Needs approach life insurance Idea

Home » Trending » Needs approach life insurance IdeaYour Needs approach life insurance images are ready. Needs approach life insurance are a topic that is being searched for and liked by netizens now. You can Get the Needs approach life insurance files here. Get all free photos and vectors.

If you’re searching for needs approach life insurance images information linked to the needs approach life insurance topic, you have come to the right site. Our website always provides you with hints for downloading the highest quality video and image content, please kindly surf and find more enlightening video articles and images that match your interests.

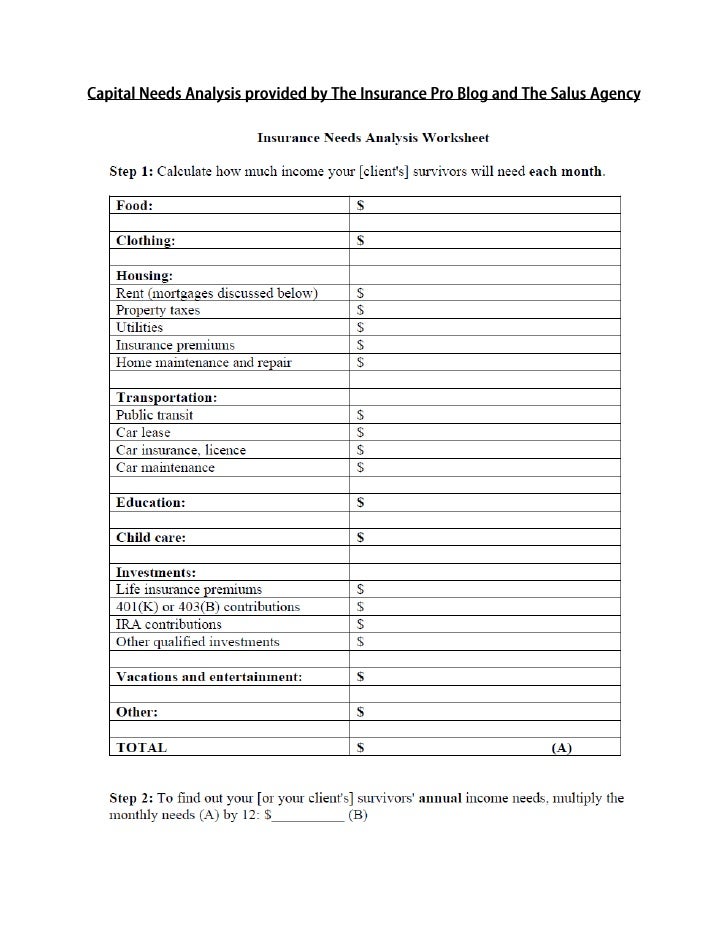

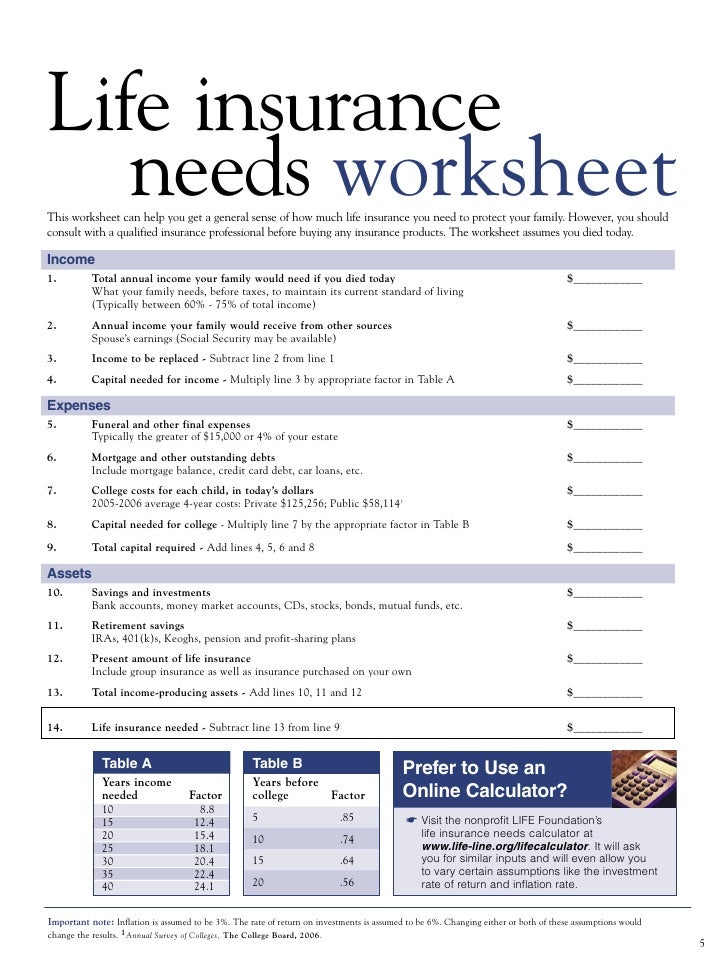

Needs Approach Life Insurance. Life insurance need is, the financial need analysis approach. It is not an independent approach. It takes into account all the present and future family needs and calculates directly the amount