No proof of insurance florida statute information

Home » Trending » No proof of insurance florida statute informationYour No proof of insurance florida statute images are available. No proof of insurance florida statute are a topic that is being searched for and liked by netizens today. You can Find and Download the No proof of insurance florida statute files here. Get all royalty-free vectors.

If you’re searching for no proof of insurance florida statute pictures information related to the no proof of insurance florida statute topic, you have come to the ideal blog. Our site always gives you suggestions for downloading the maximum quality video and image content, please kindly hunt and find more informative video content and images that match your interests.

No Proof Of Insurance Florida Statute. I predict this wordage will generate numerous law suits in the state of florida. (4) any person presenting proof of insurance as required in subsection (1) who knows that the insurance as represented by such proof of insurance is not currently in force is guilty of a misdemeanor of the first degree, punishable as provided in s. Additionally, the court imposes a mandatory $25 administrative fee to all offenders. The required proof of insurance may be sent by mail by the owner as long as it is received within ten days.

No Proof Of Insurance Florida Statute noclutter.cloud From noclutter.cloud

No Proof Of Insurance Florida Statute noclutter.cloud From noclutter.cloud

(4) any person presenting proof of insurance as required in subsection (1) who knows that the insurance as represented by such proof of insurance is not currently in force is guilty of a misdemeanor of the first degree, punishable as provided in s. Start with culling certificates of insurance you have on these parties to obtain (some) of this information as to whom to send the request to. Before you register a vehicle with at least four wheels in florida, you must show proof of personal injury protection (pip) and property damage liability (pdl) automobile insurance.pip covers 80 percent of all necessary and reasonable medical expenses up to $10,000 resulting from a covered injury, no matter who caused the crash. The required proof of insurance may be sent by mail by the owner as long as it is received within ten days. This request can be in a separate letter or the same letter (as the notice of defects letter) and should reference florida statute s. If they don’t ask for it, you don’t have to provide it.

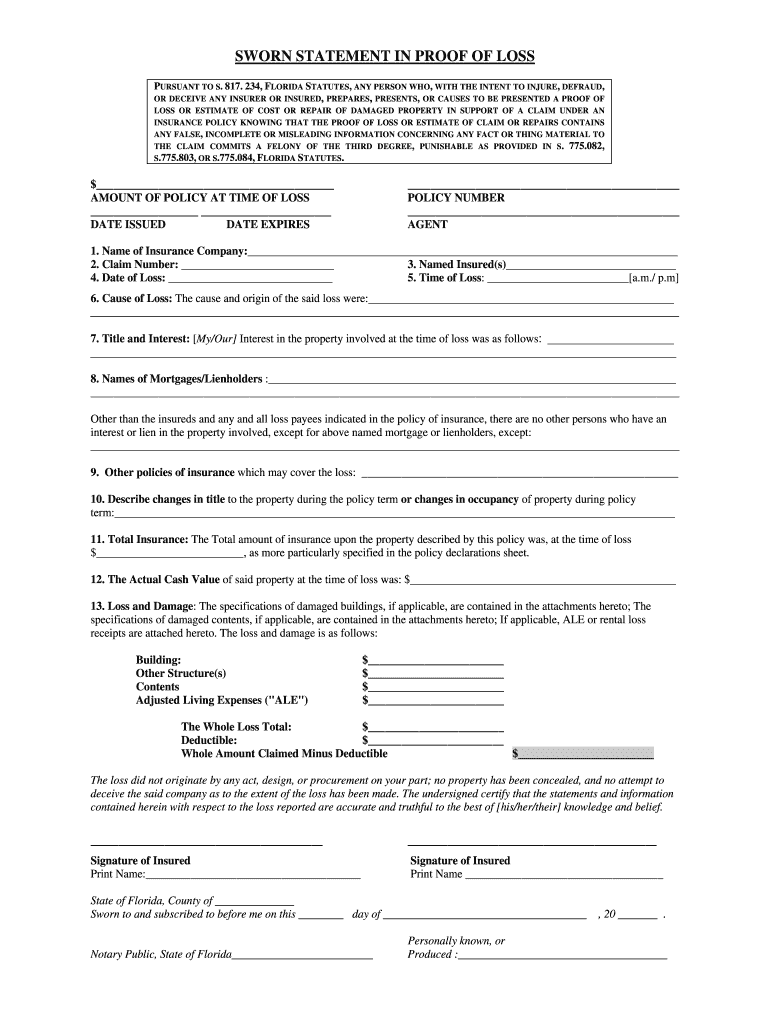

Florida law requires policyholders to provide proof of loss information upon the insurer’s request.

