Need of risk management in insurance Idea

Home » Trending » Need of risk management in insurance IdeaYour Need of risk management in insurance images are ready in this website. Need of risk management in insurance are a topic that is being searched for and liked by netizens today. You can Download the Need of risk management in insurance files here. Find and Download all free vectors.

If you’re looking for need of risk management in insurance pictures information connected with to the need of risk management in insurance keyword, you have pay a visit to the ideal site. Our site always gives you hints for refferencing the maximum quality video and image content, please kindly hunt and find more enlightening video articles and images that fit your interests.

Need Of Risk Management In Insurance. It will help you prepare your business around the world for any eventuality, prevent the frequent occurrence of incidents, and support you through every crisis. Analyze the likelihood and impact of each one. Ad essential intelligence for insurance risk management at your fingertips. They must be revised periodically because risk, risk control, and risk transfer methods change constantly.

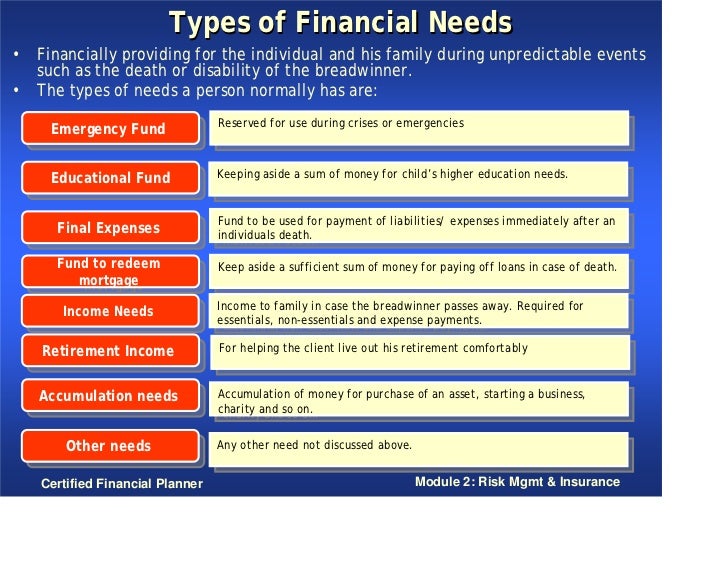

Risk Management and Insurance From slideshare.net

Risk Management and Insurance From slideshare.net

Don’t risk what you can’t afford to lose in order to try to gain what you don’t need. Why is risk management important? Part of creating a risk management plan is determining how to reduce the impact a risk will have on a company. The volume and value of insurance is proven to reduce. However, there are more benefits that you may not think of right away. The management should know how risks are being managed.

Act with confidence and seize new opportunities within the insurance sector.

Internal risk management model portfolio management process in the second section it was already underlined the importance of asset allocation (technical reserves) to the latvian insurance companies in order to cover losses from main business operations, while the asset allocation decision is not an isolated choice, but rather it is a component. Every risk management plan that is created should include insurance as one of its elements. Insurance is a critical type of risk management, but you can also implement other risk management strategies to back up an insurance policy. Analyze the likelihood and impact of each one. Earning a bachelor of business administration in insurance and risk management (irm) offers career stability for graduates of the uhd program. Risk management is vital because you want to avoid risk and potential loss as much as possible.

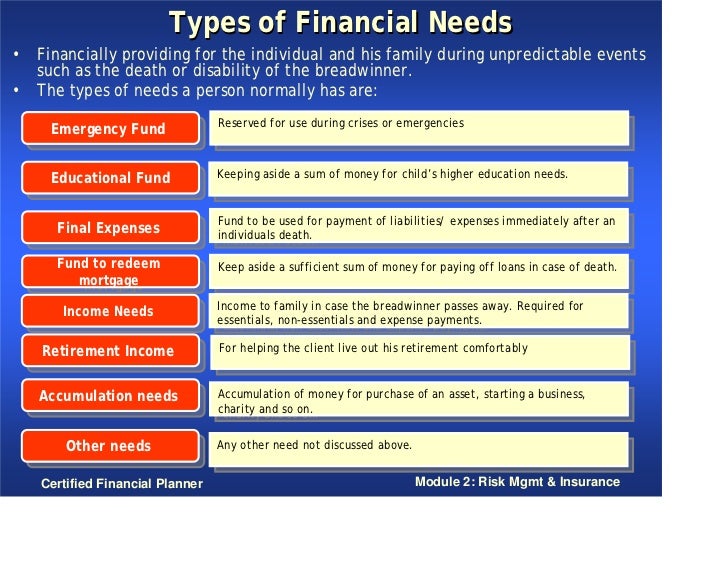

Source: slideshare.net

Source: slideshare.net

When you take the time to reduce the size and number of your losses, you can positively impact the availability and affordability of insurance. Analyze the likelihood and impact of each one. Having appropriate insurance in place is one way to. You are probably already familiar with the concept of diversification to reduce risk. However, there are more benefits that you may not think of right away.