necessary to meet those needs. To help make your insurance needs estimate more accurate, the income replacement approach allows for some adjustments to the human life value.

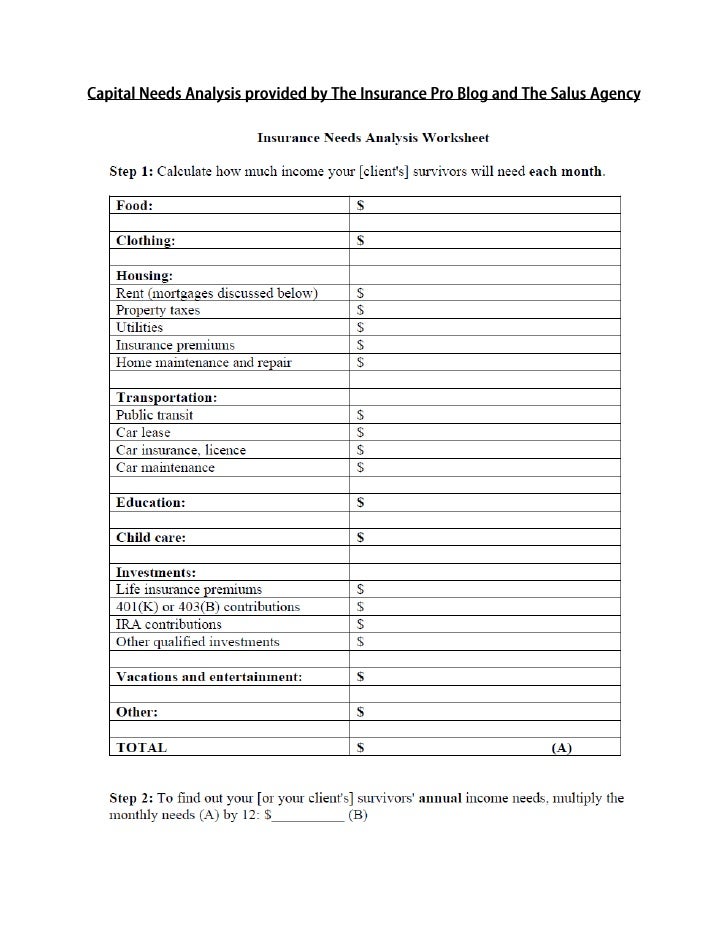

Life Insurance Capital Needs Analysis From slideshare.net

Life Insurance Capital Needs Analysis From slideshare.net

The capital retention approach is one of two methods of calculating your family�s life insurance needs under the family needs approach. They cannot be worth more than what their productive potential allows, and Rather, it is one of two ways to determine the lump sum of insurance proceeds the surviving spouse will need to receive and invest in order to take care of ongoing family. The excel calculator provided here offers many options to accomplish the above. Click again to see term in life insurance, the needs approach is used mostly to establish. Sep 6, 2021 — needs approach meaning is a method used to calculate the life insurance amount you must purchase.