As the work is performed and expenses are incurred, the insurer shall pay remaining amounts necessary to perform the repairs. This statute requires the insurer to pay initially no less than the actual cash value of the insured loss less an applicable deductible. If they don’t ask for it, you don’t have to provide it. A person is guilty of a gross misdemeanor who violates this section within ten years of the first of two prior convictions under this section, section 169.791, or a statute or ordinance in conformity with one of those sections.the operator of a vehicle who violates subdivision 3 and who causes or. As the work is performed and expenses are incurred, the insurer shall pay remaining amounts necessary to perform the repairs. As with some of the other auto insurance requirements, florida technically gives another option to buying a pip insurance policy.

Source: noclutter.cloud

Source: noclutter.cloud

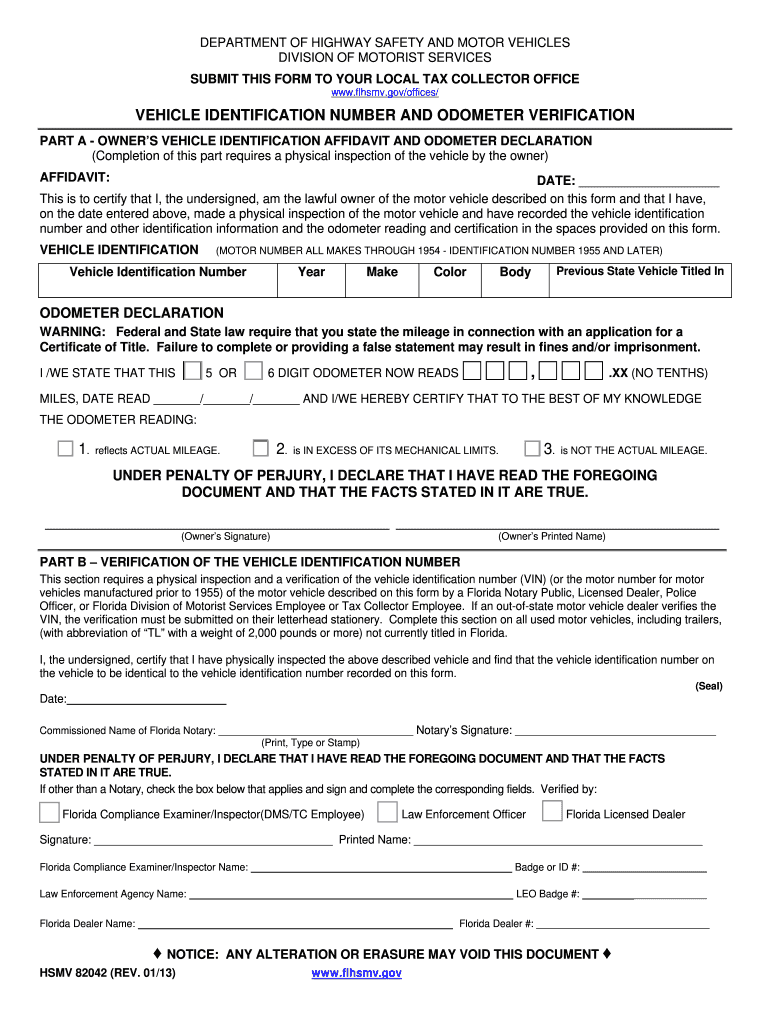

Before you register a vehicle with at least four wheels in florida, you must show proof of personal injury protection (pip) and property damage liability (pdl) automobile insurance.pip covers 80 percent of all necessary and reasonable medical expenses up to $10,000 resulting from a covered injury, no matter who caused the crash. (6) if a law enforcement officer of this state determines that the owner or operator of a motor vehicle subject to the provisions of this code section does not have proof or evidence of required minimum insurance coverage, the arresting officer shall issue a uniform traffic citation for operating a motor vehicle without proof of insurance. This request can be in a