Nevada insurance premium tax information

Home » Trend » Nevada insurance premium tax informationYour Nevada insurance premium tax images are ready. Nevada insurance premium tax are a topic that is being searched for and liked by netizens now. You can Download the Nevada insurance premium tax files here. Get all free vectors.

If you’re looking for nevada insurance premium tax pictures information connected with to the nevada insurance premium tax topic, you have pay a visit to the right blog. Our website always gives you hints for viewing the highest quality video and picture content, please kindly hunt and find more informative video content and images that fit your interests.

Nevada Insurance Premium Tax. Eligibility requirements for the advanced premium tax credit. Between 2000 and 2004, insurance premium tax revenue grew by 43 percent. In 2004, $14 billion in taxes on insurance premiums were collected on $960 billion worth of insurance premiums and annuity considerations, accounting for 2.4 percent of state tax revenue. When are the quarterly insurance returns due?

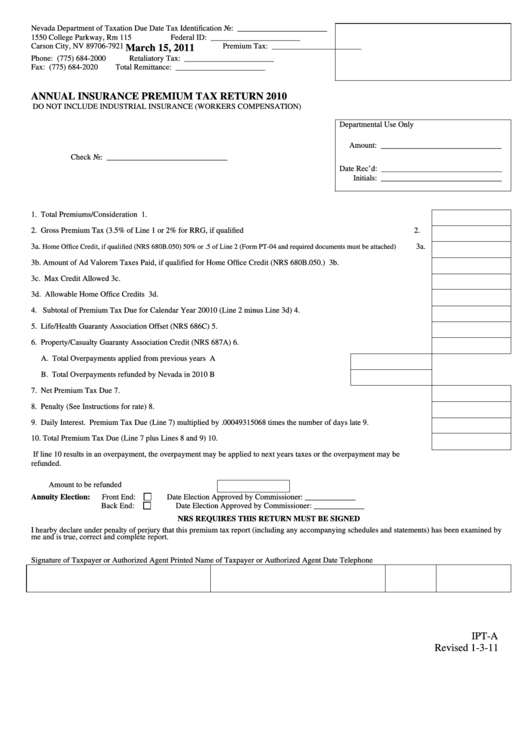

The nevada premium tax rate is 3.5%. When are the quarterly insurance returns due? Nevada does have an industrial insured exemption (see appendix c) which will remain in effect. Your tax credit is based on the income estimate and household information you put on your marketplace application. The tax is assessed on each insurer transacting insurance business in this state on net direct premiums and considerations at a rate of 3.5 percent. Quarterly insurance premium tax return.

The nevada premium tax rate is 3.5%.

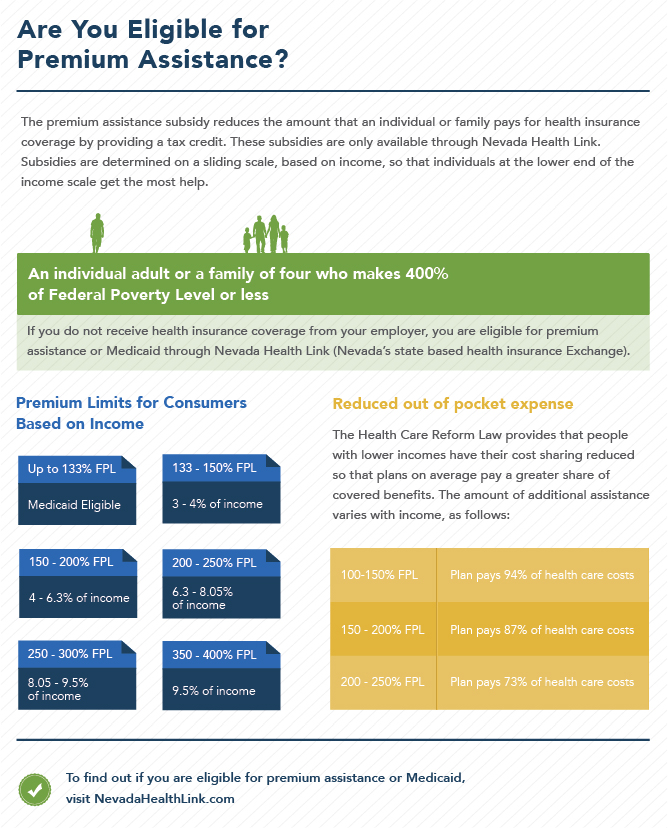

264 are domiciled in nevada, and 202 companies are captives. To be eligible for the aptc, you must be lawfully present in the united states, a current tax filer with the irs and earn between 138% and 400% of the federal poverty level (fpl). Pursuant to nrs 680b.025, premium tax is a tax levied by the state of nevada on insurance companies doing business in this state. One component of the insurance premium tax involves annuities which are Instead, it will be deducted from the initial value of the annuity contract. The nevada premium tax rate is 3.5% or 2% for risk retention groups, if qualified.

