract to a certain sum of money on the death of a person in consideration of the certain annuity for his life calculated according to the probable duration of life. As above said insurance is a contract and all fundamental principles of a valid contract under the indian contract act, 1872 are applicable for the formation of life insurance contract. Life insurance/assurance is a contract by which the insurer/assuror undertakes to pay the person for whose benefit the cover is effected, or to his personal representative, a certain sum of money on the happening of a given event, or on the death of the person whose life is assured. Insurer guarantees compensation in occurrence of any contingency to insured and insured pays premium to insurer for protection.

Source: printablelegaldoc.com

Source: printablelegaldoc.com

Insurer guarantees compensation in occurrence of any contingency to insured and insured pays premium to insurer for protection. Nature of insurance, risk, perils and hazards. 1.in case of wagering agreement,. The essentials of any insurance contract are discussed as under with reference to the life insurance only. ( life insurance and some maritime insurance policies are notable exceptions to this standard.)

Source: slideshare.net

Source: slideshare.net

In simple words, insurance is a contract, a legal agreement between two parties, i.e., the individual named insured and the insurance company called insurer. E.g., subsequently (a) an offer made by the insurance company to proposer that The parties are insurer and insured. Life insurance contract may be defined as the contract, whereby the insurer in consideration of a premium undertakes to pay a certain sum of money either on the death of the insured or on the expiry of a fixed period. Nature of life insurance life insurance provides payment of a death benefit at the death of the insured(s).

Source: bianoti.com

Source: bianoti.com

1.in case of wagering agreement,. The event, the death, in life insurance is certain, but the only uncertainty is the time when death will occur. Life insurance contracts are valued contracts. In this agreement, the insurer promises to help with the losses of the insured on the happening contingency. Life insurance/assurance is a contract by which the insurer/assuror undertakes to pay the person for whose benefit the cover is effected, or to his personal representative, a certain sum of money on the happening of a given event, or on the death of the person whose life is assured.

Source: insurance-info-center.blogspot.com

Source: insurance-info-center.blogspot.com

Meaning of life insurance life insurance is a contract to a certain sum of money on the death of a person in consideration of the certain annuity for his life calculated according to the probable duration of life. In life insurance an offer can be made either by the insurance company or the applicant (proposer) & the acceptance will follow. It is a contingent contract where the event death is certain to take place but it is a question of time. Nature of life insurance contract. Contract of insurance ( except life, accident and sickness insurances) is a contract of indemnity.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title nature of life insurance contract by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.