separate letter or the same letter (as the notice of defects letter) and should reference florida statute s. By executing the aforesaid affidavit, no licensed motor vehicle dealer will be. 319.23, the original or a photostatic copy of such card, insurance policy, insurance policy binder, or certificate of insurance or the original affidavit from the insured shall be forwarded by the dealer to the tax collector of the county or the department of highway safety and motor vehicles for processing.

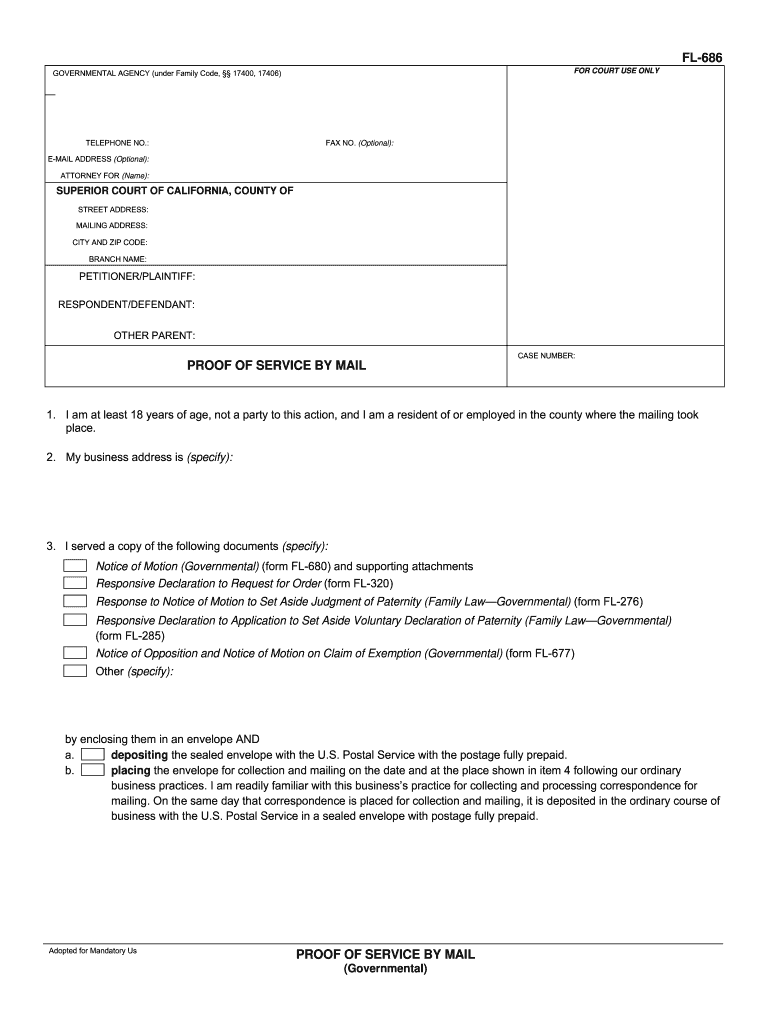

Source: pdffiller.com

Source: pdffiller.com

(5) the department shall adopt rules to administer this section. Penalties for first offense after your first offense, the state can suspend your license until you provide proof of auto insurance and pay a fee of $150. This is not something you can ignore; As a condition precedent to filing a lawsuit for statutory bad faith, the florida department of insurance, as well as the insurer, must be given sixty (60) days written notice of any alleged violation. The problem with no proof of insurance citations.

Source: finance-review.com

Source: finance-review.com

(5) the department shall adopt rules to administer this section. Following this notice, the insurer has the opportunity to cure the alleged bad faith violation. This statute requires the insurer to pay initially no less than the actual cash value of the insured loss less an applicable deductible. Failure to show proof of insurance is a criminal traffic offense in florida. (c) each party to the crash must provide the law enforcement officer with proof of insurance, which must be documented in the crash report.