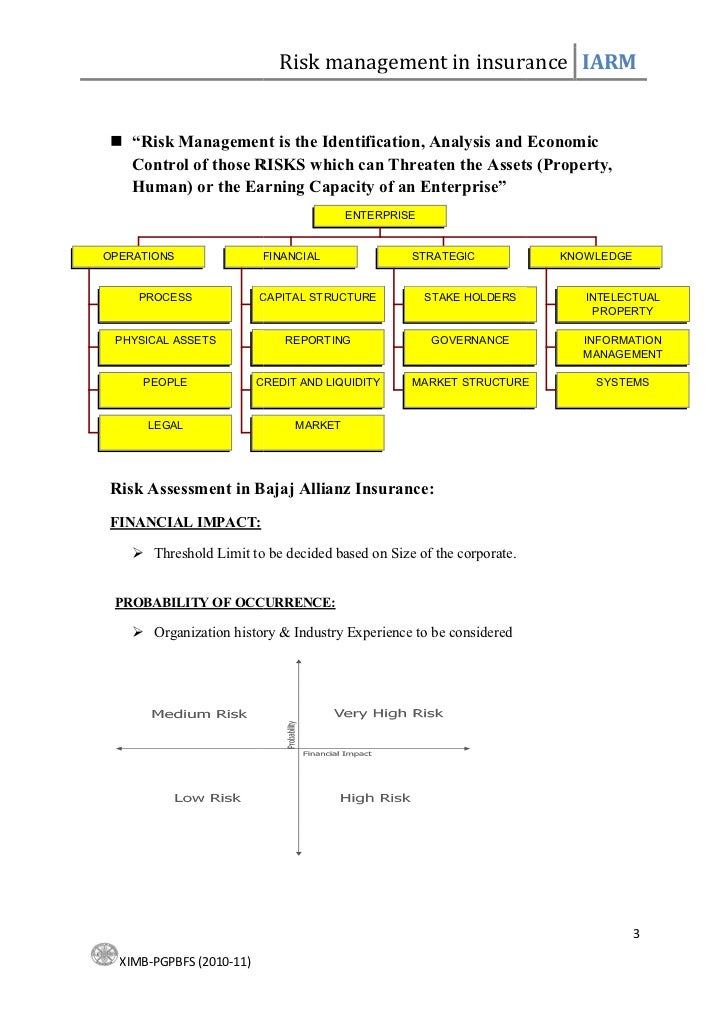

Source: bohatala.com

Source: bohatala.com

Risk management plans are never finished. When you take the time to reduce the size and number of your losses, you can positively impact the availability and affordability of insurance. Insurance is one of many tools available to risk managers and only one part of the process. It incorporates insurance in the process but also provides organized alternatives if insurance is not available, inappropriate or too expensive. In the case of the asset management arms, the need for credit policies, committees and independent credit analysts has, historically, been open to debate for two reasons.

Source: slideserve.com

Source: slideserve.com

Ad essential intelligence for insurance risk management at your fingertips. Introduction of business course code: When you take the time to reduce the size and number of your losses, you can positively impact the availability and affordability of insurance. Risk management plans are never finished. You are probably already familiar with the concept of diversification to reduce risk.

Source: slideserve.com

Source: slideserve.com

Naic sets out five steps to risk management for insurance companies. They make people whole again after tragedy, providing a safety blanket for workers, offering security for companies to stay in business, and protecting from the numerous threats out there. Design an information security program an information security program should be appropriate for the insurance professional’s size and complexity. Treat (or respond to) the risk conditions. Naic sets out five steps to risk management for insurance companies.

