New york insurance law 3420 Idea

Home » Trending » New york insurance law 3420 IdeaYour New york insurance law 3420 images are available. New york insurance law 3420 are a topic that is being searched for and liked by netizens today. You can Download the New york insurance law 3420 files here. Get all free photos.

If you’re searching for new york insurance law 3420 images information related to the new york insurance law 3420 keyword, you have visit the ideal site. Our website always provides you with hints for seeking the maximum quality video and image content, please kindly search and find more informative video content and images that fit your interests.

New York Insurance Law 3420. Munich reinsurance america, inc., et al., 2014 n.y. Under insurance law §3420 (d) (2), which applies to claims of bodily injury or death arising from accidents within new york state,. When a commercial general liability (cgl) insurer receives notice of a claim against the insured, it needs to act promptly to disclaim coverage based upon an exclusion in the policy to comply with new york insurance law § 3420 (d)(2). These two recent cases highlight the importance of complying with n.y.

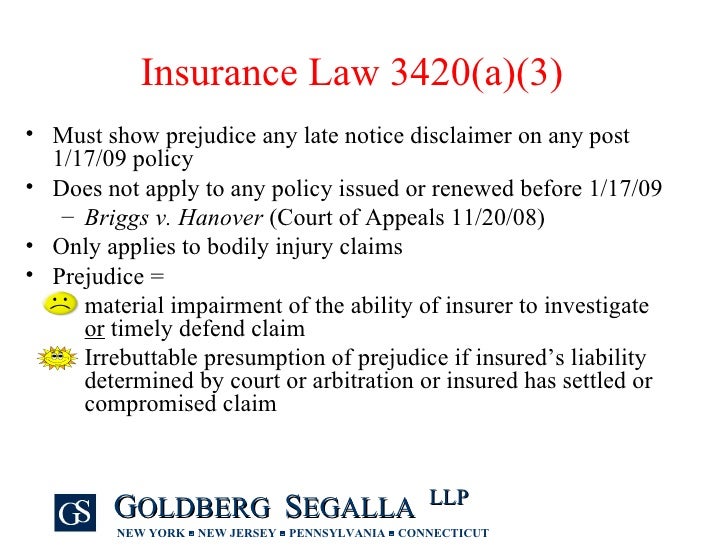

The key learning objectives are an understanding of when insurance law section 3420 (d) (2) applies and what must be done when the law does apply to satisfy its requirements. Under new york insurance law §3420(d)(2) , “it is not necessary for an insured to show prejudice caused by an insurer’s unreasonable delay in disclaiming liability or denying coverage.” commercial union ins. The new york court of appeals recently confirmed that the heightened timeliness of disclaimer requirement in new york insurance law § 3420(d)(2) does not apply to claims arising from property damage, in keyspan gas east corp. Click here for information on subscription discounts and group viewing opportunities. It is of paramount importance that liability insurers doing business in new york be aware of the heightened disclaimer obligations applicable to claims implicating insurance law § 3420 (d) (2). Law §3420(a) by adding subparagraph (5), which provides that all liability policies issued or delivered in.

Purchase of this product provides online access for 180 days.

Insurance law §3420 is arguably the most important insurance statute in new york state, as it includes new york state’s direct action statute (§3420 (b) (2)), and new york’s draconian disclaimer statute (§3420 (d) (2)). Ny insurance law 3420 (d) (2) is strictly enforced. Insurance law § 3420 is limited to establishing minimum requirements for liability policies. New york insurance law § 3420(a)(2) allows a claimant who has obtained judgment against an insured and, therefore, becomes a judgment creditor of the insured, to present that judgment to the insurer and the insured for payment. The aforesaid provision establishes the mandatory uninsured motorist coverage that must be maintained by owner/operators of motor vehicles in new york state. These two recent cases highlight the importance of complying with n.y.

Source: propertycasualtyfocus.com

Source: propertycasualtyfocus.com

Ny ins l § 3420 (2017) 3420. The aforesaid provision establishes the mandatory uninsured motorist coverage that must be maintained by owner/operators of motor vehicles in new york state. Casualty insurers doing business in the state of new york that wish to deny coverage on a claim for death or bodily injury are subject to the timing requirements set forth in new york insurance law (nyil) § 3420 (d) (2),. Ny ins l § 3420 (2017) 3420. New york insurance law § 3420(a)(2) allows a claimant who has obtained judgment against an insured and, therefore, becomes a judgment creditor of the insured, to present that judgment to the insurer and the insured for payment.

