Negotiating with insurance adjusters on totalled car Idea

Home » Trend » Negotiating with insurance adjusters on totalled car IdeaYour Negotiating with insurance adjusters on totalled car images are available in this site. Negotiating with insurance adjusters on totalled car are a topic that is being searched for and liked by netizens now. You can Find and Download the Negotiating with insurance adjusters on totalled car files here. Find and Download all royalty-free images.

If you’re searching for negotiating with insurance adjusters on totalled car images information connected with to the negotiating with insurance adjusters on totalled car interest, you have come to the right blog. Our website frequently gives you suggestions for viewing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

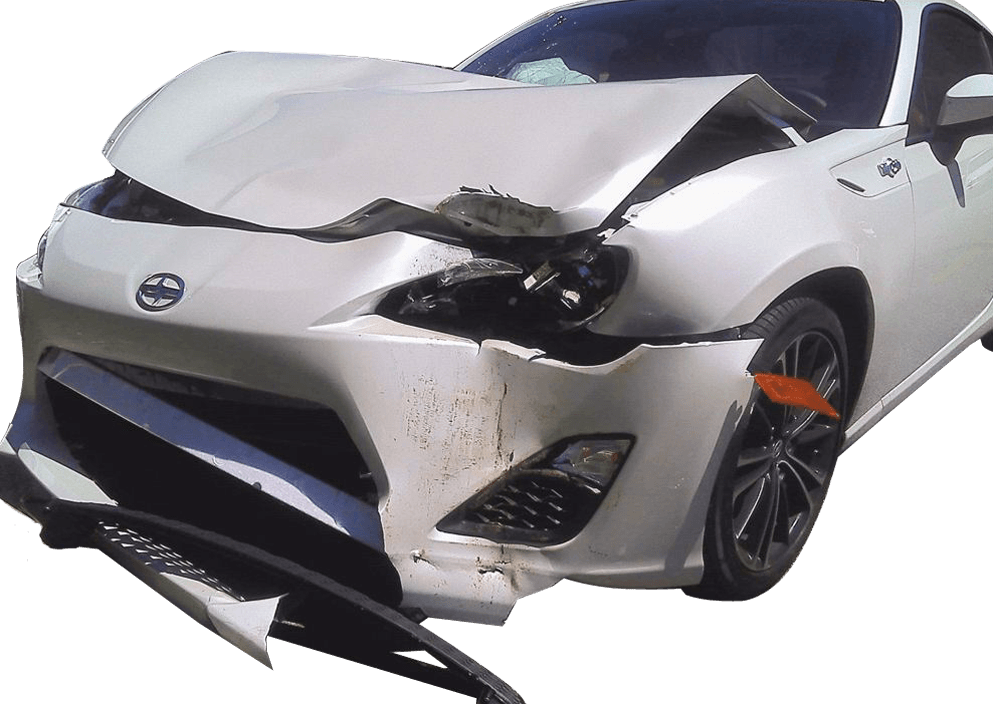

Negotiating With Insurance Adjusters On Totalled Car. When the expense of the vehicle repairs exceeds the vehicle’s actual worth or actual cash value (acv), the vehicle is considered a total loss. Filing a claim is the first step in the negotiation process with the insurance claim adjuster. The second step in the negotiation process soon after filing an insurance claim, you should receive a reservation of rights letter. The determination of the wrecked car value is left to the company.

Car Totaled? MyG37 From myg37.com

Car Totaled? MyG37 From myg37.com

They want to see if you know what your claim is really worth so they are testing you. Your insurer is not going to pay out on damage that is not covered under your policy. This is called the replacement value. If you have a major accident and the car is totaled, the cost to turn around and purchase a new car will always be higher than what your old car was worth at the time of the accident. How to negotiate with car insurance adjusters about a car total loss determine what the vehicle is worth. The second step in the negotiation process soon after filing an insurance claim, you should receive a reservation of rights letter.

They will use this to their advantage to create a situation such as insurance not paying enough for a totaled car.

I feel that the adjuster will value my car a lot less than it is. When negotiating with the insurer or their adjuster, make sure you know what your auto insurance policy does and does not cover. When you are attempting to negotiate with an insurer after a total loss claim you are likely to find out your vehicle is not worth as what you expect. The “reservation of rights” letter: The determination of the wrecked car value is left to the company. You may need to demonstrate how you arrived at your payout amount if you are willing to negotiate.