Source: shefferinsurance.com

Source: shefferinsurance.com

Risk management monitor recently discussed some of the core benefits of risk management: The globalization of economic enterprise and the complexities of our multinational corporate environment are creating an increasing demand for highly skilled risk managers. Risk management is the active identification, evaluation and management of all potential hazards and exposures to loss that a risk may experience. Insurance is a critical type of risk management, but you can also implement other risk management strategies to back up an insurance policy. It incorporates insurance in the process but also provides organized alternatives if insurance is not available, inappropriate or too expensive.

Source: hamiltonleigh.com

Source: hamiltonleigh.com

The management should know how risks are being managed. Act with confidence and seize new opportunities within the insurance sector. It is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss. In the case of the asset management arms, the need for credit policies, committees and independent credit analysts has, historically, been open to debate for two reasons. Earning a bachelor of business administration in insurance and risk management (irm) offers career stability for graduates of the uhd program.

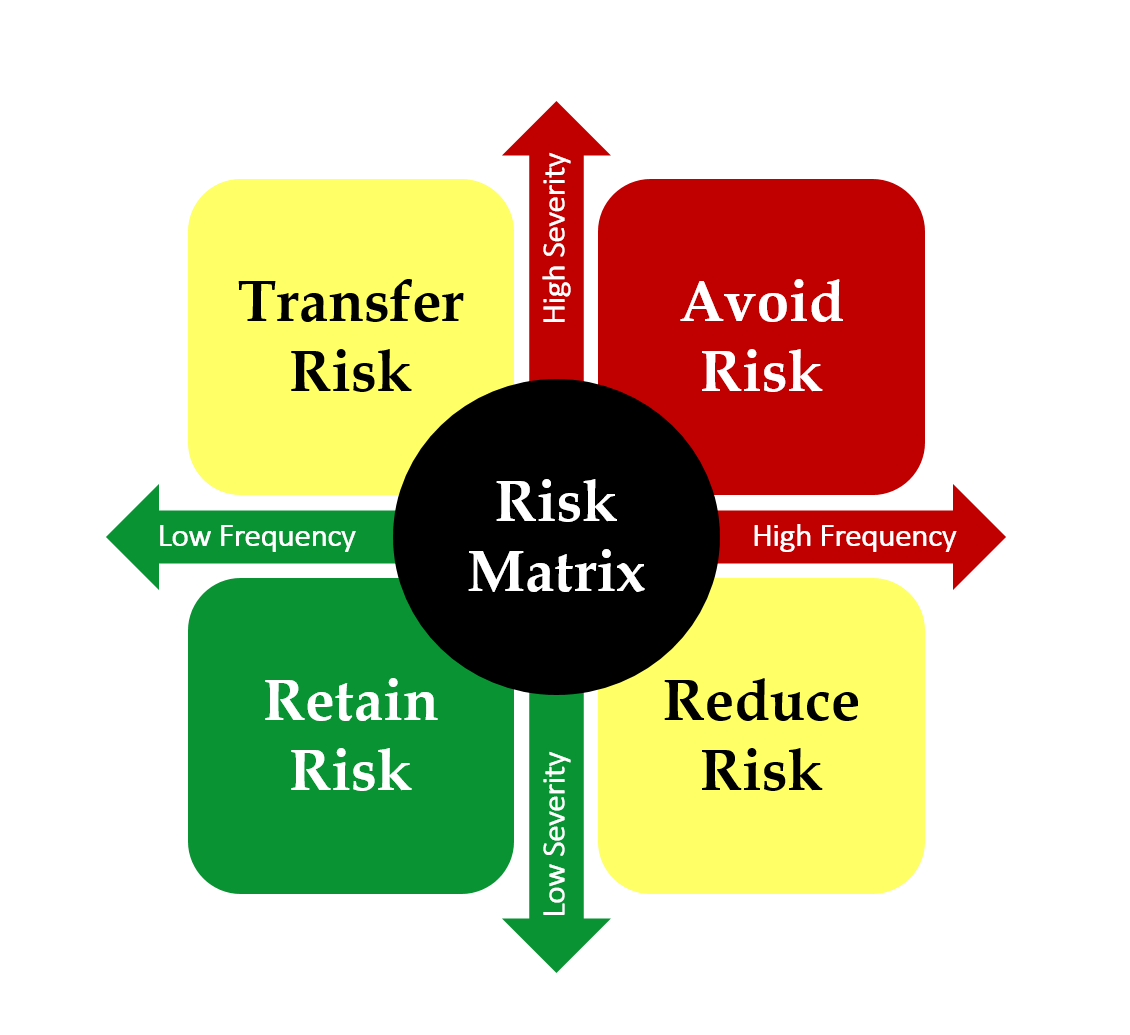

As part of the erm approach, a company may choose to mitigate the risks itself or transfer the risk to a vendor. Insurance can be a key tool in preventing financial losses in the early stages of the game. Risk management plans are never finished. It will help you prepare your business around the world for any eventuality, prevent the frequent occurrence of incidents, and support you through every crisis. In the case of the asset management arms, the need for credit policies, committees and independent credit analysts has, historically, been open to debate for two reasons.