Source: slideshare.net

Source: slideshare.net

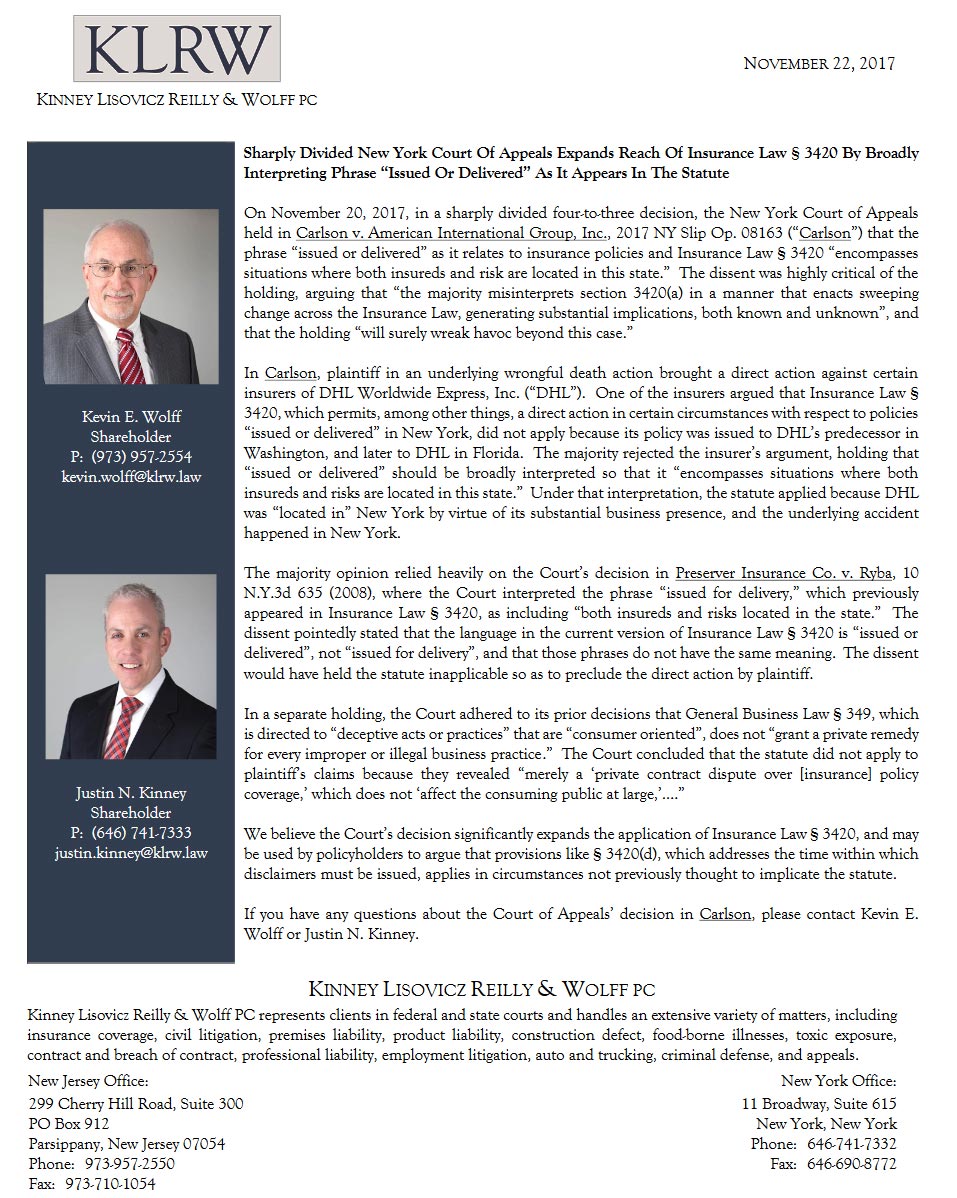

The application of new york insurance law § 3420(d)(2), which requires notice of disclaimer as soon as reasonably possible under a liability policy, has resulted in quite a few cases testing its outer limits and proper implementation. (a) no policy or contract insuring against liability for injury to person, except as provided in subsection (g) of this section, or against liability for injury to, or destruction of, property shall be issued or delivered in this state, unless it contains in substance the Casualty insurers doing business in the state of new york that wish to deny coverage on a claim for death or bodily injury are subject to the timing requirements set forth in new york insurance law (nyil) § 3420 (d) (2),. Under new york law, policies covering risks and policyholders located in new york are now subject to § 3420 and its requirements, irrespective of where the insurer issued or delivered the policy. New york insurance law § 3420(a)(2) allows a claimant who has obtained judgment against an insured and, therefore, becomes a judgment creditor of the insured, to present that judgment to the insurer and the insured for payment.