Please keep in mind that the primary reason to purchase life insurance is for the death.

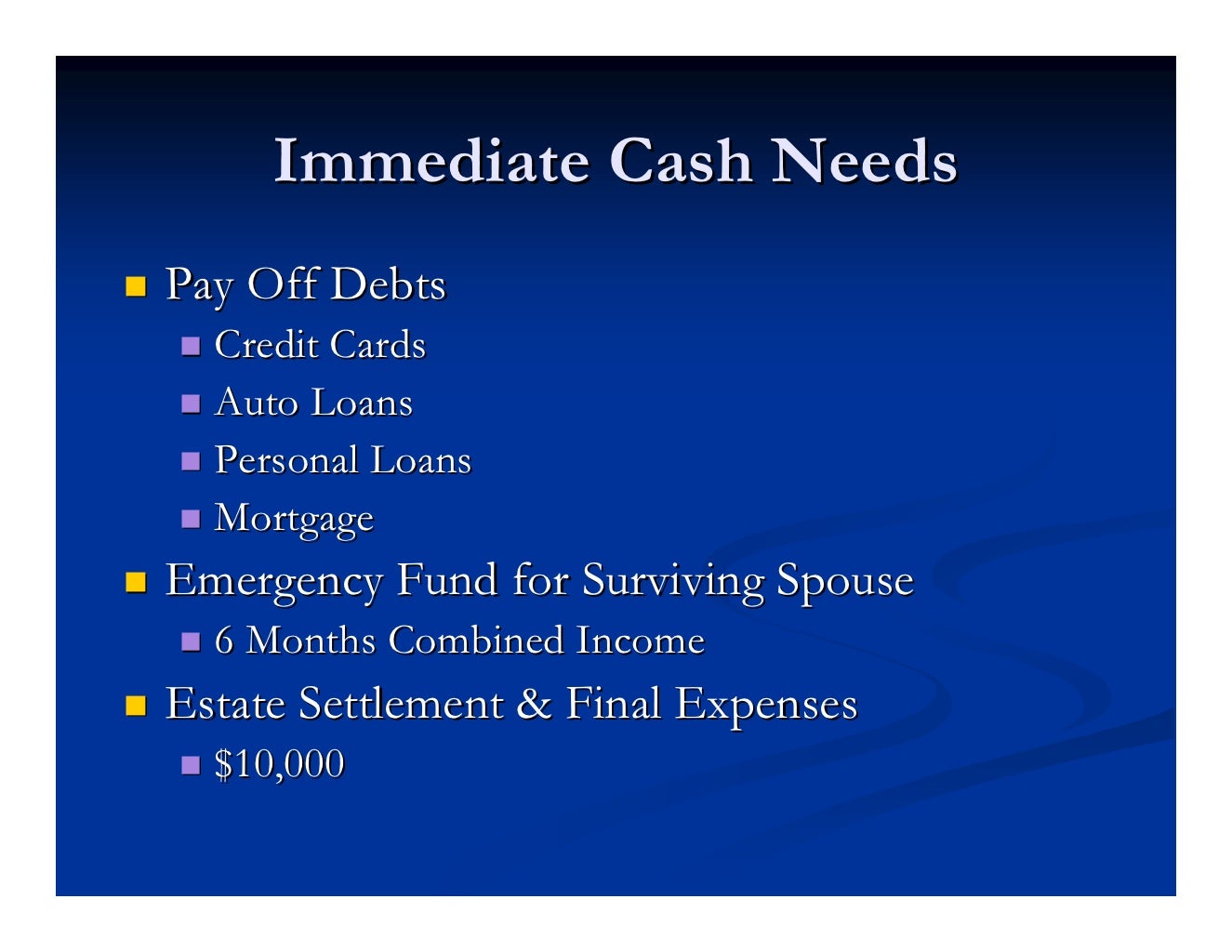

The “needs approach” in life insurance is most useful in determining the amount of life insurance to be recommended to a client. The family needs approach requires you to purchase enough life insurance to allow your family to meet its various expenses in the event of your death. The needs approach to life insurance planning is used to estimate the amount of insurance coverage an individual needs. The second way to calculate insurance needs is through a shortfall calculation. Please keep in mind that the primary reason to purchase life insurance is for the death. It assumes that the goal of life insurance is to cover the surviving family members� immediate expenses after the insured family member�s death as well as their ongoing expenses into the future.

Source: es.slideshare.net

Source: es.slideshare.net

Under the family needs approach, you divide your family’s needs into three main categories: The needs approach is a method of calculating how much life insurance an individual or family requires to cover their expenses. The needs approach to life insurance planning is used to estimate the amount of insurance coverage an individual needs. It is not an independent approach. The needs approach is a function of two variables:

Source: esosojazosazules.blogspot.com

Source: esosojazosazules.blogspot.com

This is, by definition, how much an individual is worth (economically). Life insurance policies contain fees, such as mortality and expense charges, and may contain restrictions, such as surrender periods. Click again to see term in life insurance, the needs approach is used mostly to establish. The needs approach to life insurance planning is used to estimate the amount of insurance coverage an individual needs. Choose the one which you are comfortable.

Source: dremelmicro.com

Source: dremelmicro.com

The needs approach to life insurance planning is used to estimate the amount of insurance coverage an individual needs. It is a comprehensive calculator and the method used is the most accurate one for estimating insurance amount. It is not an independent approach. The family needs approach requires you to purchase enough life insurance to allow your family to meet its various expenses in the event of your death. It assumes that the goal of life insurance is to cover the surviving family members� immediate expenses after the insured family member�s death as well as their ongoing expenses into the future.

Source: slideshare.net

Source: slideshare.net

The second way to calculate insurance needs is through a shortfall calculation. The needs analysis approach to life insurance? The needs approach is one of the most accurate methods to determine the amount of life insurance to own. Rather, it is one of two ways to determine the lump sum of insurance proceeds the surviving spouse will need to receive and invest in order to take care of ongoing family. Life insurance policies contain fees, such as mortality and expense charges, and may contain restrictions, such as surrender periods.