Source: revisi.net

Source: revisi.net

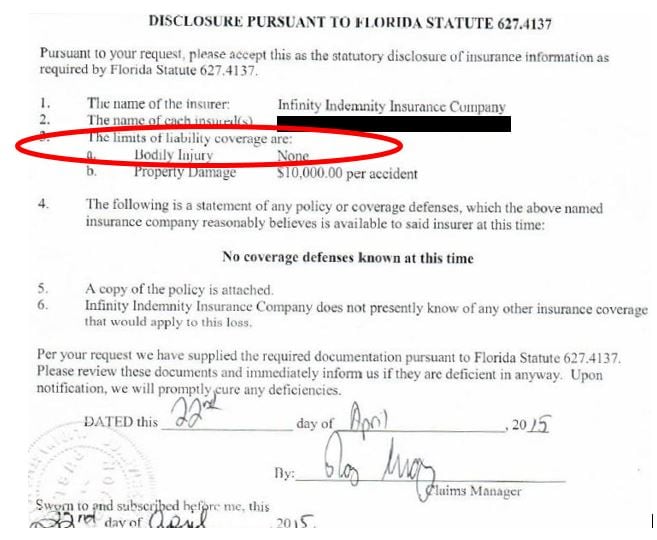

Note that insurers don’t always request this information. 627.4137 and request the information in the below statutory language: Driving without car insurance in florida can end up costing you a lot more than your monthly insurance bill. The problem with no proof of insurance citations. Upon presentation of such proof, the citation shall be dismissed by the prosecutor or county attorney without cost to the owner and no prosecution for the offense cited shall occur.

Source: formdownload.org

Source: formdownload.org

Before you register a vehicle with at least four wheels in florida, you must show proof of personal injury protection (pip) and property damage liability (pdl) automobile insurance.pip covers 80 percent of all necessary and reasonable medical expenses up to $10,000 resulting from a covered injury, no matter who caused the crash. If a law enforcement officer submits a report on the crash, proof of insurance must be provided to the officer by each. No proof of insurance florida statute. Following this notice, the insurer has the opportunity to cure the alleged bad faith violation. 319.23, the original or a photostatic copy of such card, insurance policy, insurance policy binder, or certificate of insurance or the original affidavit from the insured shall be forwarded by the dealer to the tax collector of the county or the department of highway safety and motor vehicles for processing.

Source: noclutter.cloud

Source: noclutter.cloud

627.4137 and request the information in the below statutory language: Driving without car insurance in florida can end up costing you a lot more than your monthly insurance bill. Failure to show proof of insurance is a criminal traffic offense in florida. (3) the department shall, for any person convicted for a violation of this section, reinstate such person�s operator�s license, motor vehicle certificate of. This will likely be due to the fact that you do not have your insurance card on you.

(a) a person who violates this section is guilty of a misdemeanor. If you fail to provide proof of insurance, then your license, plates, and registration will be suspended for up to three years; Note that insurers don’t always request this information. If any person charged with a violation of this section fails to furnish proof insurance was valid at the time the citation was issued, a conviction will be entered on the driving record and the driver’s license department shall, upon receiving notice of the conviction from the court, suspend the person’s registration and driver’s. (a) a person who violates this section is guilty of a misdemeanor.

Source: slideshare.net

Source: slideshare.net

Florida law requires policyholders to provide proof of loss information upon the insurer’s request. (c) each party to the crash must provide the law enforcement officer with proof of insurance, which must be documented in the crash report. Any subsequent lapses in coverage carry harsher penalties. This will likely be due to the fact that you do not have your insurance card on you. Before you register a vehicle with at least four wheels in florida, you must show proof of personal injury protection (pip) and property damage liability (pdl) automobile insurance.pip covers 80 percent of all necessary and reasonable medical expenses up to $10,000 resulting from a covered injury, no matter who caused the crash.