Source: itunes.apple.com

Source: itunes.apple.com

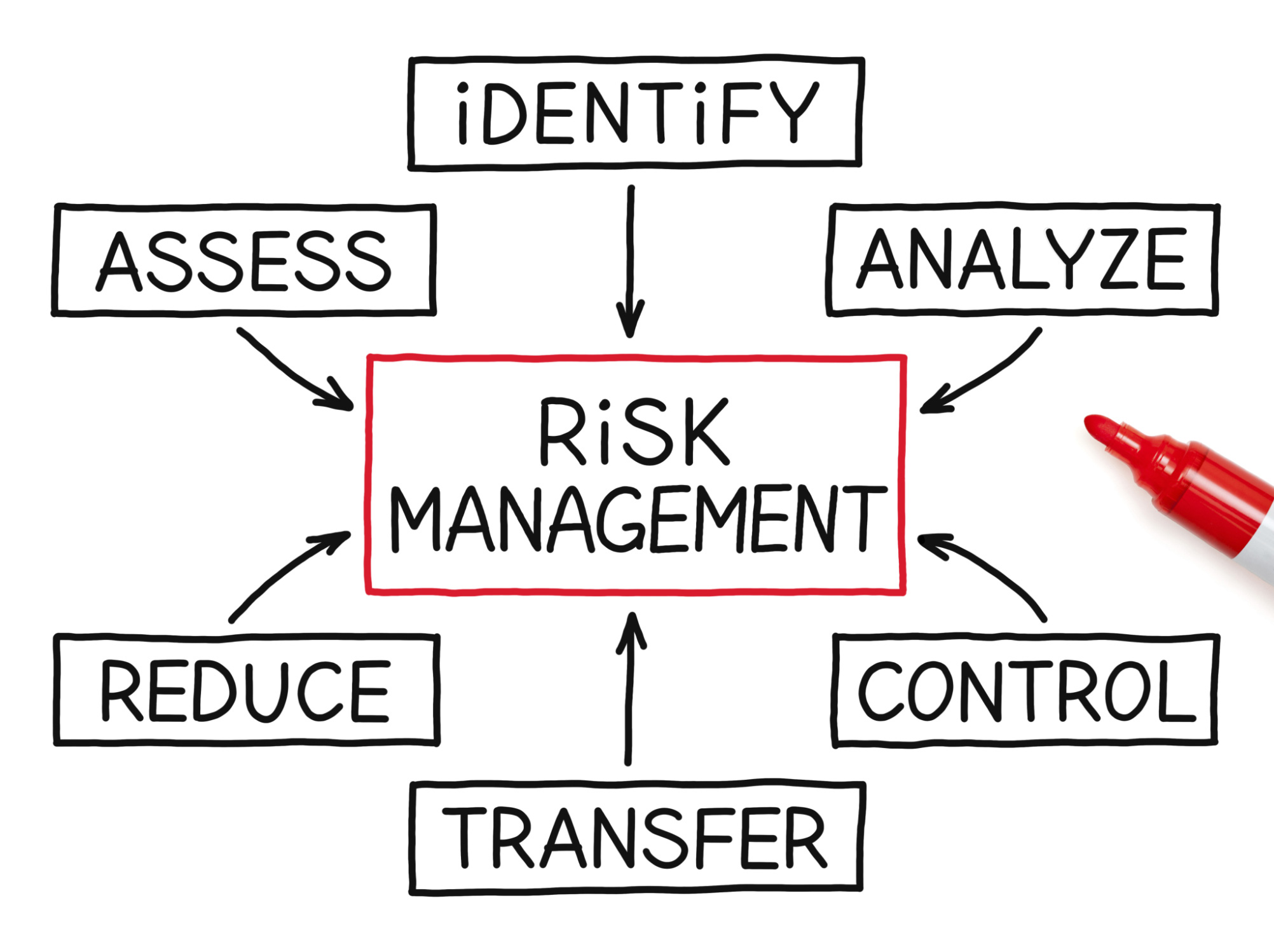

Every risk management plan that is created should include insurance as one of its elements. Part of creating a risk management plan is determining how to reduce the impact a risk will have on a company. Insurance is one of many tools available to risk managers and only one part of the process. Risk management involves five basic steps: Don’t risk what you can’t afford to lose in order to try to gain what you don’t need.

