Negotiating insurance settlement property damage information

Home » Trend » Negotiating insurance settlement property damage informationYour Negotiating insurance settlement property damage images are available in this site. Negotiating insurance settlement property damage are a topic that is being searched for and liked by netizens now. You can Download the Negotiating insurance settlement property damage files here. Get all free vectors.

If you’re searching for negotiating insurance settlement property damage pictures information connected with to the negotiating insurance settlement property damage interest, you have come to the right blog. Our website frequently gives you suggestions for seeking the highest quality video and image content, please kindly surf and find more informative video content and graphics that match your interests.

Negotiating Insurance Settlement Property Damage. Schedule a free consultation document everything related to your claim Many people who have suffered property damage or a personal injury find themselves in a situation where they have to negotiate with the insurance company. Typically, the adjuster will not send the claimant a check for the […] Connect the dots with the provisions in your homeowners policy.

Negotiating Your Fire Damage Insurance Claim Settlement From millerpublicadjusters.com

You can submit a claim for property damage compensation to the insurance company of the driver who was at fault for the accident. You can write a letter to the adjuster with the negotiated amount. The process starts by filing your claim. Always seek to be fully indemnified for your loss, do not “negotiate” or settle for any less than what is fully owed to you. Hire a professional public adjuster to help negotiate your insurance settlement in order to obtain the fairest. What to expect in negotiation based on the information contained in the adjuster’s damage report, the adjuster will propose an initial settlement offer.

This process will be done when you and the insurance company agree on the settlement.

Search for jobs related to negotiating insurance settlement property damage or hire on the world�s largest freelancing marketplace with 20m+ jobs. The second, insurance adjuster reviews your claim to offer you a settlement. This process will be done when you and the insurance company agree on the settlement. If you’ve been in an accident, you may need to hire an attorney to negotiate an insurance settlement on your behalf. Always seek to be fully indemnified for your loss, do not “negotiate” or settle for any less than what is fully owed to you. The first offer may be a percentage of what they think is the final value.

Source: millerpublicadjusters.com

Connect the dots with the provisions in your homeowners policy. Many people who have suffered property damage or a personal injury find themselves in a situation where they have to negotiate with the insurance company. The process starts by filing your claim. It is often the case that the initial settlement offer is lower than what the claimant was anticipating or hoping for. If you’ve been in an accident, you may need to hire an attorney to negotiate an insurance settlement on your behalf.

Source: kpattorney.com

Source: kpattorney.com

Fortunately, you do not have to negotiate alone. Countering a low insurance settlement offer Then settle for nothing less. Analyze the policy and document everything related to your insurance settlement claim the first step in. Negotiating your fire damage insurance claim settlement starts when you report your fire loss.

Source: slideshare.net

Source: slideshare.net

Many people who have suffered property damage or a personal injury find themselves in a situation where they have to negotiate with the insurance company. Hire a professional public adjuster to help negotiate your insurance settlement in order to obtain the fairest. From an ethical standpoint, be sure to let the property claim adjuster know if you record a conversation or take notes. The adjuster will accept your offer or will offer you another proposal. 3 important tips for negotiating insurance settlement after property damage 1.

Source: injurylawyers.com

Source: injurylawyers.com

A recorded statement for a property insurance claim can help resolve disputes. So for example, you may have a certain value to your claim, and it’s based in large part on the fact that your client has substantial economic damages. From an ethical standpoint, be sure to let the property claim adjuster know if you record a conversation or take notes. Connect the dots with the provisions in your homeowners policy. Typically, the adjuster will not send the claimant a check for the […]

Source: zalma.com

Source: zalma.com

Insurers do this to pay out as little as possible. No matter the circumstances of your accident, the first step in negotiating an insurance settlement is to determine where to file the insurance claim. You can submit a claim for property damage compensation to the insurance company of the driver who was at fault for the accident. How does the insurance decide to offer a settlement? You can write a letter to the adjuster with the negotiated amount.

Source: youtube.com

Source: youtube.com

Schedule a free consultation document everything related to your claim Insurance negotiation tip number six when negotiating a claim is to seek a commitment to the facts that build the basis of how you’re valuing your claim. A recorded statement for a property insurance claim can help resolve disputes. It�s free to sign up and bid on jobs. It is often the case that the initial settlement offer is lower than what the claimant was anticipating or hoping for.

Source: takemycounsel.com

Source: takemycounsel.com

To claim compensation for damaged or destroyed property, you must be able to show that the property was actually damaged in. Negotiating an insurance settlement yourself Countering a low insurance settlement offer A recorded statement for a property insurance claim can help resolve disputes. In some cases, injury victims or people whose homes were damaged in a hurricane are anxious to get some money because they need to pay for medical treatments, home or vehicle repairs or.