Insurance law §3420 is arguably the most important insurance statute in new york state, as it includes new york state’s direct action statute (§3420 (b) (2)), and new york’s draconian disclaimer statute (§3420 (d) (2)). In a recent case, a new york intermediate appellate court was asked to address § 3420(d)(2)’s application in the context of. Law §3420(a) by adding subparagraph (5), which provides that all liability policies issued or delivered in. Click here for information on subscription discounts and group viewing opportunities. (a) no policy or contract insuring against liability for injury to person, except as provided in subsection (g) of this section, or against liability for injury to, or destruction of, property shall be issued or delivered in this state, unless it contains in substance the

Source: nybusinesslaw.com

Source: nybusinesslaw.com

Ny insurance law 3420 (d) (2) is strictly enforced. Insurance law § 3420 is limited to establishing minimum requirements for liability policies. Casualty insurers doing business in the state of new york that wish to deny coverage on a claim for death or bodily injury are subject to the timing requirements set forth in new york insurance law (nyil) § 3420 (d) (2),. Click here for information on subscription discounts and group viewing opportunities. International flavors & fragrances, inc., 822 f.2d 267, 274 n.

Source: forensicpursuit.com

Source: forensicpursuit.com

This requirement applies whether the owner/operator secures coverage under. The application of new york insurance law § 3420(d)(2), which requires notice of disclaimer as soon as reasonably possible under a liability policy, has resulted in quite a few cases testing its outer limits and proper implementation. Insurance law § 3420(f)(1) (mckinney supp. Under new york insurance law §3420(d)(2) , “it is not necessary for an insured to show prejudice caused by an insurer’s unreasonable delay in disclaiming liability or denying coverage.” commercial union ins. This requirement applies whether the owner/operator secures coverage under.

Source: fintel.io

Source: fintel.io

Under new york insurance law §3420(d)(2) , “it is not necessary for an insured to show prejudice caused by an insurer’s unreasonable delay in disclaiming liability or denying coverage.” commercial union ins. Purchase of this product provides online access for 180 days. Click here for information on subscription discounts and group viewing opportunities. It is of paramount importance that liability insurers doing business in new york be aware of the heightened disclaimer obligations applicable to claims implicating insurance law § 3420 (d) (2). The statute, which applies to bodily injury or death claims arising out of an accident occurring within.

Source: propertycasualtyfocus.com

Source: propertycasualtyfocus.com

Purchase of this product provides online access for 180 days. Munich reinsurance america, inc., et al., 2014 n.y. These two recent cases highlight the importance of complying with n.y. Insurance law §3420 is arguably the most important insurance statute in new york state, as it includes new york state’s direct action statute (§3420 (b) (2)), and new york’s draconian disclaimer statute (§3420 (d) (2)). New york insurance law § 3420(a)(2) allows a claimant who has obtained judgment against an insured and, therefore, becomes a judgment creditor of the insured, to present that judgment to the insurer and the insured for payment.

Source: rfogellaw.com

Source: rfogellaw.com

Ny ins l § 3420 (2017) 3420. Purchase of this product provides online access for 180 days. In a recent case, a new york intermediate appellate court was asked to address § 3420(d)(2)’s application in the context of. Munich reinsurance america, inc., et al., 2014 n.y. Insurance law § 3420 is limited to establishing minimum requirements for liability policies.

Source: pmtlawfirm.com

Source: pmtlawfirm.com

This requirement applies whether the owner/operator secures coverage under. The aforesaid provision establishes the mandatory uninsured motorist coverage that must be maintained by owner/operators of motor vehicles in new york state. The key learning objectives are an understanding of when insurance law section 3420 (d) (2) applies and what must be done when the law does apply to satisfy its requirements. Insurance law § 3420(f)(1) (mckinney supp. Purchase of this product provides online access for 180 days.

Source: rivkinradler.com

Source: rivkinradler.com

Law § 3420, post.> (a) no policy or contract insuring against liability for injury to person, except as provided in subsection (g) of this section, or against liability for injury to, or destruction of, property shall be issued or delivered in this state, unless it In a recent case, a new york intermediate appellate court was asked to address § 3420(d)(2)’s application in the context of. (a) no policy or contract insuring against liability for injury to. The key learning objectives are an understanding of when insurance law section 3420 (d) (2) applies and what must be done when the law does apply to satisfy its requirements. International flavors & fragrances, inc., 822 f.2d 267, 274 n.

