Non contributory insurance information

Home » Trend » Non contributory insurance informationYour Non contributory insurance images are ready. Non contributory insurance are a topic that is being searched for and liked by netizens today. You can Download the Non contributory insurance files here. Download all royalty-free images.

If you’re searching for non contributory insurance images information linked to the non contributory insurance keyword, you have pay a visit to the ideal blog. Our website frequently gives you suggestions for seeking the highest quality video and image content, please kindly surf and find more informative video content and graphics that match your interests.

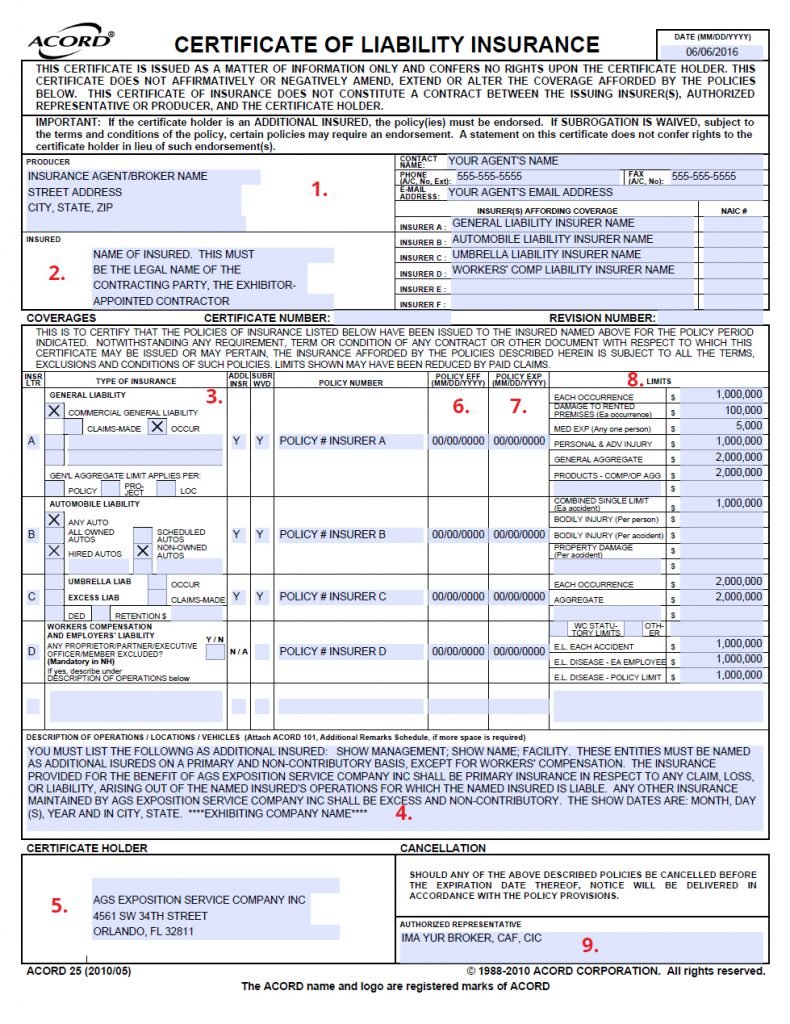

Non Contributory Insurance. Contractor agrees that all general liability coverages required under this insurance section are primary and that any insurance of mts, sdti, sd&ae, sd&iv, and sdtc shall be excess and noncontributory ( endorsement required). While they make no contributions, employees are still required to apply for coverage within 31 days of the date when they and their dependents. Construction contracts often require a subcontractor’s general liability insurance policy to name the owner or general contractor as an additional insured on a “primary and noncontributory” basis. Construction contracts often require a subcontractor’s general liability insurance policy to name the owner or general contractor as an additional insured on a “primary and noncontributory” basis.