Source: rfautogroup.com

Source: rfautogroup.com

Drivers should always negotiate with insurance adjusters to ensure that they receive the right value for their claim. Typically, the adjuster will not send the claimant a check for the car until he or she. They will use this to their advantage to create a situation such as insurance not paying enough for a totaled car. Insurance companies will try to save money wherever they can, but furnishing additional information like estimates, work receipts, and even policy details can help provide a more accurate value. It is possible to get estimates from multiple body shops as well as online tools.

Source: money.usnews.com

Source: money.usnews.com

Collecting evidence is key to negotiating with an insurance company after a car crash. Insurance companies will try to save money wherever they can, but furnishing additional information like estimates, work receipts, and even policy details can help provide a more accurate value. When your car is totaled in an accident and you file a claim, your auto insurance should pay you the same amount it would cost for you to walk onto a lot and purchase the exact same car. Decide if the initial offer is too low. If your insurance adjuster makes you a low offer, ask them to justify it.

Source: valientemott.com

Source: valientemott.com

Filing a claim is the first step in the negotiation process with the insurance claim adjuster. If your insurance adjuster makes you a low offer, ask them to justify it. So if you are close to the 50 percent threshold, you can argue with the adjuster to just total it out. that way, you get a check that you can put toward the purchase of. If your car is a total loss, and the insurance carrier accepts liability, they are required to pay fair market value for the vehicle. This is called the replacement value.

Source: myg37.com

Source: myg37.com

After you get into an accident, the car will be sent to a claims adjuster who will determine how much it will take to repair it. When negotiating, be sure to. This is a letter stating the insurance company’s intention to investigate your claim. The ability to negotiate effectively is critical to settling early and for the maximum amount. After you get into an accident, the car will be sent to a claims adjuster who will determine how much it will take to repair it.

Source: firstlightlaw.com

Source: firstlightlaw.com

You can claim a total loss of your vehicle if it is beyond salvation and has become utterly unusable after an accident. How to negotiate with car insurance adjusters about a car total loss determine what the vehicle is worth. If your vehicle has been totaled, find out how your auto insurance company calculates a vehicle’s. When negotiating with the insurer or their adjuster, make sure you know what your auto insurance policy does and does not cover. It is possible to get estimates from multiple body shops as well as online tools.

Source: myg37.com

Source: myg37.com

This is a letter stating the insurance company’s intention to investigate your claim. If you have a major accident and the car is totaled, the cost to turn around and purchase a new car will always be higher than what your old car was worth at the time of the accident. I feel that the adjuster will value my car a lot less than it is. The second step in the negotiation process soon after filing an insurance claim, you should receive a reservation of rights letter. When your car is totaled in an accident and you file a claim, your auto insurance should pay you the same amount it would cost for you to walk onto a lot and purchase the exact same car.

Source: hoffmannpersonalinjury.com

Source: hoffmannpersonalinjury.com

Drivers should always negotiate with insurance adjusters to ensure that they receive the right value for their claim. You may need to demonstrate how you arrived at your payout amount if you are willing to negotiate. They will use this to their advantage to create a situation such as insurance not paying enough for a totaled car. This is what insurers are going to use to determine how much your car is worth at the time of the accident. After you get into an accident, the car will be sent to a claims adjuster who will determine how much it will take to repair it.

Source: reddit.com

Source: reddit.com

It is possible to get estimates from multiple body shops as well as online tools. The determination of the wrecked car value is left to the company. Your insurer is not going to pay out on damage that is not covered under your policy. You can negotiate with insurance for a higher payout if your car is deemed a total loss. So, ask them why the offer is so low and actively take notes when they give you their answers.

Source: totallossappraisals.com

Source: totallossappraisals.com

The second step in the negotiation process soon after filing an insurance claim, you should receive a reservation of rights letter. Actual cash value refers to the cost to replace your vehicle minus its depreciated value. When an insurance company settles a total loss claim they compensate you for the “actual cash value” (acv) of your vehicle. They will use this to their advantage to create a situation such as insurance not paying enough for a totaled car. This is called the replacement value.

