No deductible car insurance Idea

Home » Trend » No deductible car insurance IdeaYour No deductible car insurance images are available. No deductible car insurance are a topic that is being searched for and liked by netizens now. You can Download the No deductible car insurance files here. Find and Download all free images.

If you’re searching for no deductible car insurance images information linked to the no deductible car insurance keyword, you have come to the ideal site. Our website always provides you with hints for seeing the maximum quality video and picture content, please kindly surf and locate more informative video content and graphics that match your interests.

No Deductible Car Insurance. You may be able to choose to go through your own collision insurance to repair your car while fault is being determined. When you are covered under an insurance policy, you pay a monthly premium so that in the event of an accident or damage involving your vehicle, you don�t have to pay for all the sudden high costs. When another driver hits you and it’s deemed their fault, their insurance is required to pay your damages. Zero deductible car insurance zero deductible car insurance allows drivers to trade higher monthly rates for no.

Yes! 40 Bumper Repair No Deductible What Car or Auto From youtube.com

Yes! 40 Bumper Repair No Deductible What Car or Auto From youtube.com

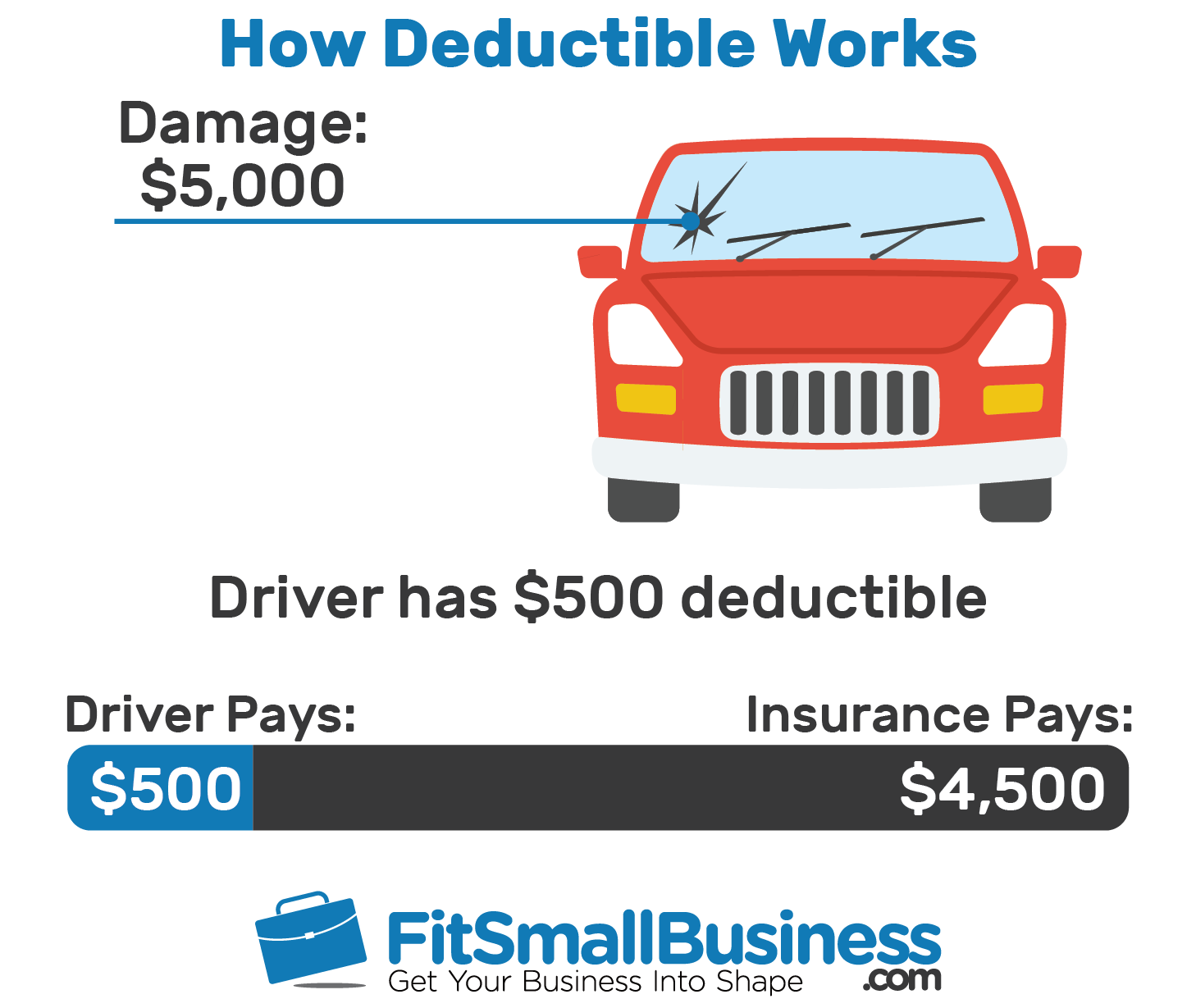

Essentially, when you have a car accident and file a claim, your claim payment will be reduced by the amount of your deductible. A deductible is a set amount that the policyholder will have to pay out of his own pocket for repairing his car before the insurance company covers the rest