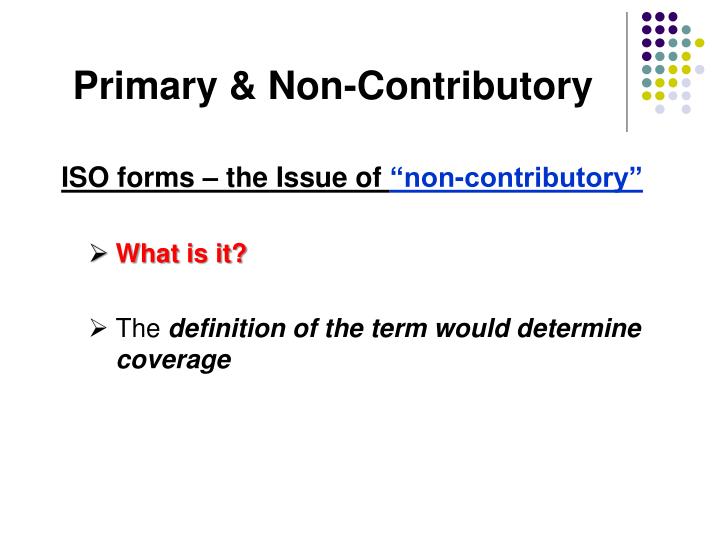

PPT Certificates of Insurance PowerPoint Presentation From slideserve.com

PPT Certificates of Insurance PowerPoint Presentation From slideserve.com

The international risk management institute (irmi). In insurance terms, the right to contribution arises when several insurers are obligated to indemnify the same loss, with one insurer paying out more than their proportion of the loss and looking for reimbursement of that paid cost, from any other insurance policy. After mary submits the suit to her insurer, this is ultimately settled for $44,000. Contingent on the business, a primary and noncontributory endorsement can be an important part of an insurance policy. This insurance is excess over all other insurance available to the additional insured whether on a primary, excess, contingent or any other basis. As subrogation is derived solely from an insured�s rights, the insurer would likely retain its right of contribution.

The employees make no contributions to the benefit plan;

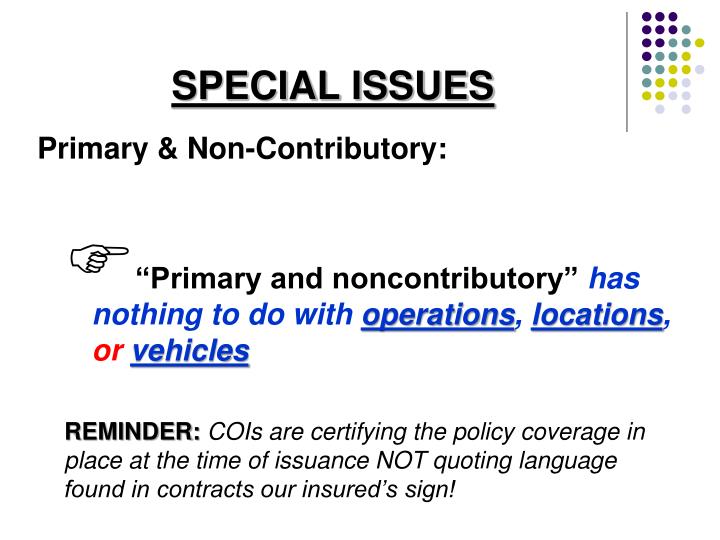

Primary and noncontributory — this term is commonly used in contract insurance requirements to stipulate the order in which multiple policies triggered by the same loss are to respond. In insurance terms, the right to contribution arises when several insurers are obligated to indemnify the same loss, with one insurer paying out more than their proportion of the loss and looking for reimbursement of that paid cost, from any other insurance policy. The employees make no contributions to the benefit plan; This means that if the additional insured is the subject of a claim covered by the policyholder�s insurance, the policyholder�s insurer won�t ask the additional insured�s insurer to contribute any portion. $22,000 is paid by the insurer on behalf of sassy salon & spa, and $22,000 is paid by this same insurance company on behalf of commercial properties inc. Construction contracts often require a subcontractor’s general liability insurance policy to name the owner or general contractor as an additional insured on a “primary and noncontributory” basis.