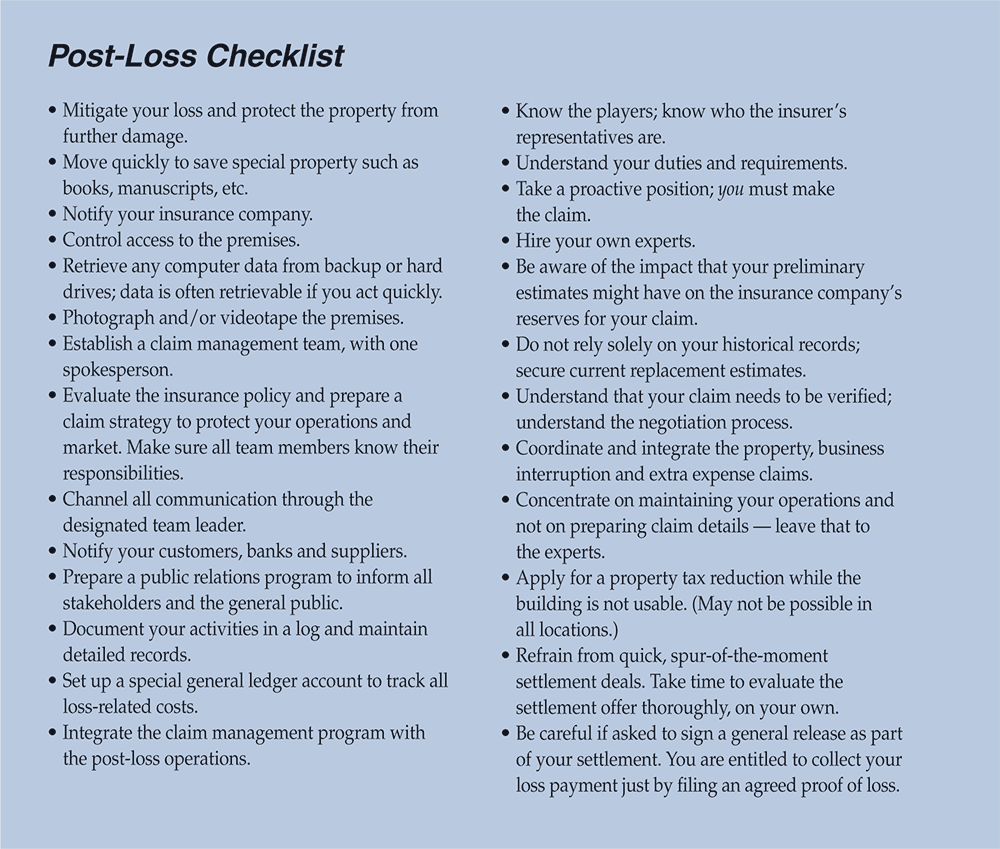

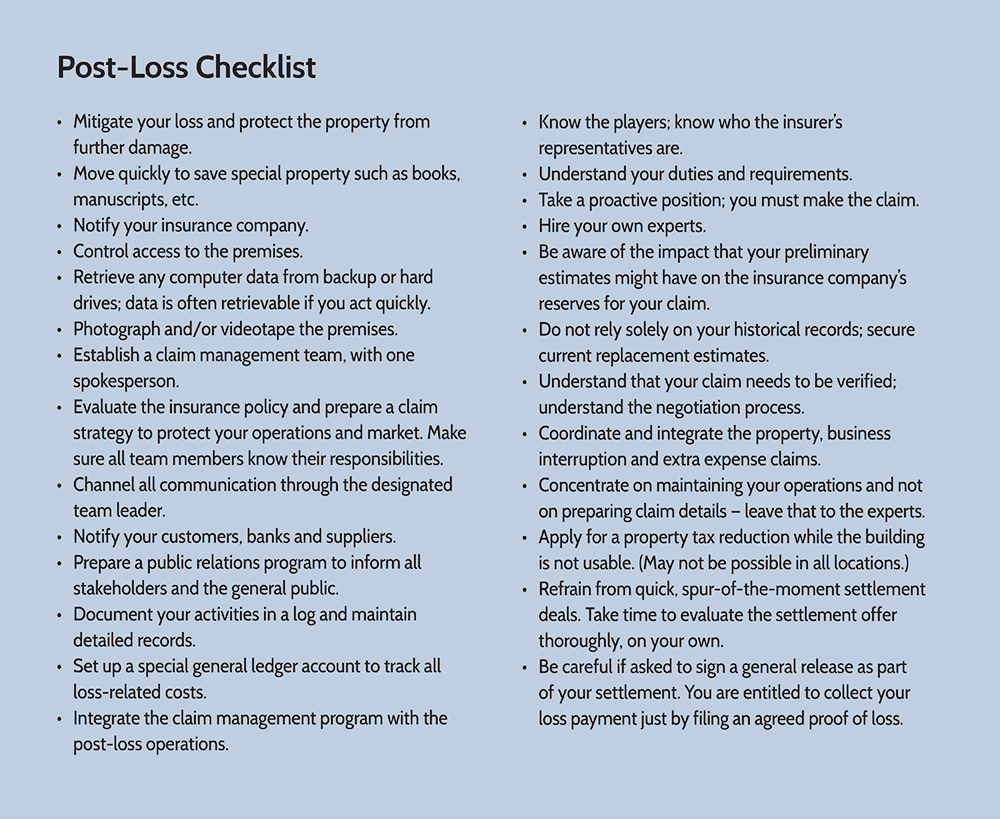

Source: adjustersinternational.com

Source: adjustersinternational.com

If you’ve been in an accident, you may need to hire an attorney to negotiate an insurance settlement on your behalf. Reject their initial offer and make a counteroffer focusing on your strongest point. Fortunately, you do not have to negotiate alone. The adjuster will use several resources to determine how much it will cost to repair any property damage. You can submit a claim for property damage compensation to the insurance company of the driver who was at fault for the accident.

