Nl insurance tax reduction information

Home » Trending » Nl insurance tax reduction informationYour Nl insurance tax reduction images are ready. Nl insurance tax reduction are a topic that is being searched for and liked by netizens now. You can Get the Nl insurance tax reduction files here. Find and Download all free vectors.

If you’re looking for nl insurance tax reduction images information linked to the nl insurance tax reduction topic, you have pay a visit to the ideal site. Our website always provides you with hints for viewing the highest quality video and image content, please kindly hunt and find more enlightening video content and images that fit your interests.

Nl Insurance Tax Reduction. Following through a budget 2018, the provincial government has reduced the tax on If the dutch tax and customs administration considers you to be an entrepreneur for income tax purposes, you will pay income tax on your. Retail sales tax on insurance premiums; The most significant benefit is that the taxable amount of your gross dutch salary is reduced from 100% to 70%.

Lightspeed Trading Review Discount Broker GoodSitesLike From goodsiteslike.com

Lightspeed Trading Review Discount Broker GoodSitesLike From goodsiteslike.com

The 30% reimbursement ruling is a tax advantage for certain expat employees in the netherlands. The tax reduction on automobile insurance that the government of newfoundland and labrador announced when they tabled their budget in may of 2018 takes effect in the new year. Since 1 january 2019 qualifying workers may use this 30% facility for only 5 years. The government provides instructions on dutch income tax calculations. Taxpayers whose income fall in the highest bracket in box 1 will gradually have less tax advantage from deductible items like alimony, specific healthcare. If they satisfy conditions for the 30% facility, they are exempt from paying tax on up to 30% of their salary.

The government provides instructions on dutch income tax calculations.

Auto insurance tax to be reduced in 2019. Understand how serious your tax problem is might it be. The rate of tax applicable to automobile insurance was reduced from 15% to 13% effective january 1, 2019. The tax reduction on automobile insurance that the government of newfoundland and labrador announced when they tabled their budget in may of 2018 takes effect in the new year. Losses incurred before 2019 can still be carried forward for a maximum of nine years. In 2022, the credit amounts for people not yet at retirement age are:

Source: henrykotula.com

Source: henrykotula.com

Sales tax harmonized sales tax; The most significant benefit is that the taxable amount of your gross dutch salary is reduced from 100% to 70%. The term for carry back stays the same (at one year). The government provides instructions on dutch income tax calculations. The amount calculated is then reduced by one or more tax credits.

Source: cbc.ca

Source: cbc.ca

Since 1 january 2019 qualifying workers may use this 30% facility for only 5 years. As of 1 january 2019, the maximum term of the 30% ruling has been reduced from eight to five years. Posted on december 20, 2018. The term for carry back stays the same (at one year). Personal income tax rates 2019 (before retirement age) taxable income tax rate national insurance premium1 total box 1 from up to € 0 € 20.384 9,00 % 27,65 % 36,65 % € 20.384 € 34.300 10,45 % 27,65 % 38,10 %

Source: dudkowiak.com

Source: dudkowiak.com

The following are 4 basic advances that any entrepreneur can take to bring down your expense charge this year. If they satisfy conditions for the 30% facility, they are exempt from paying tax on up to 30% of their salary. Sales tax harmonized sales tax; What your �tax part� is. The total amount of tax payable is calculated by applying the various dutch tax rates to the different taxable incomes in the boxes.

Source: wijchensnieuws.nl

Source: wijchensnieuws.nl

If you employ staff in the netherlands, you are obliged to deduct payroll tax from your employees� wages. The following provides more detail on each of these taxes. Retail sales tax on automobile insurance (elimination) The rate of tax applicable to automobile insurance was reduced from 15% to 13% effective january 1, 2019. If they satisfy conditions for the 30% facility, they are exempt from paying tax on up to 30% of their salary.

Source: kbcbrussels.be

Source: kbcbrussels.be

For more tax reduction, and get small business tax. Check the �i enjoy the 30% ruling� and find the maximum amount of tax you can save with the 30 percent ruling. The following are 4 basic advances that any entrepreneur can take to bring down your expense charge this year. Sole traders (self employed) receive additional tax credits lowering the total amount of tax paid. Sales tax harmonized sales tax;

Source: kbcbrussels.be

Retail sales tax on automobile insurance (elimination) Following through a budget 2018, the provincial government has reduced the tax on You may apply the payroll tax reduction solely when the employee has submitted a written request for you to do so. Newfoundland and labrador offers the following tax credits and reductions to reduce your amount of provincial tax payable: Select �self employment� to calculate your net income if you are a sole trader.

Source: readkong.com

Source: readkong.com

Following through a budget 2018, the provincial government has reduced the tax on The term for carry back stays the same (at one year). Following through a budget 2018, the provincial government has reduced the tax on In newfoundland and labrador, individuals pay income tax, sales tax, gasoline tax, carbon tax, tobacco tax, and vapour products tax. In addition, more smes will pay this lower rate in the years ahead.