Source: slideserve.com

Source: slideserve.com

In insurance terms, the right to contribution arises when several insurers are obligated to indemnify the same loss, with one insurer paying out more than their proportion of the loss and looking for reimbursement of that paid cost, from any other insurance policy. For instance, if there was a claim and both you and your client were liable, then the injured party would have the right to recover damages from both you and your client’s insurance. This seemingly simple requirement can cause a lot of difficulty and may hamper the sub’s ability to start the project. The policy must be endorsed to include this verbiage and evidence of coverage provided with the certificate. As subrogation is derived solely from an insured�s rights, the insurer would likely retain its right of contribution.

Source: slideserve.com

Source: slideserve.com

This party is typically an additional insured. When the employer pays the entire cost and employees do not contribute to the premium for a type of coverage (for example, group term life insurance or short (9). For instance, if there was a claim and both you and your client were liable, then the injured party would have the right to recover damages from both you and your client’s insurance. The policy must be endorsed to include this verbiage and evidence of coverage provided with the certificate. After mary submits the suit to her insurer, this is ultimately settled for $44,000.

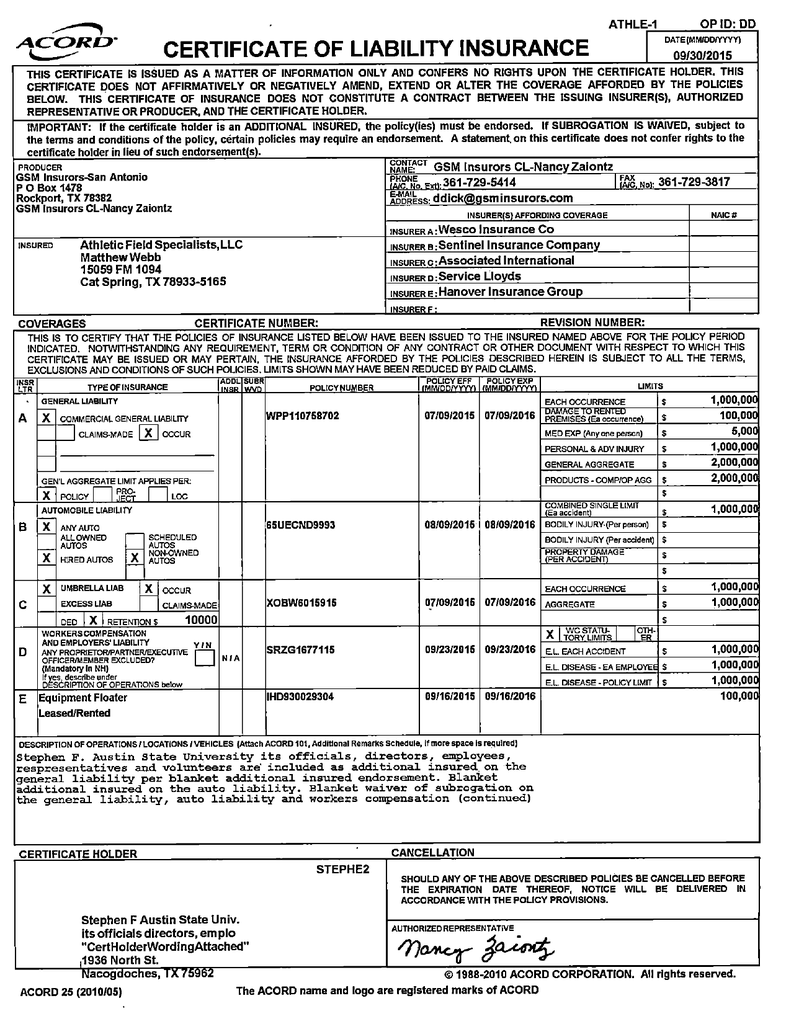

Source: pdftaste.weebly.com

Source: pdftaste.weebly.com

The international risk management institute (irmi). This means that if the additional insured is the subject of a claim covered by the policyholder�s insurance, the policyholder�s insurer won�t ask the additional insured�s insurer to contribute any portion. The employees make no contributions to the benefit plan; This party is typically an additional insured. After mary submits the suit to her insurer, this is ultimately settled for $44,000.