of the claim amount it may be possible to get certain types of insurance coverages, such as collision and comprehensive coverage, without a deductible The other driver’s liability insurance should pay for your repairs. If you have a covered claim for $1,500 in repairs, your insurer would reimburse you the full $1,500. You selected a disappearing deductible When you are not required to pay your car insurance deductible in most cases, you do not have to pay your deductible if another insured driver hits you.

Car insurance deductible key points.

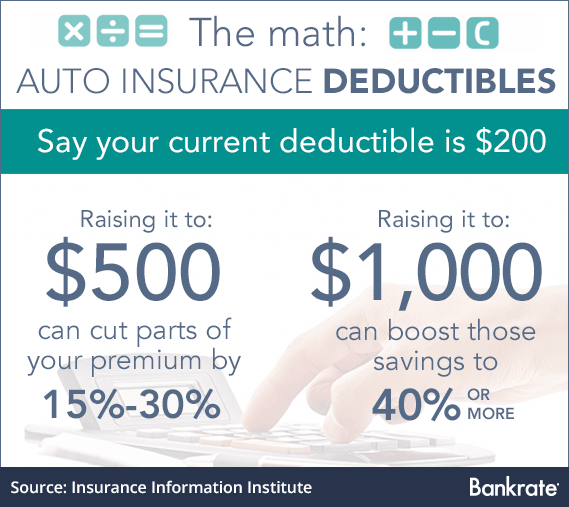

In fact, many insurers in the united states offer car insurance without a deductible. If your deductible is $1,000 for the year, you’re typically responsible for paying for the first $1,000 of your healthcare costs before your insurance carrier will begin to pay. For each year you do not file, your payment will be reduced by 20%. A disappearing, or vanishing, deductible is an endorsement that can be added to your insurance to lower your costs. That no deductible option will add about $4 to $6 per day to your overall cost for an economy car. For example, say you opted for collision coverage with no deductible.

Source: dorabectise.blogspot.com

Source: dorabectise.blogspot.com

If the vehicle gets damaged, things can get quite expensive. If you have already purchased, call autoeurope rep and see if they can revise (if you want the no deductible). A car insurance deductible is the amount of money you are required to pay when you file a claim for an insured loss. Advantages it is an extra way to save. Zero deductible car insurance zero deductible car insurance allows drivers to trade higher monthly rates for no.