Source: nourish-brow.blogspot.com

Source: nourish-brow.blogspot.com

The tax is assessed on each insurer transacting insurance business in this state on net direct premiums and considerations at a rate of 3.5 percent. Insurers are required to obtain and document the consent of the vehicle owner or owner’s authorized. The insurance premium tax was enacted in 1933 and is authorized by nevada revised statutes section 680b. 2% (annually) (except life insurance) mississippi. Per nrs 680b, nevada imposes a tax of 3.5% of net direct premiums written and net direct considerations written in our state.

$5,000 minimum* $175,000 maximum * a captive insurer is entitled to receive a nonrefundable credit of $5,000 applied against the aggregate taxes owned for the first year in which the captive insurer incurs any liability for the payment of taxes. The premium tax will be deducted from the first payment. Specifically, insurance premium tax, industrial insurance premium tax, retaliatory tax, and. Premium taxes range from $5,000 minimum to 175,000 maximum You make up to 400% of the federal poverty level;

Source: revisi.net

Source: revisi.net

Qualified risk retention groups pay a premium tax of 2%. Premium taxes are due for the year that the captive is licensed. 264 are domiciled in nevada, and 202 companies are captives. In 2004, $14 billion in taxes on insurance premiums were collected on $960 billion worth of insurance premiums and annuity considerations, accounting for 2.4 percent of state tax revenue. The nevada premium tax rate is 3.5%.

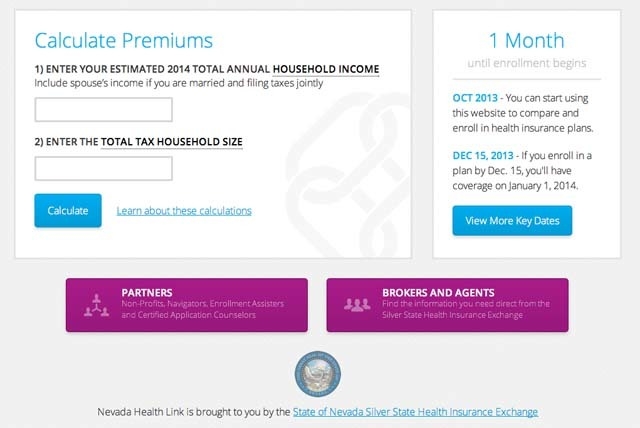

Premium taxes are due for the year that the captive is licensed. The tax is assessed on each insurer transacting insurance business in this state on net direct premiums and considerations at a rate of 3.5 percent. A premium tax credit, sometimes called subsidies or discounts, can be used to lower your monthly insurance payment (called your “premium”) when you enroll in a health insurance plan through nevada health link. The annual premium tax forms are available on the state of nevada division of insurance’s captive insurers page under forms. Eligibility requirements for the advanced premium tax credit.

