Net retention ratio insurance Idea

Home » Trend » Net retention ratio insurance IdeaYour Net retention ratio insurance images are ready in this website. Net retention ratio insurance are a topic that is being searched for and liked by netizens now. You can Download the Net retention ratio insurance files here. Download all free images.

If you’re looking for net retention ratio insurance images information related to the net retention ratio insurance topic, you have come to the right blog. Our site frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly surf and locate more informative video content and images that fit your interests.

Net Retention Ratio Insurance. Why is this metric important? Earnings can be referred to as net income and is found on the income statement. Size of the insurance company�s health ratio. If you’re a highly successful company with happy customers, your nrr will most likely exceed 100%.

Net Retention Ratio Insurance at Insurance From revisi.net

Net Retention Ratio Insurance at Insurance From revisi.net

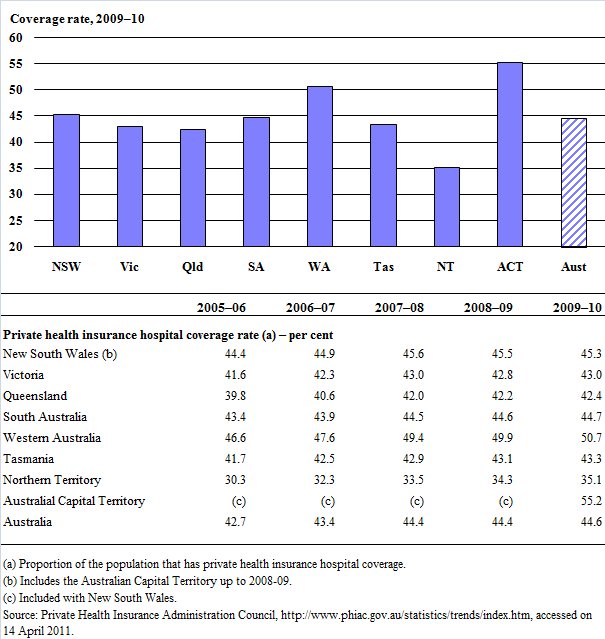

Whatever is in between varies by the industry. The measurement reflects the number of underwritten insurance plans that remain in. Meanwhile, a 15% retention rate is usually bad. According to an article posted by the independent insurance agents of dallas, the average customer retention rate within the insurance industry is 84%. Total central government debt (million usd). Net incurred claim ratios (defined as net incurred claims divided by net earned premium) table 13:

The retention ratio (also known as the net income retention ratio) is the ratio of a company’s retained income to its net income.

That�s why it�s imperative to compare your retention rate to similar companies and niches rather than strive for a certain number. Divide the company�s retained earnings by. The retention ratio (also known as the net income retention ratio) is the ratio of a company’s retained income to its net income. How to calculate the retention ratio obtain the company�s net income figure listed at the bottom of its income statement. Insurance retention ratio is the amount of business an insurance company retains. Net premium written ÷gross premium written.

Source: newmlmmodel.blogspot.com

Source: newmlmmodel.blogspot.com

Divide the company�s retained earnings by. Net commission ratios (defined as net commission to net earned premium) According to an article posted by the independent insurance agents of dallas, the average customer retention rate within the insurance industry is 84%. Why is this metric important? Compiled from the annual reports of lic and sbi life insurance co.

Source: newmlmmodel.blogspot.com

Source: newmlmmodel.blogspot.com

Retained earnings is shown in the numerator of the formula as net income minus dividends. Net premium written ÷gross premium written. The retention ratio measures the percentage of a company’s profits that are reinvested into the company in some way, rather than being paid out to investors as dividends. By comparison, the oecd average is 85 percent, while the united states and the united kingdom reported retention ratios of 84.4 and 80.5 percent respectively at this time. A 100% retention rate is always good.

Source: newmlmmodel.blogspot.com

Source: newmlmmodel.blogspot.com

Our revolutionary technology changes the way individuals and organizations discover, visualize, model, and present their data and the world�s data to facilitate better. How to calculate the retention ratio obtain the company�s net income figure listed at the bottom of its income statement. Retention ratio = 80 % see also how were the new time and space theories demonstrated in art? The retention ratio measures the percentage of a company’s profits that are reinvested into the company in some way, rather than being paid out to investors as dividends. According to an article posted by the independent insurance agents of dallas, the average customer retention rate within the insurance industry is 84%.

Source: newmlmmodel.blogspot.com

Our revolutionary technology changes the way individuals and organizations discover, visualize, model, and present their data and the world�s data to facilitate better. For example, a company with a very low expense ratio can afford a higher target loss ratio. Net retention ratios (defined as net written premium divided by gross written premium) table 11: Many studies have shown that $1 paid towards customer retention increases profits by more than $5 spent on new customer acquisition. Whatever is in between varies by the industry.

Source: newmlmmodel.blogspot.com

Source: newmlmmodel.blogspot.com

Net retention ratios (defined as net written premium divided by gross written premium) table 11: Business net retention is a measure of how many policies an insurance company has on hand at any particular time. The importance of retention itself is also reflected by ojk regulation no. Denmark was the the oecd country with the highest reinsurance retention rate for life insurance in 2019, with 99.9 percent. Insurance regulatory and do development authority cir no.