Source: slideshare.net

Source: slideshare.net

Risk management is vital because you want to avoid risk and potential loss as much as possible. Risk management is vital because you want to avoid risk and potential loss as much as possible. Risk management plans are never finished. Risk management monitor recently discussed some of the core benefits of risk management: Risk mgmt & insurance 8.

Source: tfetimes.com

Source: tfetimes.com

The practice of identifying and analyzing loss exposures and taking steps to minimize the financial impact of the risks they impose. Risk management monitor recently discussed some of the core benefits of risk management: Analyze the likelihood and impact of each one. As part of the erm approach, a company may choose to mitigate the risks itself or transfer the risk to a vendor. The management should know how risks are being managed.

Source: colonialwalletwisdom.com

Source: colonialwalletwisdom.com

Risk management involves five basic steps: Risk management plans are never finished. When you take the time to reduce the size and number of your losses, you can positively impact the availability and affordability of insurance. The globalization of economic enterprise and the complexities of our multinational corporate environment are creating an increasing demand for highly skilled risk managers. Risk management monitor recently discussed some of the core benefits of risk management:

Source: advancedwealth.com

Source: advancedwealth.com

Your customised workforce resilience risk management solution with international sos acts a complementary extension of your risk management approach. We now turn to some aspects of risk management relating to stocks and bonds. Risk management plans are never finished. They must be revised periodically because risk, risk control, and risk transfer methods change constantly. Act with confidence and seize new opportunities within the insurance sector.

Source: slideserve.com

Source: slideserve.com

It is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss. Introduction of business course code: This involves appointing a chief risk officer (cro) for risk management and the organizational culture too should support it. However, there are more benefits that you may not think of right away. Part of creating a risk management plan is determining how to reduce the impact a risk will have on a company.

Source: fiduciawealth.ca

Source: fiduciawealth.ca

Every risk management plan that is created should include insurance as one of its elements. Risk management and insurance course name: Act with confidence and seize new opportunities within the insurance sector. Internal risk management model portfolio management process in the second section it was already underlined the importance of asset allocation (technical reserves) to the latvian insurance companies in order to cover losses from main business operations, while the asset allocation decision is not an isolated choice, but rather it is a component. As part of the erm approach, a company may choose to mitigate the risks itself or transfer the risk to a vendor.

Source: pdilms.com

Source: pdilms.com

The volume and value of insurance is proven to reduce. Risk management involves five basic steps: Naic sets out five steps to risk management for insurance companies. As part of the erm approach, a company may choose to mitigate the risks itself or transfer the risk to a vendor. The volume and value of insurance is proven to reduce.

Source: slideshare.net

Source: slideshare.net

They make people whole again after tragedy, providing a safety blanket for workers, offering security for companies to stay in business, and protecting from the numerous threats out there. This involves appointing a chief risk officer (cro) for risk management and the organizational culture too should support it. The practice of identifying and analyzing loss exposures and taking steps to minimize the financial impact of the risks they impose. Risk management and insurance are forces for restoration and protection for people, communities and companies. Prioritize risks based on business objectives.

Source: sageoakfinancial.com

Source: sageoakfinancial.com

However, there are more benefits that you may not think of right away. In the case of the asset management arms, the need for credit policies, committees and independent credit analysts has, historically, been open to debate for two reasons. Ad essential intelligence for insurance risk management at your fingertips. Risk management is vital because you want to avoid risk and potential loss as much as possible. Design an information security program an information security program should be appropriate for the insurance professional’s size and complexity.

Source: kopykitab.com

Source: kopykitab.com

Analyze the likelihood and impact of each one. Risk management involves five basic steps: Treat (or respond to) the risk conditions. Insurance can be a key tool in preventing financial losses in the early stages of the game. The volume and value of insurance is proven to reduce.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title need of risk management in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.