Source: suncoastroofing.com

Source: suncoastroofing.com

Note that insurers don’t always request this information. (4) any person presenting proof of insurance as required in subsection (1) who knows that the insurance as represented by such proof of insurance is not currently in force is guilty of a misdemeanor of the first degree, punishable as provided in s. However, the proof of loss request might be built into the terms of your insurance policy. This request can be in a separate letter or the same letter (as the notice of defects letter) and should reference florida statute s. You�ll have to pay a fine to get reinstated.

Source: pdffiller.com

Source: pdffiller.com

A no proof of insurance ticket can cost around $550 or more. (a) a person who violates this section is guilty of a misdemeanor. (c) each party to the crash must provide the law enforcement officer with proof of insurance, which must be documented in the crash report. You can face this charge if you are pulled over in your vehicle by a law enforcement officer and are not able to show the officer proof that you have car insurance on the vehicle you’re driving. (3) the department shall, for any person convicted for a violation of this section, reinstate such person�s operator�s license, motor vehicle certificate of.

Source: signnow.com

Source: signnow.com

By executing the aforesaid affidavit, no licensed motor vehicle dealer will be. As a condition precedent to filing a lawsuit for statutory bad faith, the florida department of insurance, as well as the insurer, must be given sixty (60) days written notice of any alleged violation. Florida law requires policyholders to provide proof of loss information upon the insurer’s request. I predict this wordage will generate numerous law suits in the state of florida. If a law enforcement officer submits a report on the crash, proof of insurance must be provided to the officer by each.

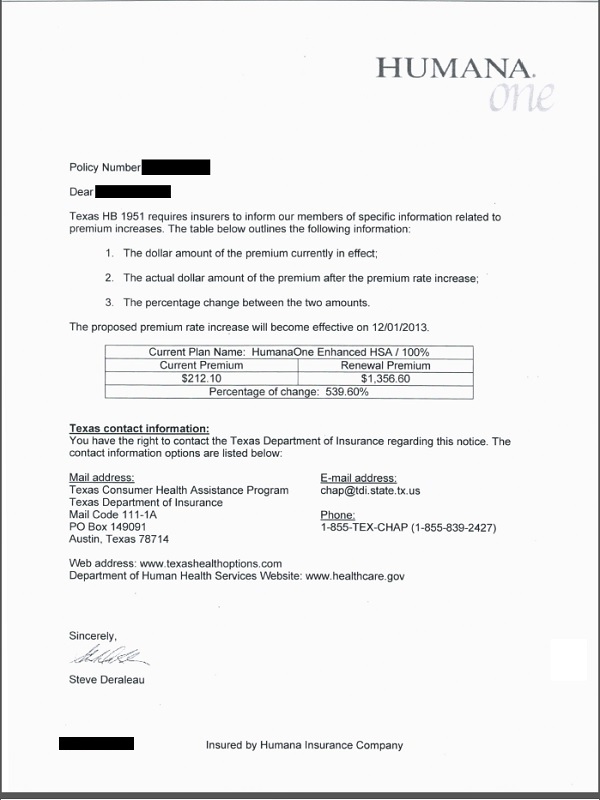

Source: complaintsboard.com

Source: complaintsboard.com

Before you register a vehicle with at least four wheels in florida, you must show proof of personal injury protection (pip) and property damage liability (pdl) automobile insurance.pip covers 80 percent of all necessary and reasonable medical expenses up to $10,000 resulting from a covered injury, no matter who caused the crash. Any subsequent lapses in coverage carry harsher penalties. You may also receive a ticket for the primary offense, which increases your overall costs. Failing to meet florida�s car insurance requirements could result in a fine plus a suspended driver�s license, license plates and registration for up to three years. If you fail to provide proof of insurance, then your license, plates, and registration will be suspended for up to three years;

Source: npa1.org

Source: npa1.org

319.23, the original or a photostatic copy of such card, insurance policy, insurance policy binder, or certificate of insurance or the original affidavit from the insured shall be forwarded by the dealer to the tax collector of the county or the department of highway safety and motor vehicles for processing. You can face this charge if you are pulled over in your vehicle by a law enforcement officer and are not able to show the officer proof that you have car insurance on the vehicle you’re driving. (5) the department shall adopt rules to administer this section. Any owner who fails to produce proof of insurance within ten days of an officer�s request under this subdivision is guilty of a misdemeanor. I predict this wordage will generate numerous law suits in the state of florida.