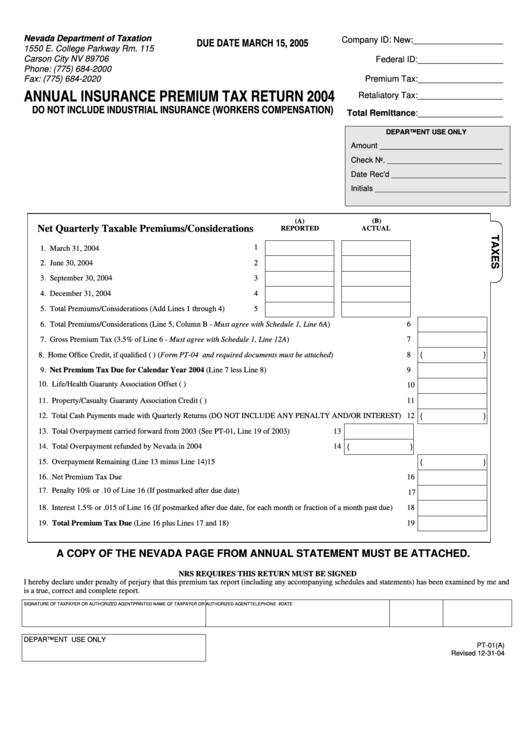

Source: eskotti.blogspot.com

Source: eskotti.blogspot.com

To be eligible for the aptc, you must be lawfully present in the united states, a current tax filer with the irs and earn between 138% and 400% of the federal poverty level (fpl). The nevada premium tax rate is 3.5% of premiums written on policies and the nevada premium tax rate is 3.5% or 2% for. The marginal premium tax rate is in the 2.5 percent range, but because the tax is on gross Premium taxes range from $5,000 minimum to 175,000 maximum The nevada premium tax rate is 3.5% or 2% for risk retention groups, if qualified.

Source: doi.nv.gov

Source: doi.nv.gov

Instead, it will be deducted from the initial value of the annuity contract. The nevada premium tax rate is 3.5%. You make up to 400% of the federal poverty level; In 2004, $14 billion in taxes on insurance premiums were collected on $960 billion worth of insurance premiums and annuity considerations, accounting for 2.4 percent of state tax revenue. $5,000 minimum* $175,000 maximum * a captive insurer is entitled to receive a nonrefundable credit of $5,000 applied against the aggregate taxes owned for the first year in which the captive insurer incurs any liability for the payment of taxes.

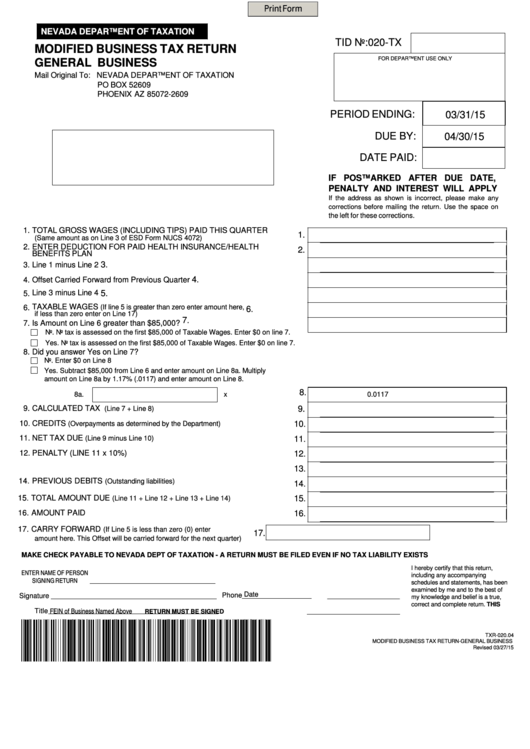

Source: formsbank.com

Source: formsbank.com

115 carson city, nv 89706. Therefore, the department does not have the statutory authority to waive any such penalties and interest related to premium taxes found in nrs 680b.027. Nevada has also incorporated the nrra exempt commercial purchaser exemption. In 2004, $14 billion in taxes on insurance premiums were collected on $960 billion worth of insurance premiums and annuity considerations, accounting for 2.4 percent of state tax revenue. Per nrs 680b, nevada imposes a tax of 3.5% of net direct premiums written and net direct considerations written in our state.

Source: reviewjournal.com

Source: reviewjournal.com

The nevada premium tax rate is 3.5% of premiums written on policies and 115 carson city, nv 89706. Net premium tax due (line 8) multiplied by 0.00049315068 multiplied by the number of days late The premium tax will be deducted from the first payment. The marginal premium tax rate is in the 2.5 percent range, but because the tax is on gross

Source: kiawqlohrfincknr56insurance.hatenablog.com

3% for policies issued against fire, lightning or tornado) missouri. The nevada premium tax rate is 3.5% or 2% for risk retention groups, if qualified. The marginal premium tax rate is in the 2.5 percent range, but because the tax is on gross Between 2000 and 2004, insurance premium tax revenue grew by 43 percent. Premium taxes are due for the year that the captive is licensed.