Source: carsdirect.com

Source: carsdirect.com

Negotiate with your auto insurer confirm the agreement in writing determine the value of your car knowing the true value of your car is vital when negotiating with an insurance company. In massachusetts, it’s left to the auto insurer to decide whether or not a vehicle is a total loss. Actual cash value refers to the cost to replace your vehicle minus its depreciated value. This is called the replacement value. Collecting evidence is key to negotiating with an insurance company after a car crash.

Source: taxattorneyslive.com

Source: taxattorneyslive.com

They want to see if you know what your claim is really worth so they are testing you. This value is considered replacement value, and in most cases you will need to negotiate with your insurance provider to get the most value out of your totaled. In massachusetts, it’s left to the auto insurer to decide whether or not a vehicle is a total loss. Actual cash value refers to the cost to replace your vehicle minus its depreciated value. Yes, an insurance company can force you to total your car because state laws regulate when cars need to be totaled.

Source: city-data.com

Source: city-data.com

Your car insurance company may send an adjuster to represent them in the negotiations, or you may just deal with them directly. The second step in the negotiation process soon after filing an insurance claim, you should receive a reservation of rights letter. Be willing to negotiate ideally, your suggested settlement amount will be higher than your bottom line because the adjuster will want to negotiate. Unfortunately, you might find their estimate of. This value is considered replacement value, and in most cases you will need to negotiate with your insurance provider to get the most value out of your totaled.

Source: youtube.com

Source: youtube.com

After your car is totaled, you might expect your insurance company to pay you what you paid for your car so that you can replace it. This value is considered replacement value, and in most cases you will need to negotiate with your insurance provider to get the most value out of your totaled. Learn how to get the most for your totaled car and how to negotiate the value of your car with your auto insurance company. You can claim a total loss of your vehicle if it is beyond salvation and has become utterly unusable after an accident. Negotiate with your auto insurer confirm the agreement in writing determine the value of your car knowing the true value of your car is vital when negotiating with an insurance company.

Source: takemycounsel.com

Source: takemycounsel.com

Get free car insurance quotes >> tips for negotiating the actual cash value of your car. Actual cash value refers to the cost to replace your vehicle minus its depreciated value. Be willing to negotiate ideally, your suggested settlement amount will be higher than your bottom line because the adjuster will want to negotiate. There may be no need to negotiate with your claims adjuster if. So, ask them why the offer is so low and actively take notes when they give you their answers.

So if you are close to the 50 percent threshold, you can argue with the adjuster to just total it out. that way, you get a check that you can put toward the purchase of. How to negotiate a total loss vehicle value. The ability to negotiate effectively is critical to settling early and for the maximum amount. A total loss situation can occur if the cost of fixing your vehicle is at least 70 percent of. When your car is totaled in an accident and you file a claim, your auto insurance should pay you the same amount it would cost for you to walk onto a lot and purchase the exact same car.

Source: limerickautobody.com

Source: limerickautobody.com

Learn how to get the most for your totaled car and how to negotiate the value of your car with your auto insurance company. You can claim a total loss of your vehicle if it is beyond salvation and has become utterly unusable after an accident. When negotiating with the insurer or their adjuster, make sure you know what your auto insurance policy does and does not cover. Typically they sent a low offer as a negotiating tactic. This value is considered replacement value, and in most cases you will need to negotiate with your insurance provider to get the most value out of your totaled.

Source: rairais.blogspot.com

Source: rairais.blogspot.com

Your car insurance company may send an adjuster to represent them in the negotiations, or you may just deal with them directly. In massachusetts, it’s left to the auto insurer to decide whether or not a vehicle is a total loss. Yes, an insurance company can force you to total your car because state laws regulate when cars need to be totaled. Five critical tips for negotiating total loss settlements 1. Talk to your insurance adjuster about negotiating if you feel the vehicle’s worth is not being offered, you can negotiate with your claims adjuster.

Source: carspoon.com

Source: carspoon.com

Get free car insurance quotes >> tips for negotiating the actual cash value of your car. Adjusters rely on people not knowing enough about the claims process to protect their rights. When negotiating with the insurer or their adjuster, make sure you know what your auto insurance policy does and does not cover. Be willing to negotiate ideally, your suggested settlement amount will be higher than your bottom line because the adjuster will want to negotiate. Insurance companies will try to save money wherever they can, but furnishing additional information like estimates, work receipts, and even policy details can help provide a more accurate value.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title negotiating with insurance adjusters on totalled car by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.