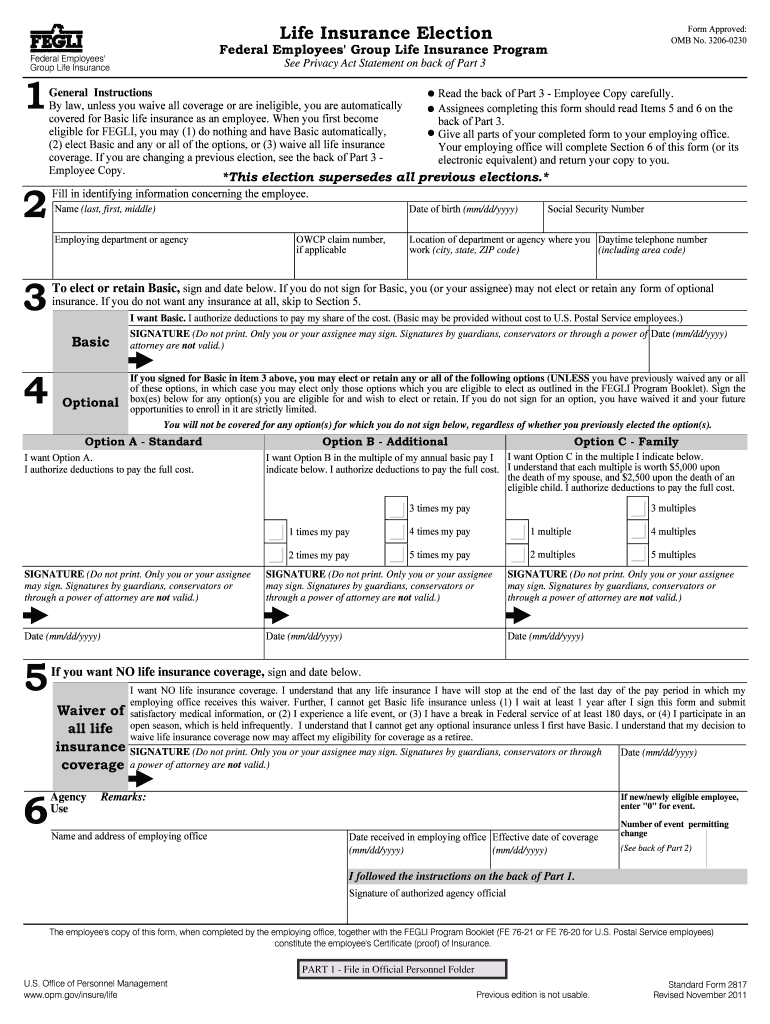

Source: what-is-this.net

Source: what-is-this.net

For instance, if there was a claim and both you and your client were liable, then the injured party would have the right to recover damages from both you and your client’s insurance. This seemingly simple requirement can cause a lot of difficulty and may hamper the sub’s ability to start the project. While they make no contributions, employees are still required to apply for coverage within 31 days of the date when they and their dependents. For instance, if there was a claim and both you and your client were liable, then the injured party would have the right to recover damages from both you and your client’s insurance. Construction contracts often require a subcontractor’s general liability insurance policy to name the owner or general contractor as an additional insured on a “primary and noncontributory” basis.