Click here for information on subscription discounts and group viewing opportunities. These two recent cases highlight the importance of complying with n.y. Under insurance law §3420 (d) (2), which applies to claims of bodily injury or death arising from accidents within new york state,. When a commercial general liability (cgl) insurer receives notice of a claim against the insured, it needs to act promptly to disclaim coverage based upon an exclusion in the policy to comply with new york insurance law § 3420 (d)(2). In a recent case, a new york intermediate appellate court was asked to address § 3420(d)(2)’s application in the context of.

Source: nlr-qc.tekfads.com

Source: nlr-qc.tekfads.com

The new york court of appeals recently confirmed that the heightened timeliness of disclaimer requirement in new york insurance law § 3420(d)(2) does not apply to claims arising from property damage, in keyspan gas east corp. Purchase of this product provides online access for 180 days. Under new york law, policies covering risks and policyholders located in new york are now subject to § 3420 and its requirements, irrespective of where the insurer issued or delivered the policy. Munich reinsurance america, inc., et al., 2014 n.y. Click here for information on subscription discounts and group viewing opportunities.

Source: rfogellaw.com

Source: rfogellaw.com

June 10, 2014).unanimously reversing the appellate division, the keyspan. Click here for information on subscription discounts and group viewing opportunities. These two recent cases highlight the importance of complying with n.y. Ny ins l § 3420 (2017) 3420. Law §3420(a) by adding subparagraph (5), which provides that all liability policies issued or delivered in.

Source: klrw.law

Source: klrw.law

Casualty insurers doing business in the state of new york that wish to deny coverage on a claim for death or bodily injury are subject to the timing requirements set forth in new york insurance law (nyil) § 3420 (d) (2),. Ny insurance law 3420 (d) (2) is strictly enforced. The statute, which applies to bodily injury or death claims arising out of an accident occurring within. This legislation, which amends section 3420 of the new york insurance law, makes it much harder for insurance companies to deny coverage on. These two recent cases highlight the importance of complying with n.y.

Source: insurancedevelopments.com

When a commercial general liability (cgl) insurer receives notice of a claim against the insured, it needs to act promptly to disclaim coverage based upon an exclusion in the policy to comply with new york insurance law § 3420 (d)(2). Under new york insurance law §3420(d)(2) , “it is not necessary for an insured to show prejudice caused by an insurer’s unreasonable delay in disclaiming liability or denying coverage.” commercial union ins. The new york court of appeals recently confirmed that the heightened timeliness of disclaimer requirement in new york insurance law § 3420(d)(2) does not apply to claims arising from property damage, in keyspan gas east corp. International flavors & fragrances, inc., 822 f.2d 267, 274 n. The key learning objectives are an understanding of when insurance law section 3420 (d) (2) applies and what must be done when the law does apply to satisfy its requirements.

Source: fintel.io

Source: fintel.io

Insurance law § 3420(f)(1) (mckinney supp. Under new york insurance law §3420(d)(2), an additional insured becomes bound by a policy exclusion only after the insurer sends timely notice of the exclusion directly to that additional insured.failure to provide timely notice of policy disclaimers directly to each additional insured will result in that disclaimer being deemed void. Insurance law §3420 is arguably the most important insurance statute in new york state, as it includes new york state’s direct action statute (§3420 (b) (2)), and new york’s draconian disclaimer statute (§3420 (d) (2)). The key learning objectives are an understanding of when insurance law section 3420 (d) (2) applies and what must be done when the law does apply to satisfy its requirements. Insurance law § 3420(f)(1) (mckinney supp.

Source: sec.gov

Source: sec.gov

This requirement applies whether the owner/operator secures coverage under. The aforesaid provision establishes the mandatory uninsured motorist coverage that must be maintained by owner/operators of motor vehicles in new york state. The new york court of appeals recently confirmed that the heightened timeliness of disclaimer requirement in new york insurance law § 3420(d)(2) does not apply to claims arising from property damage, in keyspan gas east corp. Ny insurance law 3420 (d) (2) is strictly enforced. The application of new york insurance law § 3420(d)(2), which requires notice of disclaimer as soon as reasonably possible under a liability policy, has resulted in quite a few cases testing its outer limits and proper implementation.

Source: nycoveragecounsel.blogspot.com

Source: nycoveragecounsel.blogspot.com

Ny ins l § 3420 (2017) 3420. Munich reinsurance america, inc., et al., 2014 n.y. (a) no policy or contract insuring against liability for injury to. The new york court of appeals recently confirmed that the heightened timeliness of disclaimer requirement in new york insurance law § 3420(d)(2) does not apply to claims arising from property damage, in keyspan gas east corp. Law § 3420, post.> (a) no policy or contract insuring against liability for injury to person, except as provided in subsection (g) of this section, or against liability for injury to, or destruction of, property shall be issued or delivered in this state, unless it

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title new york insurance law 3420 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.