Nebraska car insurance laws information

Home » Trending » Nebraska car insurance laws informationYour Nebraska car insurance laws images are ready. Nebraska car insurance laws are a topic that is being searched for and liked by netizens today. You can Download the Nebraska car insurance laws files here. Download all royalty-free vectors.

If you’re looking for nebraska car insurance laws pictures information related to the nebraska car insurance laws interest, you have come to the right site. Our website always gives you hints for seeking the maximum quality video and image content, please kindly search and find more informative video content and graphics that fit your interests.

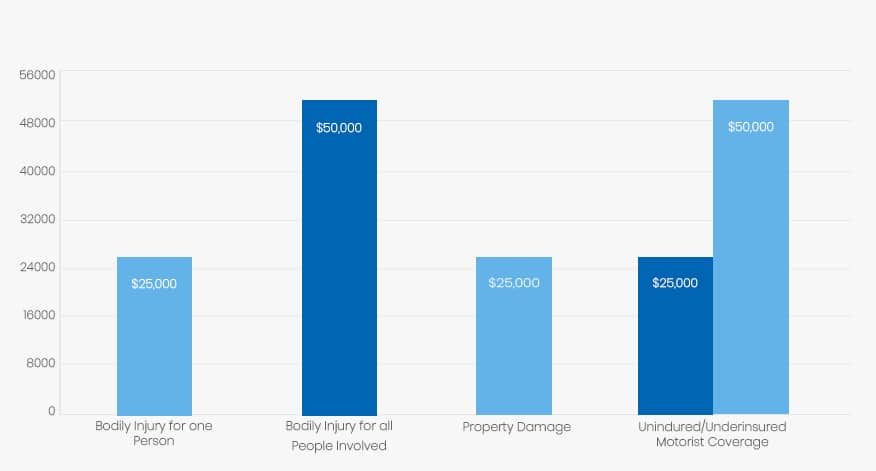

Nebraska Car Insurance Laws. Below are the coverage requirements for nebraska minimum car insurance. Nebraska is one of 38 tort law states in the country, which means that drivers in nebraska are financially responsible for all damages they cause while driving their vehicle; Save up to 50% on car insurance get started Nebraska law requires drivers to have both liability coverage and uninsured/underinsured motorist coverage.

Nebraska Car Insurance Requirements From everquote.com

Nebraska Car Insurance Requirements From everquote.com

Save up to 50% on car insurance get started Start to fulfill the cornhusker state�s insurance requirements today and save. In nebraska, you need valid car insurance in place before you can register your car, or renew your car registration. According to the nebraska department of motor vehicles, nebraska‘s car insurance laws require all drivers to present proof of liability insurance when they register their vehicle. Yes what are the minimum limits for nebraska? Is it mandatory to have car insurance in nebraska?

Nebraska law states that drivers must carry automobile liability insurance or meet the “financial responsibility” of insurance through alternative means (i.e., surety bond or cash deposit).

This can be proof of a bond or certificate of deposit (typically in the amount of $75,000) or, for most vehicle owners, a certificate of insurance showing liability coverage at the following minimums: Nebraska law states that drivers must carry automobile liability insurance or meet the “financial responsibility” of insurance through alternative means (i.e., surety bond or cash deposit). Nebraska law requires that all drivers carry certain levels of car insurance coverage in order to be legal. Nebraska car insurance laws nebraska’s basic liability car insurance requirements of $25,000 bodily injury liability per person and $50,000 per accident, plus $25,000 for property damage liability, are substantial enough to protect many drivers. In nebraska, your car insurance policy must meet at least these following liability coverage minimums per accident: This can be proof of a bond or certificate of deposit (typically in the amount of $75,000) or, for most vehicle owners, a certificate of insurance showing liability coverage at the following minimums:

Source: holdemfeed.blogspot.com

Source: holdemfeed.blogspot.com

Proof of financial responsibility is required on all vehicles registered in the state of nebraska and must be carried in the vehicle at all times with the following exceptions: Nebraska car insurance laws state that drivers must carry a policy that meets at least the state minimum requirement of 25/50/25. In nebraska, it is illegal to operate a vehicle if you are under the influence of drugs or alcohol, meaning you are noticeably impaired in your ability to operate a vehicle safely. $25,000 per person and $50,000 per accident. Right of subrogation of medical payments;

Source: joinroot.com

Source: joinroot.com

Nebraska law requires that all drivers carry certain levels of car insurance coverage in order to be legal. Nebraska�s minimum requirements for car insurance coverage are: $25,000 per person and $50,000 per accident. The following is a breakdown of minimum liability requirements for nebraska: $50,000 for total bodily injury if multiple people are hurt.