Source: slideserve.com

Source: slideserve.com

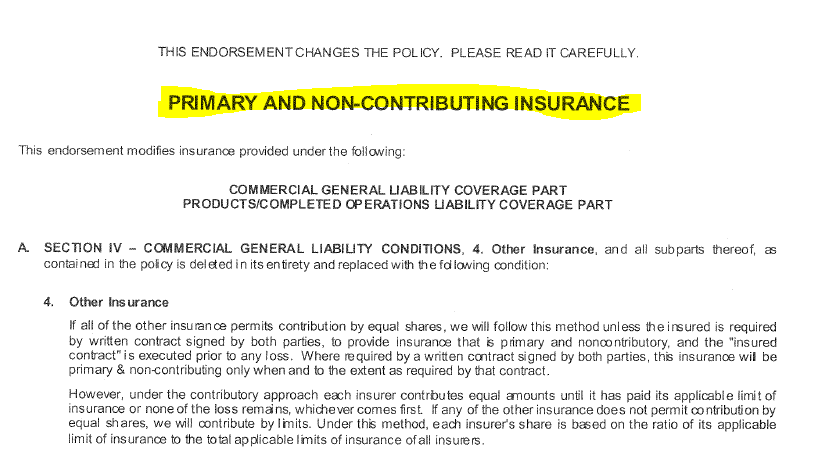

Construction contracts often require a subcontractor’s general liability insurance policy to name the owner or general contractor as an additional insured on a “primary and noncontributory” basis. Construction contracts often require a subcontractor’s general liability insurance policy to name the owner or general contractor as an additional insured on a “primary and noncontributory” basis. As subrogation is derived solely from an insured�s rights, the insurer would likely retain its right of contribution. The second requirement of a primary and noncontributory clause is that coverage afforded to the additional insured must be noncontributory. The policy must be endorsed to include this verbiage and evidence of coverage provided with the certificate.

Source: ags-expo.com

Source: ags-expo.com

Hence, it is known as noncontributory. Hence, it is known as noncontributory. After mary submits the suit to her insurer, this is ultimately settled for $44,000. The second requirement of a primary and noncontributory clause is that coverage afforded to the additional insured must be noncontributory. As subrogation is derived solely from an insured�s rights, the insurer would likely retain its right of contribution.

Source: researchgate.net

Source: researchgate.net

For instance, if there was a claim and both you and your client were liable, then the injured party would have the right to recover damages from both you and your client’s insurance. Hence, it is known as noncontributory. Contractor agrees that all general liability coverages required under this insurance section are primary and that any insurance of mts, sdti, sd&ae, sd&iv, and sdtc shall be excess and noncontributory ( endorsement required). The employees make no contributions to the benefit plan; This seemingly simple requirement can cause a lot of difficulty and may hamper the.

Source: slideserve.com

Source: slideserve.com

When the employer pays the entire cost and employees do not contribute to the premium for a type of coverage (for example, group term life insurance or short (9). Construction contracts often require a subcontractor’s general liability insurance policy to name the owner or general contractor as an additional insured on a “primary and noncontributory” basis. For instance, if there was a claim and both you and your client were liable, then the injured party would have the right to recover damages from both you and your client’s insurance. As subrogation is derived solely from an insured�s rights, the insurer would likely retain its right of contribution. In insurance terms, the right to contribution arises when several insurers are obligated to indemnify the same loss, with one insurer paying out more than their proportion of the loss and looking for reimbursement of that paid cost, from any other insurance policy.

Source: researchgate.net

Source: researchgate.net

This insurance is excess over all other insurance available to the additional insured whether on a primary, excess, contingent or any other basis. Contingent on the business, a primary and noncontributory endorsement can be an important part of an insurance policy. Primary and noncontributory — this term is commonly used in contract insurance requirements to stipulate the order in which multiple policies triggered by the same loss are to respond. This seemingly simple requirement can cause a lot of difficulty and may hamper the sub’s ability to start the project. While they make no contributions, employees are still required to apply for coverage within 31 days of the date when they and their dependents.

Source: support.verifly.com

Source: support.verifly.com

This seemingly simple requirement can cause a lot of difficulty and may hamper the sub’s ability to start the project. For instance, if there was a claim and both you and your client were liable, then the injured party would have the right to recover damages from both you and your client’s insurance. When the employer pays the entire cost and employees do not contribute to the premium for a type of coverage (for example, group term life insurance or short (9). This insurance is excess over all other insurance available to the additional insured whether on a primary, excess, contingent or any other basis. The second requirement of a primary and noncontributory clause is that coverage afforded to the additional insured must be noncontributory.