Source: eskotti.blogspot.com

Source: eskotti.blogspot.com

You make up to 400% of the federal poverty level; §384.051 (6) 5% (annually) montana. Pursuant to nrs 680b.025, premium tax is a tax levied by the state of nevada on insurance companies doing business in this state. Premium taxes range from $5,000 minimum to 175,000 maximum The nevada premium tax rate is 3.5% of premiums written on policies and

Source: prlog.org

Source: prlog.org

The insurance premium tax was enacted in 1933 and is authorized by nevada revised statutes section 680b. The nevada premium tax rate is 3.5% of premiums written on policies and the nevada premium tax rate is 3.5% or 2% for. Instead, it will be deducted from the initial value of the annuity contract. Pursuant to nrs 680b.025, premium tax is a tax levied by the state of nevada on insurance companies doing business in this state. Nevada does have an industrial insured exemption (see appendix c) which will remain in effect.

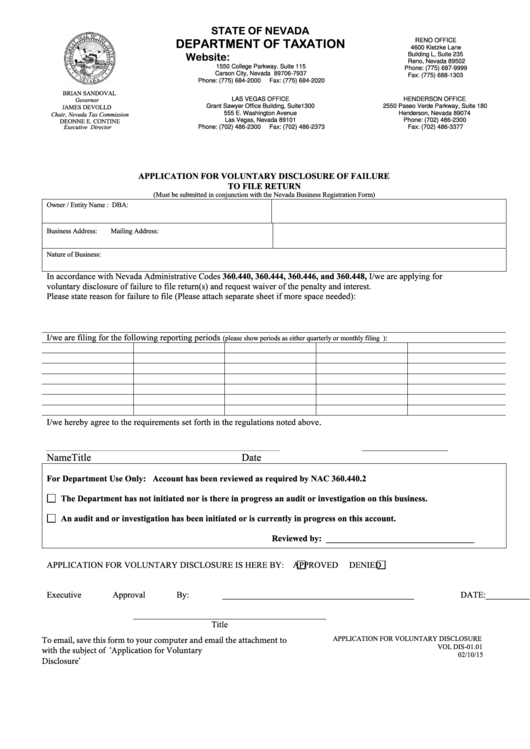

Source: tax.nv.gov

Source: tax.nv.gov

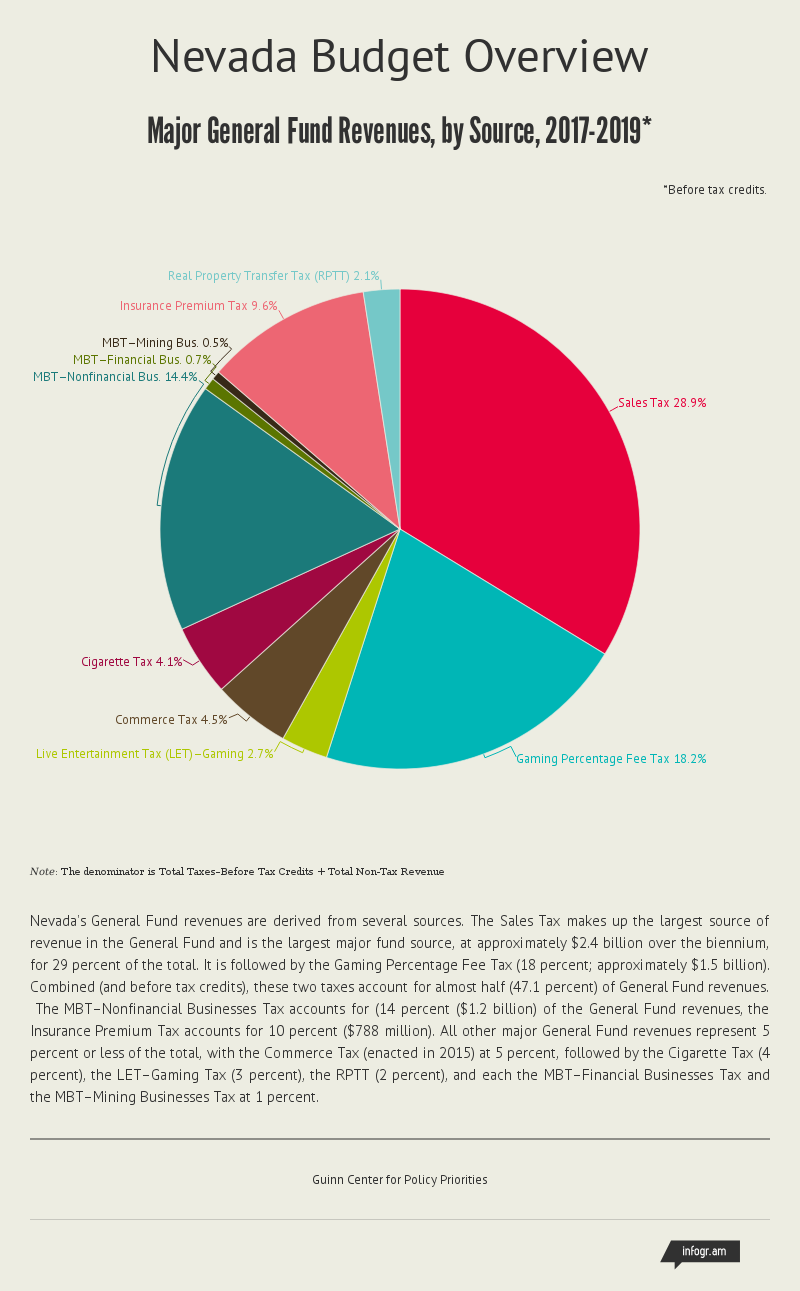

Nevada�s insurance premium tax provided over $358 million of revenue to the state�s general fund for fiscal year 2017. To be eligible for the premium tax credit, the following must apply to you: You make up to 400% of the federal poverty level; 2% (annually) (except life insurance) mississippi. Pure captives required to affix signatures on line 15 and 16 all captives minimum annual tax due $5,000 pursuant to nrs 694c.450 mark if original return

Source: zanebenefits.com

Source: zanebenefits.com

3.5%, payable by broker, plus.4% stamping fee applicable to all premiums (penalty of $500 for “failure to pay taxes” within 45 days after the quarter ends). The nevada premium tax rate is 3.5% or 2% for risk retention groups, if qualified. To be eligible for the premium tax credit, the following must apply to you: Specifically, insurance premium tax, industrial insurance premium tax, retaliatory tax, and. Pursuant to nrs 680b.025, premium tax is a tax levied by the state of nevada on insurance companies doing business in this state.

Source: hebertandly1968.blogspot.com