Source: injurylawyers.com

Source: injurylawyers.com

It’s a tactic to pressure you to accept an offer for less than the fair value of the claim. 3 important tips for negotiating insurance settlement after property damage 1. Many people who have suffered property damage or a personal injury find themselves in a situation where they have to negotiate with the insurance company. Arrange for an inspection of your property to have a comparison line to negotiate a settlement with an insurance claim adjuster insurance companies often calculate repair estimates in a different way than other parties. What to expect in negotiation based on the information contained in the adjuster’s damage report, the adjuster will propose an initial settlement offer.

Source: insurancespecialists.com

Source: insurancespecialists.com

The adjuster will use several resources to determine how much it will cost to repair any property damage. Arrange for an inspection of your property to have a comparison line to negotiate a settlement with an insurance claim adjuster insurance companies often calculate repair estimates in a different way than other parties. To claim compensation for damaged or destroyed property, you must be able to show that the property was actually damaged in. Search for jobs related to negotiating insurance settlement property damage or hire on the world�s largest freelancing marketplace with 20m+ jobs. What to expect in negotiation based on the information contained in the adjuster’s damage report, the adjuster will propose an initial settlement offer.

Source: claimsmate.com

Source: claimsmate.com

After filing a claim, an insurance company adjuster arrives at your property to assess the damage. Connect the dots with the provisions in your homeowners policy. How does the insurance decide to offer a settlement? The first offer may be a percentage of what they think is the final value. Be sure to compare your final settlement offer with your notes and recorded conversations to ensure the settlement matches the verbal promise.

Source: selzcontracting.com

Source: selzcontracting.com

The process starts by filing your claim. A recorded statement for a property insurance claim can help resolve disputes. Negotiating an insurance settlement yourself Help is a click away The adjuster will use several resources to determine how much it will cost to repair any property damage.

Source: injurylawyers.com

Source: injurylawyers.com

Always seek to be fully indemnified for your loss, do not “negotiate” or settle for any less than what is fully owed to you. No matter the circumstances of your accident, the first step in negotiating an insurance settlement is to determine where to file the insurance claim. Insurance negotiation tip number six when negotiating a claim is to seek a commitment to the facts that build the basis of how you’re valuing your claim. This process will be done when you and the insurance company agree on the settlement. It is possible, however, to negotiate your own settlement, especially when the injuries are relatively minor and the other party’s fault is obvious.

Source: adjustersinternational.com

Source: adjustersinternational.com

The first offer may be a percentage of what they think is the final value. Help is a click away Now that you understand what a claims adjuster�s role is, let�s discuss how to begin the settlement negotiation process. To negotiate a cash settlement with an insurance company, file an insurance claim, and accept a cash settlement. The first step of the negotiating process is filling a residential insurance claim.

Source: youtube.com

Source: youtube.com

A “settlement authority” is just a negotiating tactic.if an adjustor tells you about their authority, he or she is trying to convince you to accept the offer on the table. Claims adjusters will divide damages into two categories: Many people who have suffered property damage or a personal injury find themselves in a situation where they have to negotiate with the insurance company. So for example, you may have a certain value to your claim, and it’s based in large part on the fact that your client has substantial economic damages. To negotiate a cash settlement with an insurance company, file an insurance claim, and accept a cash settlement.

Source: firstlightlaw.com

Source: firstlightlaw.com

Help is a click away Negotiating an insurance settlement yourself What to expect in negotiation based on the information contained in the adjuster’s damage report, the adjuster will propose an initial settlement offer. Then settle for nothing less. You can submit a claim for property damage compensation to the insurance company of the driver who was at fault for the accident.

Source: ydesignr.blogspot.com

Source: ydesignr.blogspot.com

No matter the circumstances of your accident, the first step in negotiating an insurance settlement is to determine where to file the insurance claim. It is often the case that the initial settlement offer is lower than what the claimant was anticipating or hoping for. Hire an attorney if necessary. The first step of the negotiating process is filling a residential insurance claim. After filing a claim, an insurance company adjuster arrives at your property to assess the damage.

Source: stellaradjusting.com

Source: stellaradjusting.com

A recorded statement for a property insurance claim can help resolve disputes. Hire an attorney if necessary. The adjuster will accept your offer or will offer you another proposal. Always seek to be fully indemnified for your loss, do not “negotiate” or settle for any less than what is fully owed to you. This process will be done when you and the insurance company agree on the settlement.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title negotiating insurance settlement property damage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.