Source: slideserve.com

Source: slideserve.com

Noncontributory generally means that an insurer has agreed not to seek its independent right to contribution when two or more insurers apply to the same accident for the same insured. Contingent on the business, a primary and noncontributory endorsement can be an important part of an insurance policy. For instance, if there was a claim and both you and your client were liable, then the injured party would have the right to recover damages from both you and your client’s insurance. When the employer pays the entire cost and employees do not contribute to the premium for a type of coverage (for example, group term life insurance or short (9). While they make no contributions, employees are still required to apply for coverage within 31 days of the date when they and their dependents.

Source: slideserve.com

Source: slideserve.com

The importance of this term is its common use in contract insurance. In insurance terms, the right to contribution arises when several insurers are obligated to indemnify the same loss, with one insurer paying out more than their proportion of the loss and looking for reimbursement of that paid cost, from any other insurance policy. This means that if the additional insured is the subject of a claim covered by the policyholder�s insurance, the policyholder�s insurer won�t ask the additional insured�s insurer to contribute any portion. When the employer pays the entire cost and employees do not contribute to the premium for a type of coverage (for example, group term life insurance or short (9). This party is typically an additional insured.

Source: studylib.net

Source: studylib.net

$22,000 is paid by the insurer on behalf of sassy salon & spa, and $22,000 is paid by this same insurance company on behalf of commercial properties inc. When the employer pays the entire cost and employees do not contribute to the premium for a type of coverage (for example, group term life insurance or short (9). The policy must be endorsed to include this verbiage and evidence of coverage provided with the certificate. Noncontributory generally means that an insurer has agreed not to seek its independent right to contribution when two or more insurers apply to the same accident for the same insured. Hence, it is known as noncontributory.

Source: support.verifly.com

Source: support.verifly.com

Noncontributory insurance is a type of group coverage where the employer pays the entirety of the premium. This means that if the additional insured is the subject of a claim covered by the policyholder�s insurance, the policyholder�s insurer won�t ask the additional insured�s insurer to contribute any portion. For example, a contractor may be required to provide liability insurance that is primary and noncontributory. This seemingly simple requirement can cause a lot of difficulty and may hamper the. Hence, it is known as noncontributory.

Source: slideserve.com

Source: slideserve.com

This insurance is excess over all other insurance available to the additional insured whether on a primary, excess, contingent or any other basis. For instance, if there was a claim and both you and your client were liable, then the injured party would have the right to recover damages from both you and your client’s insurance. This seemingly simple requirement can cause a lot of difficulty and may hamper the. Noncontributory generally means that an insurer has agreed not to seek its independent right to contribution when two or more insurers apply to the same accident for the same insured. This means that if the additional insured is the subject of a claim covered by the policyholder�s insurance, the policyholder�s insurer won�t ask the additional insured�s insurer to contribute any portion.

Source: signnow.com

Source: signnow.com

Primary and noncontributory — this term is commonly used in contract insurance requirements to stipulate the order in which multiple policies triggered by the same loss are to respond. While they make no contributions, employees are still required to apply for coverage within 31 days of the date when they and their dependents. The second requirement of a primary and noncontributory clause is that coverage afforded to the additional insured must be noncontributory. For instance, if there was a claim and both you and your client were liable, then the injured party would have the right to recover damages from both you and your client’s insurance. The importance of this term is its common use in contract insurance.

Source: support.verifly.com

Source: support.verifly.com

While they make no contributions, employees are still required to apply for coverage within 31 days of the date when they and their dependents. Construction contracts often require a subcontractor’s general liability insurance policy to name the owner or general contractor as an additional insured on a “primary and noncontributory” basis. The international risk management institute (irmi). This seemingly simple requirement can cause a lot of difficulty and may hamper the sub’s ability to start the project. The employees make no contributions to the benefit plan;

Source: researchgate.net

Source: researchgate.net

The employees make no contributions to the benefit plan; This party is typically an additional insured. Construction contracts often require a subcontractor’s general liability insurance policy to name the owner or general contractor as an additional insured on a “primary and noncontributory” basis. Construction contracts often require a subcontractor’s general liability insurance policy to name the owner or general contractor as an additional insured on a “primary and noncontributory” basis. This seemingly simple requirement can cause a lot of difficulty and may hamper the sub’s ability to start the project.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title non contributory insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.