Source: youtube.com

Source: youtube.com

Some insurers provide zero deductible car insurance yes, you can find no deductible car insurance policies. If you don’t meet your deductible, the health insurance plan doesn’t need to pay its share of health care services and you don’t have to pay coinsurance. You may be able to choose to go through your own collision insurance to repair your car while fault is being determined. Cdw covers most of the car if you�re in a collision, but may exclude the side mirrors, undercarriage, roof, wheels, windshield, windows. Some insurers provide zero deductible car insurance yes, you can find no deductible car insurance policies.

Source: everquote.com

Source: everquote.com

No deductible car insurance 1. For each year you do not file, your payment will be reduced by 20%. With collision coverage, you can choose to go through your own insurer. When you are not required to pay your car insurance deductible in most cases, you do not have to pay your deductible if another insured driver hits you. You selected a disappearing deductible

Source: quotewizard.com

Source: quotewizard.com

Liability auto insurance does not have a deductible like other types of coverage. You may be able to choose to go through your own collision insurance to repair your car while fault is being determined. That will give you a higher rate, but no deductible insurance. Your insurer later seeks reimbursement from the other driver’s insurance. If you get into a car accident again, you will have to pay the same deductible.

Source: canonprintermx410.blogspot.com

Source: canonprintermx410.blogspot.com

Difference a no deductible insurance plan works just like a policy with a deductible, except that when you need to use the policy, you don’t have to pay out of pocket until your deductible is met. When you are not required to pay your car insurance deductible in most cases, you do not have to pay your deductible if another insured driver hits you. If your deductible is $1,000 for the year, you’re typically responsible for paying for the first $1,000 of your healthcare costs before your insurance carrier will begin to pay. A disappearing, or vanishing, deductible is an endorsement that can be added to your insurance to lower your costs. If you have already purchased, call autoeurope rep and see if they can revise (if you want the no deductible).

Source: read-good.com

Source: read-good.com

Some insurers provide zero deductible car insurance yes, you can find no deductible car insurance policies. Uncheck the inclusive rate box and leave the �no deductible rates� box. For car insurance, deductibles are typical calculated on a per claim basis. The other driver’s liability insurance should pay for your repairs. With zero deductible car insurance, you don’t pay anything:

Source: brokencurve.com

Source: brokencurve.com

A car insurance deductible is the amount of money you are required to pay when you file a claim for an insured loss. Mrsejz notes that the “no deductible” coverage would only cost about $70us for the week’s rental, and if this really means that, no matter what happens to. That will give you a higher rate, but no deductible insurance. For each year you do not file, your payment will be reduced by 20%. Your insurer later seeks reimbursement from the other driver’s insurance.

Source: youtube.com

Source: youtube.com

That will give you a higher rate, but no deductible insurance. That will give you a higher rate, but no deductible insurance. Some insurers provide zero deductible car insurance yes, you can find no deductible car insurance policies. Comprehensive coverage comprehensive coverage reimburses you for expenses incurred if your vehicle has been damaged due to something other than. If you have a covered claim for $1,500 in repairs, your insurer would reimburse you the full $1,500.

Source: visual.ly

Source: visual.ly

Your car insurance deductible is usually a set amount, say $500. For each year you do not file, your payment will be reduced by 20%. If your deductible is $1,000 for the year, you’re typically responsible for paying for the first $1,000 of your healthcare costs before your insurance carrier will begin to pay. Car insurance deductible key points. No deductible car insurance is an option for drivers who don�t mind paying higher premiums to ensure that they�re covered in an accident without needing to pay first.

Source: blog.higginsinsurance.ca

Source: blog.higginsinsurance.ca

With no deductibles to pay in the event of a collision. For each year you do not file, your payment will be reduced by 20%. A deductible is a set amount that the policyholder will have to pay out of his own pocket for repairing his car before the insurance company covers the rest of the claim amount it may be possible to get certain types of insurance coverages, such as collision and comprehensive coverage, without a deductible When another driver hits you and it’s deemed their fault, their insurance is required to pay your damages. Most chosen (71%) covered deductible

Source: imbillionaire.net

Source: imbillionaire.net

That will give you a higher rate, but no deductible insurance. No covered deductible if the rental car gets damaged or stolen, you must pay a deductible. That will give you a higher rate, but no deductible insurance. Some insurers provide zero deductible car insurance yes, you can find no deductible car insurance policies. With no deductibles to pay in the event of a collision.