Source: quotacy.com

Source: quotacy.com

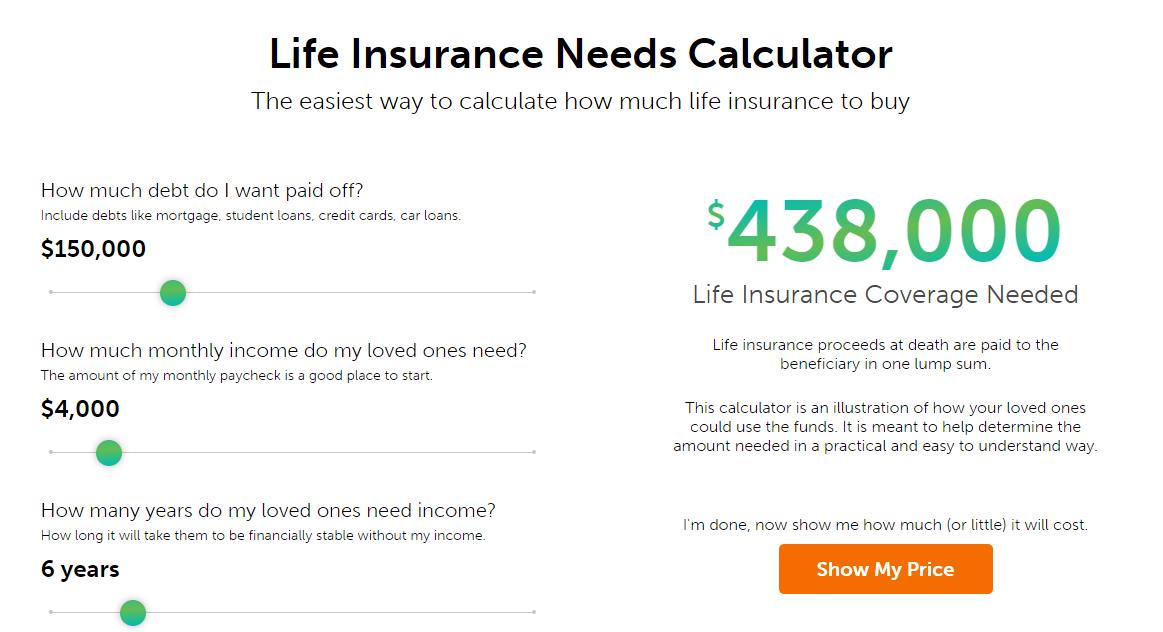

Life insurance need is, the financial need analysis approach. It is not an independent approach. The goal of this approach is to replace the primary breadwinner’s salary for a predetermined number of years. 4.3 · 6 reviews (2). The needs approach is one of the most accurate methods to determine the amount of life insurance to own.

Source: starless-suite.blogspot.com

Source: starless-suite.blogspot.com

When it comes to needs approach life insurance, you don’t have to overspend on a policy just to protect your loved ones. Rather, it is one of two ways to determine the lump sum of insurance proceeds the surviving spouse will need to receive and invest in order to take care of ongoing family income needs. Under the family needs approach, you divide your family’s needs into three main categories: Immediate needs at death (cash needed for funeral and other expenses) Using the needs approach, you calculate the amount of life insurance necessary to cover your family’s financial needs if you die.

Source: slideshare.net

Source: slideshare.net

The “needs approach” in life insurance is most useful in determining the amount of life insurance to be recommended to a client. Here, the basic objective is that the insurance coverage should be sufficient to provide for the dependants’ needs in case the breadwinner dies early. 5 · 1 review (9). The goal of this approach is to replace the primary breadwinner’s salary for a predetermined number of years. The needs approach is a method of calculating how much life insurance an individual or family requires to cover their expenses.

Source: fotorise.com

Source: fotorise.com

When it comes to needs approach life insurance, you don’t have to overspend on a policy just to protect your loved ones. Here is a sample of some of the main events which can be indemnified through life insurance: The needs approach to life insurance planning is used to estimate the amount of insurance coverage an individual needs. Please keep in mind that the primary reason to purchase life insurance is for the death. They cannot be worth more than what their productive potential allows, and

Source: slideshare.net

Source: slideshare.net

Life insurance need is, the financial need analysis approach. The needs approach to life insurance planning is used to estimate the amount of insurance coverage an individual needs. The goal of this approach is to replace the primary breadwinner’s salary for a predetermined number of years. Here is a sample of some of the main events which can be indemnified through life insurance: Life insurance policies contain fees, such as mortality and expense charges, and may contain restrictions, such as surrender periods.

Source: chegg.com

Source: chegg.com

The excel calculator provided here offers many options to accomplish the above. 5 · 1 review (9). That means if you make $50,000 a year, you will need a life insurance policy that pays around $500,000. This approach is based on the creation of a budget of expenses that will. The family needs approach requires you to purchase enough life insurance to allow your family to meet its various expenses in the event of your death.