Source: sopinskilaw.com

Source: sopinskilaw.com

Uninsured motorist bodily injury coverage: Start to fulfill the cornhusker state�s insurance requirements today and save. Save up to 50% on car insurance get started Furthermore, this proof must be shown at the request of any law enforcement official. If you are caught driving uninsured at a traffic stop — or worse, after a collision — you will lose your driving privileges instantly.

Source: smartfinancial.com

Source: smartfinancial.com

In almost every nebraska car accident scenario, insurance coverage is sure to play a key role, so it�s important to understand the state�s liability auto insurance requirements and other coverage rules that could affect your car accident claim. This means you will have to buy an auto insurance policy that covers $25,000 in bodily injury per person and up to $50,000 per accident, with $25,000 in property damage coverage. Furthermore, this proof must be shown at the request of any law enforcement official. Nebraska vehicle owners with cars registered in their name must be able to certify that they have insurance and that it meets state minimum requirements for: In nebraska, you need valid car insurance in place before you can register your car, or renew your car registration.

Source: motor1.com

Source: motor1.com

0.08% of higher if you’re 21 or older Except in rare cases, uninsured/underinsured motorist coverage must be included in a driver’s insurance policy. Proof of this coverage must be carried when behind the wheel. $25,000 bodily injury liability/uim/um coverage per individual. Nebraska is one of 38 tort law states in the country, which means that drivers in nebraska are financially responsible for all damages they cause while driving their vehicle;

Source: americaninsurance.com

Source: americaninsurance.com

Nebraska law requires that all drivers carry certain levels of car insurance coverage in order to be legal. Read on to find out more about mandatory car insurance in nebraska as well as optional coverages that add further. Situated squarely in the heart of the midwest, nebraska is home to 1.9 million residents, and it ranks 43rd in the country in the area of population density. 0.08% of higher if you’re 21 or older If you are caught driving uninsured at a traffic stop — or worse, after a collision — you will lose your driving privileges instantly.

$25,000 per person and $50,000 per accident. Get the details on nebraska�s car insurance rules. Nebraska law requires drivers to have both liability coverage and uninsured/underinsured motorist coverage. $25,000 bodily injury per person. This can be proof of a bond or certificate of deposit (typically in the amount of $75,000) or, for most vehicle owners, a certificate of insurance showing liability coverage at the following minimums:

Source: animessimer.blogspot.com

Source: animessimer.blogspot.com

All trailers (pulling unit insurance must provide coverage for the trailer); Start to fulfill the cornhusker state�s insurance requirements today and save. $25,000 bodily injury per person. Nebraska car insurance laws require drivers to carry at least 25/50/25 personal liability insurance and uninsured/underinsured motorist (uim/um) coverage. In nebraska, it is illegal to operate a vehicle if you are under the influence of drugs or alcohol, meaning you are noticeably impaired in your ability to operate a vehicle safely.

Source: pinterest.com

Source: pinterest.com

Uninsured motorist bodily injury coverage: In nebraska, it is illegal to operate a vehicle if you are under the influence of drugs or alcohol, meaning you are noticeably impaired in your ability to operate a vehicle safely. Get the details on nebraska�s car insurance rules. Nebraska car insurance laws state that drivers must carry a policy that meets at least the state minimum requirement of 25/50/25. $50,000 per accident in bodily injury liability/uim/um.

Source: sopinskilaw.com

Source: sopinskilaw.com

Except in rare cases, uninsured/underinsured motorist coverage must be included in a driver’s insurance policy. The following is a breakdown of minimum liability requirements for nebraska: Nebraska car insurance laws require drivers to carry at least 25/50/25 personal liability insurance and uninsured/underinsured motorist (uim/um) coverage. $50,000 for total bodily injury if multiple people are hurt. $25,000 per person and $50,000 per accident.