Pursuant to nrs 680b.025, premium tax is a tax levied by the state of nevada on insurance companies doing business in this state. The tax is assessed on each insurer transacting insurance business in this state on net direct premiums and considerations at a rate of 3.5 percent. 3% for policies issued against fire, lightning or tornado) missouri. Therefore, the department does not have the statutory authority to waive any such penalties and interest related to premium taxes found in nrs 680b.027. 3.5%, payable by broker, plus.4% stamping fee applicable to all premiums (penalty of $500 for “failure to pay taxes” within 45 days after the quarter ends).

Source: guinncenter.org

Source: guinncenter.org

Pure captives required to affix signatures on line 15 and 16 all captives minimum annual tax due $5,000 pursuant to nrs 694c.450 mark if original return A premium tax credit, sometimes called subsidies or discounts, can be used to lower your monthly insurance payment (called your “premium”) when you enroll in a health insurance plan through nevada health link. The nevada premium tax rate is 3.5%. Between 2000 and 2004, insurance premium tax revenue grew by 43 percent. 264 are domiciled in nevada, and 202 companies are captives.

Source: nourish-brow.blogspot.com

Source: nourish-brow.blogspot.com

Instead, it will be deducted from the initial value of the annuity contract. When someone buys a deferred annuity, the premium tax is collected during the annuitization, or payout, phase. Premium taxes are due for the year that the captive is licensed. Specifically, insurance premium tax, industrial insurance premium tax, retaliatory tax, and. When are the quarterly insurance returns due?

Source: eskotti.blogspot.com

Source: eskotti.blogspot.com

264 are domiciled in nevada, and 202 companies are captives. Qualified risk retention groups pay a premium tax of 2%. You make up to 400% of the federal poverty level; The insurance premium tax was enacted in 1933 and is authorized by nevada revised statutes section 680b. Nevada has over two thousand traditional carriers licensed to conduct business in our state that are domiciled in other states.

Source: formsbank.com

Source: formsbank.com

Qualified risk retention groups pay a premium tax of 2%. Nevada does have an industrial insured exemption (see appendix c) which will remain in effect. Eligibility requirements for the advanced premium tax credit. §384.051 (6) 5% (annually) montana. Therefore, the department does not have the statutory authority to waive any such penalties and interest related to premium taxes found in nrs 680b.027.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title nevada insurance premium tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.