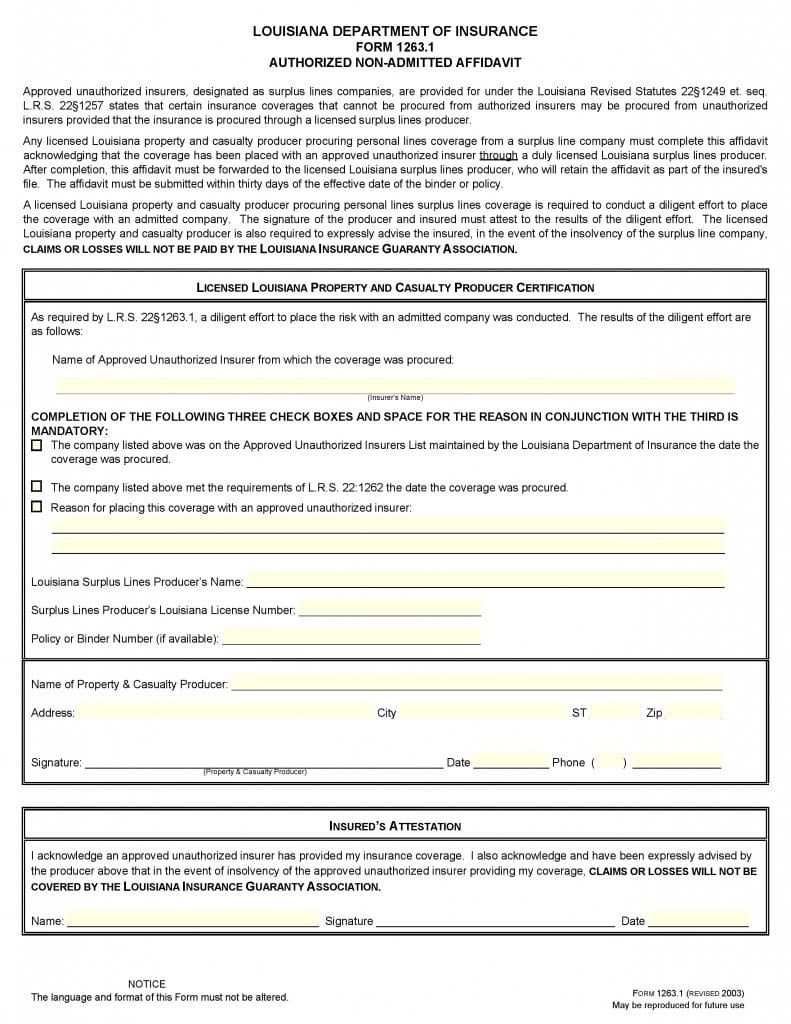

Source: formsbirds.com

Source: formsbirds.com

(6) if a law enforcement officer of this state determines that the owner or operator of a motor vehicle subject to the provisions of this code section does not have proof or evidence of required minimum insurance coverage, the arresting officer shall issue a uniform traffic citation for operating a motor. (5) the department shall adopt rules to administer this section. A no proof of insurance ticket can cost around $550 or more. Before you register a vehicle with at least four wheels in florida, you must show proof of personal injury protection (pip) and property damage liability (pdl) automobile insurance.pip covers 80 percent of all necessary and reasonable medical expenses up to $10,000 resulting from a covered injury, no matter who caused the crash. As a condition precedent to filing a lawsuit for statutory bad faith, the florida department of insurance, as well as the insurer, must be given sixty (60) days written notice of any alleged violation.

Source: floridaticketfirm.com

Source: floridaticketfirm.com

This request can be in a separate letter or the same letter (as the notice of defects letter) and should reference florida statute s. (5) the department shall adopt rules to administer this section. The required proof of insurance may be sent by mail by the owner as long as it is received within ten days. This is not something you can ignore; Failure to show proof of insurance is a criminal traffic offense in florida.