Source: autoinsurance-nearme.com

Source: autoinsurance-nearme.com

This means you will have to buy an auto insurance policy that covers $25,000 in bodily injury per person and up to $50,000 per accident, with $25,000 in property damage coverage. See the best offers from carriers in your area and get the right coverage in nebraska. All trailers (pulling unit insurance must provide coverage for the trailer); $25,000 bodily injury liability/uim/um coverage per individual. Nebraska car insurance laws require drivers to carry at least 25/50/25 personal liability insurance and uninsured/underinsured motorist (uim/um) coverage.

![Nebraska Auto Insurance [The Scoop Rates + Coverages] Nebraska Auto Insurance [The Scoop Rates + Coverages]](https://www.carinsurance101.com/wp-content/uploads/dw/monthly-nebraska-car-insurance-rates-by-zip-code-yMkzx.png) Source: carinsurance101.com

Source: carinsurance101.com

Nebraska is one of 38 tort law states in the country, which means that drivers in nebraska are financially responsible for all damages they cause while driving their vehicle; Nebraska vehicle owners with cars registered in their name must be able to certify that they have insurance and that it meets state minimum requirements for: Nebraska car insurance laws state that drivers must carry a policy that meets at least the state minimum requirement of 25/50/25. Proof of financial responsibility is required on all vehicles registered in the state of nebraska and must be carried in the vehicle at all times with the following exceptions: Nebraska law requires drivers to have both liability coverage and uninsured/underinsured motorist coverage.

Source: nebraskacarinsurance.com

Source: nebraskacarinsurance.com

$25,000 for bodily injury, per person. Nebraska law requires that all drivers carry certain levels of car insurance coverage in order to be legal. Car insurance requirements in nebraska in nebraska, proof of financial responsibility must be carried in all motor vehicles registered in the state. All trailers (pulling unit insurance must provide coverage for the trailer); The following is a breakdown of minimum liability requirements for nebraska:

Source: animessimer.blogspot.com

Source: animessimer.blogspot.com

$25,000 for bodily injury, per person. See the best offers from carriers in your area and get the right coverage in nebraska. Right of subrogation of medical payments; In nebraska, it is illegal to operate a vehicle if you are under the influence of drugs or alcohol, meaning you are noticeably impaired in your ability to operate a vehicle safely. Your policy should be able to meet at least the required 25/50/25 liability coverage amounts.

Source: animessimer.blogspot.com

Source: animessimer.blogspot.com

The following is a breakdown of minimum liability requirements for nebraska: In nebraska, you need valid car insurance in place before you can register your car, or renew your car registration. $25,000 bodily injury per person. $25,000 bodily injury per person $50,000 bodily injury per accident $25,000 property damage per accident —or— 25/50/25 dairyland ® coverage in nebraska All trailers (pulling unit insurance must provide coverage for the trailer);

Source: carinsurancelist.com

Source: carinsurancelist.com

All trailers (pulling unit insurance must provide coverage for the trailer); All trailers (pulling unit insurance must provide coverage for the trailer); Nebraska car insurance laws state that drivers must carry a policy that meets at least the state minimum requirement of 25/50/25. Proof of this coverage must be carried when behind the wheel. $25,000 bodily injury per person $50,000 bodily injury per accident $25,000 property damage per accident —or— 25/50/25 dairyland ® coverage in nebraska