Source: revisi.net

Source: revisi.net

Insurance retention ratio is the amount of business an insurance company retains. Insurance regulatory and do development authority cir no. Meanwhile, a 15% retention rate is usually bad. Higher ratio is an indicator of high risk bearing capacity of the insurers. Retention is very cost effective.

Source: newmlmmodel.blogspot.com

Source: newmlmmodel.blogspot.com

It is a rough measure of how much of the risk is being carried by an. How do you calculate retention ratio in excel? Nrr can be calculated at any time, but is usually looked at on an annual or monthly basis. Business net retention is a measure of how many policies an insurance company has on hand at any particular time. Denmark was the the oecd country with the highest reinsurance retention rate for life insurance in 2019, with 99.9 percent.

Source: revisi.net

Source: revisi.net

Total central government debt (million usd). If you’re a highly successful company with happy customers, your nrr will most likely exceed 100%. Why is this metric important? This is calculated based on premiums, or the amount each person pays for insurance coverage. Each insurance company formulates its own target loss ratio, which depends on the expense ratio.

Source: newmlmmodel.blogspot.com

Source: newmlmmodel.blogspot.com

Total central government debt (million usd). What causes the loss ratio to be high? A 100% retention rate is always good. Net commission ratios (defined as net commission to net earned premium) Denmark was the the oecd country with the highest reinsurance retention rate for life insurance in 2019, with 99.9 percent.

Source: newmlmmodel.blogspot.com

Source: newmlmmodel.blogspot.com

Denmark was the the oecd country with the highest reinsurance retention rate for life insurance in 2019, with 99.9 percent. Insurance regulatory and do development authority cir no. The overall premium retention ratio stood at 37.9% compared to 33.6% for the same period in 2020, it stated. Compiled from the annual reports of lic and sbi life insurance co. It is a rough measure of how much of the risk is being carried by an.

Source: jlkrosenberger.com

Source: jlkrosenberger.com

Many studies have shown that $1 paid towards customer retention increases profits by more than $5 spent on new customer acquisition. What causes the loss ratio to be high? Incurred claim ratio held nearly steady at 69.6% from 69.8%, while the net retention ratio rose to 76.4% from 67.7%. The overall premium retention ratio stood at 37.9% compared to 33.6% for the same period in 2020, it stated. What may work for your niche can be unacceptable for another, and vice versa.

Source: newmlmmodel.blogspot.com

Insurance business written in the reporting country. Net retention ratio change in net written premium increase in technical reserves to increase in gross written premium page 8 of 32. Combined ratio, calculated by adding incurred losses and expenses and dividing them by the premium earned, stood at. Divide the company�s retained earnings by. How do you calculate retention ratio in excel?

Source: newmlmmodel.blogspot.com

Source: newmlmmodel.blogspot.com

Average term to maturity and duration. The importance of retention itself is also reflected by ojk regulation no. Size of the insurance company�s health ratio. Many studies have shown that $1 paid towards customer retention increases profits by more than $5 spent on new customer acquisition. Nrr is perhaps the most fundamental kpi in terms of determining customer success with your product.

Source: newmlmmodel.blogspot.com

Source: newmlmmodel.blogspot.com

Divide the company�s retained earnings by. Net premium written ÷gross premium written. Net retention ratio change in net written premium increase in technical reserves to increase in gross written premium page 8 of 32. That�s why it�s imperative to compare your retention rate to similar companies and niches rather than strive for a certain number. Our revolutionary technology changes the way individuals and organizations discover, visualize, model, and present their data and the world�s data to facilitate better.

Source: newmlmmodel.blogspot.com

Source: newmlmmodel.blogspot.com

Meanwhile, a 15% retention rate is usually bad. The overall premium retention ratio stood at 37.9% compared to 33.6% for the same period in 2020, it stated. Nrr can be calculated at any time, but is usually looked at on an annual or monthly basis. Whatever is in between varies by the industry. Compiled from the annual reports of lic and sbi life insurance co.

Source: newmlmmodel.blogspot.com

Source: newmlmmodel.blogspot.com

Divide the company�s retained earnings by. Combined ratio, calculated by adding incurred losses and expenses and dividing them by the premium earned, stood at. Incurred claim ratio held nearly steady at 69.6% from 69.8%, while the net retention ratio rose to 76.4% from 67.7%. Retained earnings is shown in the numerator of the formula as net income minus dividends. Size of the insurance company�s health ratio.

Source: prosightspecialty.com

Source: prosightspecialty.com

Divide the company�s retained earnings by. Retention is very cost effective. Total central government debt (million usd). This means that 99.9 percent of life insurance premiums. The importance of retention itself is also reflected by ojk regulation no.

Source: newmlmmodel.blogspot.com

How do you calculate retention ratio in excel? Nrr is perhaps the most fundamental kpi in terms of determining customer success with your product. Size of the insurance company�s health ratio. How do you calculate retention ratio in excel? The retention ratio (also known as the net income retention ratio) is the ratio of a company’s retained income to its net income.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title net retention ratio insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.