Source: examples.com

Source: examples.com

The needs approach considers the amount of money needed to cover burial expenses as well as debts and obligations such as mortgages or college expenses. Rather, it is one of two ways to determine the lump sum of insurance proceeds the surviving spouse will need to receive and invest in order to take care of ongoing family. Well, regardless of circumstance, every individual makes a specific amount of money over their lifetime and no more (and no less). This is an approach which can take care of specific needs of an individual. Under the family needs approach, you divide your family’s needs into three main categories:

Source: taxfreemoneymachine.com

Source: taxfreemoneymachine.com

Life insurance need is, the financial need analysis approach. Please keep in mind that the primary reason to purchase life insurance is for the death. The capital retention approach is one of two methods of calculating your family’s life insurance needs under the family needs approach. Sep 6, 2021 — needs approach meaning is a method used to calculate the life insurance amount you must purchase. Independent life brokerage sources generally maintain life event lists for annual reviews, which i highly recommend.

Source: slideshare.net

Source: slideshare.net

It is a comprehensive calculator and the method used is the most accurate one for estimating insurance amount. It is a comprehensive calculator and the method used is the most accurate one for estimating insurance amount. There are three options provided for estimating the insurance corpus needed to meet your family’s expenses. The needs approach considers the amount of money needed to cover burial expenses as well as debts and obligations such as mortgages or college expenses. Rather, it is one of two ways to determine the lump sum of insurance proceeds the surviving spouse will need to receive and invest in order to take care of ongoing family.

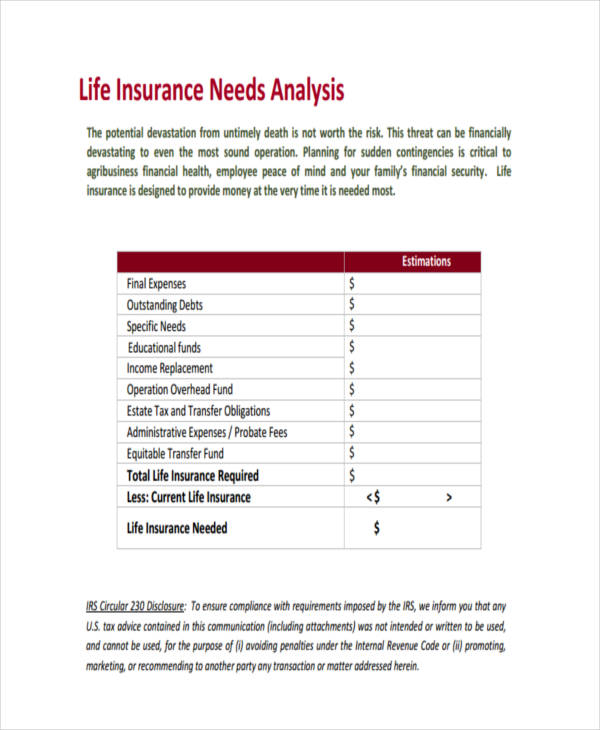

Source: sampletemplates.com

Source: sampletemplates.com

There are three options provided for estimating the insurance corpus needed to meet your family’s expenses. 5 · 1 review (9). The needs approach is a method used to calculate the amount of life insurance that an individual or a family needs to cover their necessities. The capital retention approach is one of two methods of calculating your family’s life insurance needs under the family needs approach. The family needs approach requires you to purchase enough life insurance to allow your family to meet its various expenses in the event of your death.

Source: taxfreemoneymachine.com

Source: taxfreemoneymachine.com

It assumes that the goal of life insurance is to cover the surviving family members� immediate expenses after the insured family member�s death as well as their ongoing expenses into the future. This approach is based on the creation of a budget of expenses that will. With this formula, you begin with the amount of income you would like to give to your family for a certain number of years. It is not an independent approach. The needs approach considers the amount of money needed to cover burial expenses as well as debts and.