Source: kbcbrussels.be

The tax reduction on automobile insurance that the government of newfoundland and labrador announced when they tabled their budget in may of 2018 takes effect in the new year. Losses incurred before 2019 can still be carried forward for a maximum of nine years. The tax reduction on automobile insurance that the government of newfoundland and labrador announced when they tabled their budget in may of 2018 takes effect in the new year. Sole traders (self employed) receive additional tax credits lowering the total amount of tax paid. Newfoundland and labrador offers the following tax credits and reductions to reduce your amount of provincial tax payable:

Source: accountingweb.co.uk

Source: accountingweb.co.uk

If the dutch tax and customs administration considers you to be an entrepreneur for income tax purposes, you will pay income tax on your. Following the budget on april 15, 2019, automobile insurance was excluded from the tax. Posted on december 20, 2018. You may apply the payroll tax reduction solely when the employee has submitted a written request for you to do so. Following through a budget 2018, the provincial government has reduced the tax on

Source: nlec.nf.ca

Source: nlec.nf.ca

€2.888 for those with a taxable income under €21.318. The tax reduction on automobile insurance that the government of newfoundland and labrador announced when they tabled their budget in may of 2018 takes effect in the new year. Following the budget on april 15, 2019, automobile insurance was excluded from the tax. Abolishment of the restriction for the offset of tax losses by dutch holding companies The reduction of the low corporation tax rate from 16.5% to 15% will go ahead as planned.

KBC”) Source: kbc.be

Newfoundland and labrador offers the following tax credits and reductions to reduce your amount of provincial tax payable: The salaries tax and the social security contributions are levied jointly on earned income or benefits. The total amount of tax payable is calculated by applying the various dutch tax rates to the different taxable incomes in the boxes. The term for carry back stays the same (at one year). The components of this tax credit depend on the form of wages you pay and the employee�s age.

Source: nolabels.org

Source: nolabels.org

Taxpayers whose income fall in the highest bracket in box 1 will gradually have less tax advantage from deductible items like alimony, specific healthcare. The total amount of tax payable is calculated by applying the various dutch tax rates to the different taxable incomes in the boxes. The government provides instructions on dutch income tax calculations. Following the budget on april 15, 2019, automobile insurance was excluded from the tax. Posted on december 20, 2018.

Source: harbourfinancialgroup.ca

Source: harbourfinancialgroup.ca

The rate of tax applicable to automobile insurance was reduced from 15% to 13% effective january 1, 2019. Sales tax harmonized sales tax; The tax reduction on automobile insurance that the government of newfoundland and labrador announced when they tabled their budget in may of 2018 takes effect in the new year. As of 1 january 2019, the maximum term of the 30% ruling has been reduced from eight to five years. From 2021, the low rate will apply to profits of up to €245,000 instead of €200,000.

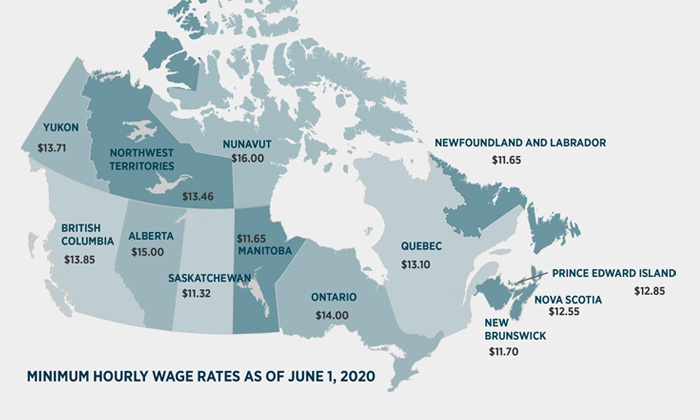

Source: mysteinbach.ca

Source: mysteinbach.ca

The salaries tax and the social security contributions are levied jointly on earned income or benefits. Posted on december 20, 2018. The reduction of the low corporation tax rate from 16.5% to 15% will go ahead as planned. Auto insurance tax to be reduced in 2019. If you employ staff in the netherlands, you are obliged to deduct payroll tax from your employees� wages.

Source: nlec.nf.ca

Source: nlec.nf.ca

In addition, more smes will pay this lower rate in the years ahead. Use our dutch tax calculator to find out how much income tax you pay in the netherlands. Newfoundlanders and labradorians are paying less for automobile insurance but a little more for fuel thanks to tax changes that came into effect on jan. If the dutch tax and customs administration considers you to be an entrepreneur for income tax purposes, you will pay income tax on your. The following provides more detail on each of these taxes.

Source: kbcbrussels.be

Source: kbcbrussels.be

If they satisfy conditions for the 30% facility, they are exempt from paying tax on up to 30% of their salary. You may apply the payroll tax reduction solely when the employee has submitted a written request for you to do so. The salaries tax and the social security contributions are levied jointly on earned income or benefits. Retail sales tax on automobile insurance (elimination) See obtain the payroll taxes details.

Source: kbcbrussels.be

Source: kbcbrussels.be

Understand how serious your tax problem is might it be. As of 1 january 2019, the maximum term of the 30% ruling has been reduced from eight to five years. The components of this tax credit depend on the form of wages you pay and the employee�s age. Personal income tax rates 2019 (before retirement age) taxable income tax rate national insurance premium1 total box 1 from up to € 0 € 20.384 9,00 % 27,65 % 36,65 % € 20.384 € 34.300 10,45 % 27,65 % 38,10 % Sales tax harmonized sales tax;

Source: jankuit.nl

Source: jankuit.nl

It�s important to only claim a home office you use exclusively and regularly for business. It�s important to only claim a home office you use exclusively and regularly for business. Entrepreneur for income tax purposes. The reduction of the low corporation tax rate from 16.5% to 15% will go ahead as planned. As of 1 january 2019, the maximum term of the 30% ruling has been reduced from eight to five years.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title nl insurance tax reduction by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.