Source: pinterest.com

Source: pinterest.com

Advantages it is an extra way to save. Your insurer later seeks reimbursement from the other driver’s insurance. If you have a covered claim for $1,500 in repairs, your insurer would reimburse you the full $1,500. No deductible car insurance 1. Ideally, after five years of driving, there would be no fee to pay unless you make a claim.

Source: compareinsurancesonline.ca

Source: compareinsurancesonline.ca

Liability auto insurance does not have a deductible like other types of coverage. Some insurers provide zero deductible car insurance yes, you can find no deductible car insurance policies. When you are not required to pay your car insurance deductible in most cases, you do not have to pay your deductible if another insured driver hits you. No deductible car insurance reimburses you in full from the first dollar in the event of a claim. You selected a disappearing deductible

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Liability auto insurance does not have a deductible like other types of coverage. Essentially, when you have a car accident and file a claim, your claim payment will be reduced by the amount of your deductible. Your insurer covers your entire claim without you paying a penny towards a deductible. Your insurer later seeks reimbursement from the other driver’s insurance. That will give you a higher rate, but no deductible insurance.

![High Deductible Car Insurance [2021] Quotes, Discounts High Deductible Car Insurance [2021] Quotes, Discounts](https://blog.insurify.com/wp-content/uploads/2020/09/high-deductible-car-insurance.jpg) Source: insurify.com

Source: insurify.com

No deductible car insurance reimburses you in full from the first dollar in the event of a claim. Zero deductible car insurance zero deductible car insurance allows drivers to trade higher monthly rates for no. No covered deductible if the rental car gets damaged or stolen, you must pay a deductible. A car insurance deductible is the amount of money you are required to pay when you file a claim for an insured loss. Difference a no deductible insurance plan works just like a policy with a deductible, except that when you need to use the policy, you don’t have to pay out of pocket until your deductible is met.

Source: symboinsurance.com

Source: symboinsurance.com

Liability auto insurance does not have a deductible like other types of coverage. No deductible car insurance reimburses you in full from the first dollar in the event of a claim. If your deductible is $1,000 for the year, you’re typically responsible for paying for the first $1,000 of your healthcare costs before your insurance carrier will begin to pay. When you are covered under an insurance policy, you pay a monthly premium so that in the event of an accident or damage involving your vehicle, you don�t have to pay for all the sudden high costs. Zero deductible car insurance zero deductible car insurance allows drivers to trade higher monthly rates for no.

Source: general.com

Source: general.com

When you are covered under an insurance policy, you pay a monthly premium so that in the event of an accident or damage involving your vehicle, you don�t have to pay for all the sudden high costs. Zero deductible car insurance zero deductible car insurance allows drivers to trade higher monthly rates for no. No deductible car insurance is an option for drivers who don�t mind paying higher premiums to ensure that they�re covered in an accident without needing to pay first. With no deductibles to pay in the event of a collision. If your deductible is $1,000 for the year, you’re typically responsible for paying for the first $1,000 of your healthcare costs before your insurance carrier will begin to pay.

Source: elephant.com

Source: elephant.com

Standard insurance policyholders through assurance.ph will get free passenger personal accident coverage worth ₱75,000 per seat (offer subject to the maximum legal seating capacity of the vehicle). Zero deductible car insurance zero deductible car insurance allows drivers to trade higher monthly rates for no. Car insurance deductible key points. If you have a covered claim for $1,500 in repairs, your insurer would reimburse you the full $1,500. Your insurer covers your entire claim without you paying a penny towards a deductible.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title no deductible car insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.