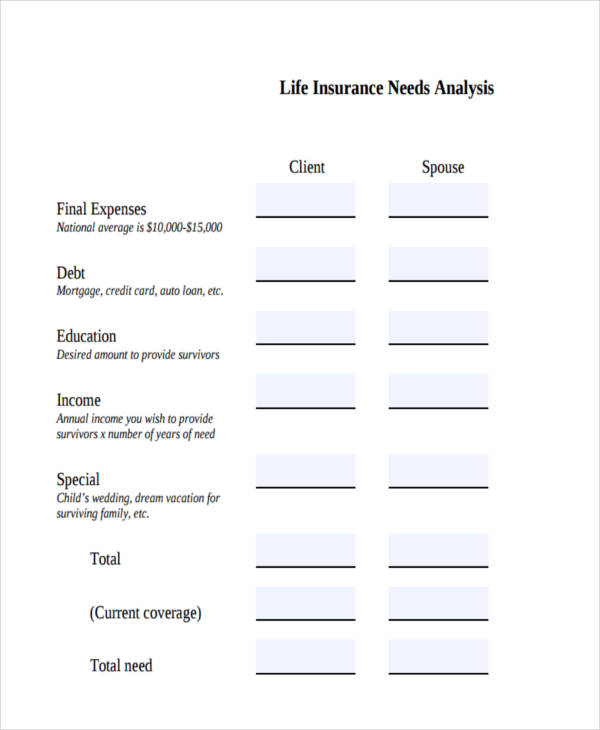

Source: sampleforms.com

Source: sampleforms.com

Well, regardless of circumstance, every individual makes a specific amount of money over their lifetime and no more (and no less). The capital retention approach is one of two methods of calculating your family�s life insurance needs under the family needs approach. The needs approach is a method of calculating how much life insurance an individual or family requires to cover their expenses. When it comes to needs approach life insurance, you don’t have to overspend on a policy just to protect your loved ones. Rather, it is one of two ways to determine the lump sum of insurance proceeds the surviving spouse will need to receive and invest in order to take care of ongoing family.

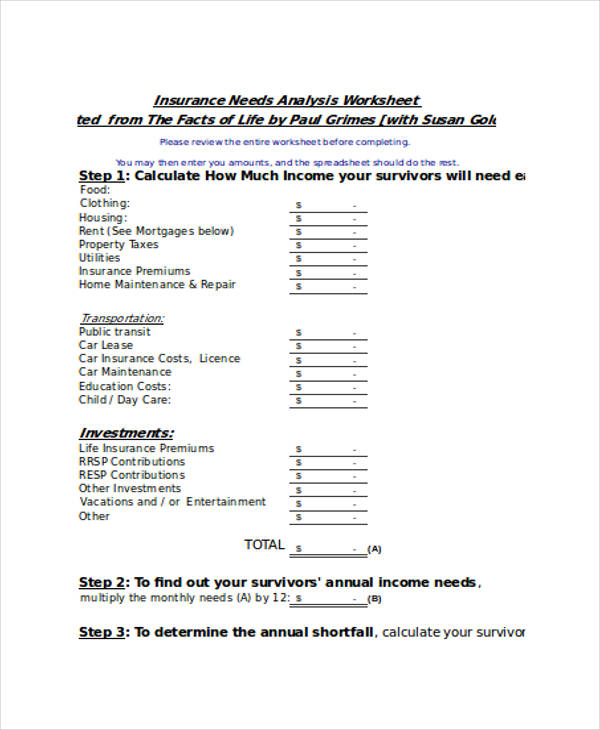

Source: help.snapprojections.com

Source: help.snapprojections.com

Choose the one which you are comfortable. The goal of this approach is to replace the primary breadwinner’s salary for a predetermined number of years. The needs approach considers the amount of money needed to cover burial expenses as well as debts and obligations such as mortgages or college expenses. Under the family needs approach, you divide your family’s needs into three main categories: The excel calculator provided here offers many options to accomplish the above.

Source: rudolfbarshai.com

Source: rudolfbarshai.com

Begin by multiplying the client’s current annual income by how many years they want to provide financial support for their survivors. They cannot be worth more than what their productive potential allows, and How much money is necessary at the time of death to meet obligations and how much future income is needed to sustain the household without falling into poverty. That means if you make $50,000 a year, you will need a life insurance policy that pays around $500,000. The two approaches to life insurance.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title needs approach life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.