Source: justinziegler.net

Source: justinziegler.net

Start with culling certificates of insurance you have on these parties to obtain (some) of this information as to whom to send the request to. Florida law requires policyholders to provide proof of loss information upon the insurer’s request. A no proof of insurance ticket can cost around $550 or more. This statute requires the insurer to pay initially no less than the actual cash value of the insured loss less an applicable deductible. The required proof of insurance may be sent by mail by the owner as long as it is received within ten days.

Source: noclutter.cloud

Source: noclutter.cloud

(4) any person presenting proof of insurance as required in subsection (1) who knows that the insurance as represented by such proof of insurance is not currently in force is guilty of a misdemeanor of the first degree, punishable as provided in s. Failing to meet florida�s car insurance requirements could result in a fine plus a suspended driver�s license, license plates and registration for up to three years. However, the proof of loss request might be built into the terms of your insurance policy. This request can be in a separate letter or the same letter (as the notice of defects letter) and should reference florida statute s. (1) any person required by s.

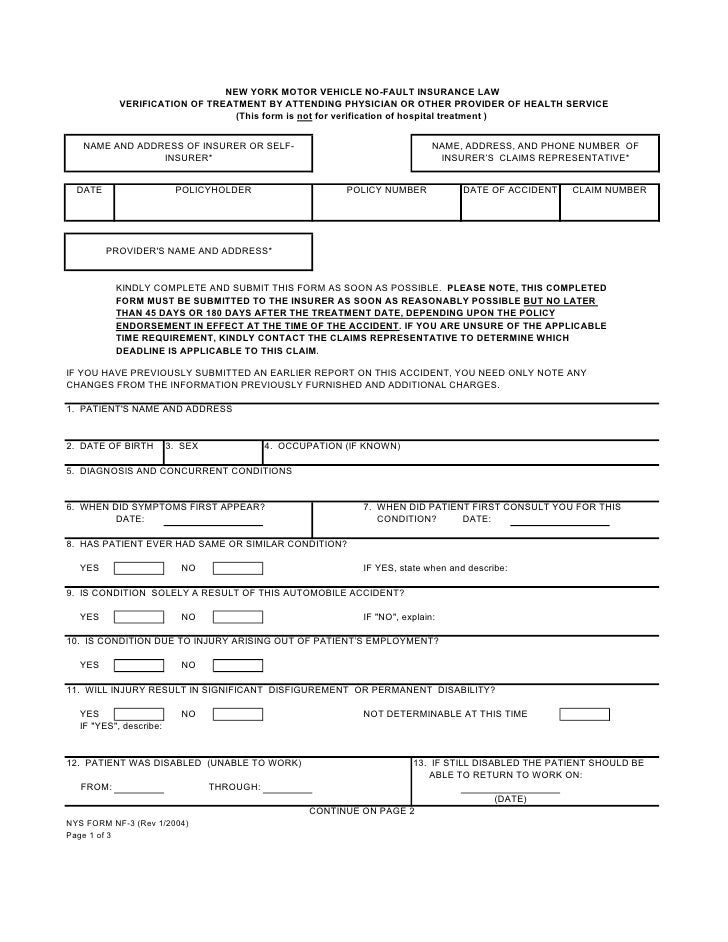

_Page_1.jpg “Coverage Counsel Fillable New York NoFault Forms NF2”) Source: nycoveragecounsel.blogspot.com

627.4137 and request the information in the below statutory language: (5) the department shall adopt rules to administer this section. 319.23, the original or a photostatic copy of such card, insurance policy, insurance policy binder, or certificate of insurance or the original affidavit from the insured shall be forwarded by the dealer to the tax collector of the county or the department of highway safety and motor vehicles for processing. Any subsequent lapses in coverage carry harsher penalties. (3) the department shall, for any person convicted for a violation of this section, reinstate such person�s operator�s license, motor vehicle certificate of.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title no proof of insurance florida statute by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.