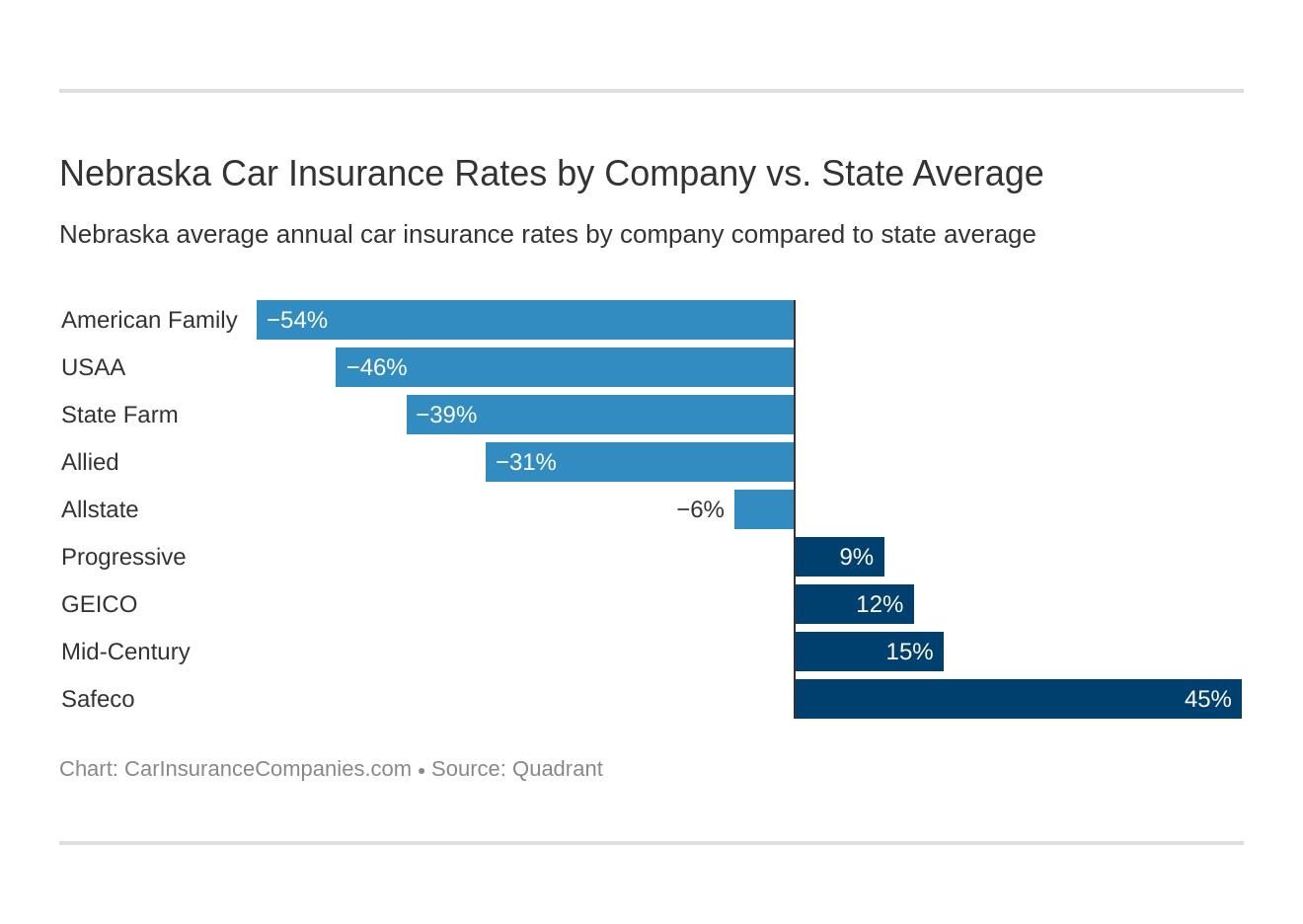

Source: carinsurancecompanies.com

Source: carinsurancecompanies.com

$50,000 per accident in bodily injury liability/uim/um. Nebraska car insurance laws require drivers to carry at least 25/50/25 personal liability insurance and uninsured/underinsured motorist (uim/um) coverage. $50,000 for total bodily injury if multiple people are hurt. Situated squarely in the heart of the midwest, nebraska is home to 1.9 million residents, and it ranks 43rd in the country in the area of population density. Nebraska vehicle owners with cars registered in their name must be able to certify that they have insurance and that it meets state minimum requirements for:

Source: insurancepanda.com

Source: insurancepanda.com

0.08% of higher if you’re 21 or older Except in rare cases, uninsured/underinsured motorist coverage must be included in a driver’s insurance policy. Right of subrogation of medical payments; Read on to find out more about mandatory car insurance in nebraska as well as optional coverages that add further. Car insurance requirements in nebraska in nebraska, proof of financial responsibility must be carried in all motor vehicles registered in the state.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title nebraska car insurance laws by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.