Non insurance risk information

Home » Trending » Non insurance risk informationYour Non insurance risk images are available in this site. Non insurance risk are a topic that is being searched for and liked by netizens today. You can Get the Non insurance risk files here. Find and Download all royalty-free photos.

If you’re looking for non insurance risk images information related to the non insurance risk keyword, you have pay a visit to the right site. Our website frequently provides you with suggestions for refferencing the highest quality video and picture content, please kindly search and locate more enlightening video content and graphics that fit your interests.

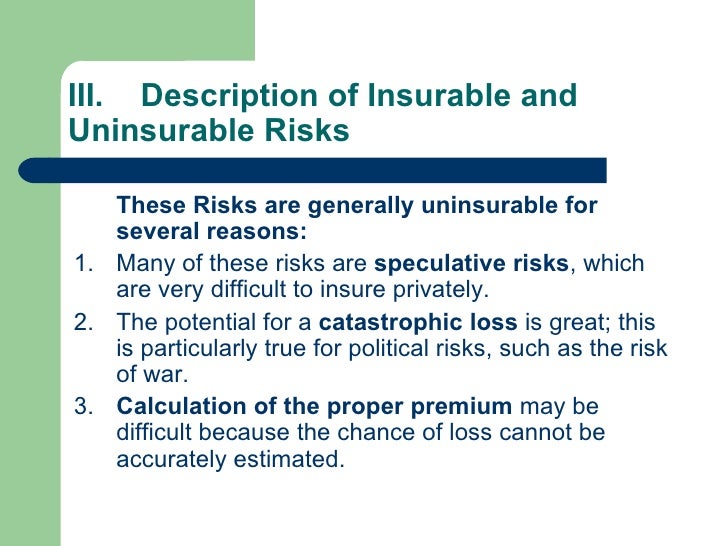

Non Insurance Risk. An example for hoas is sinkholes. 1) insurance companies have the expertise to price the risk reasonably due to their considerable experience in the same. There may be a wrong choice or a wrong decision giving rise to possible discomfort or disliking or embarrassment but not being capable of valuation in money terms. Insurance risk management is the assessment and quantification of the likelihood and financial impact of events that may occur in the customer�s world that require settlement by the insurer;

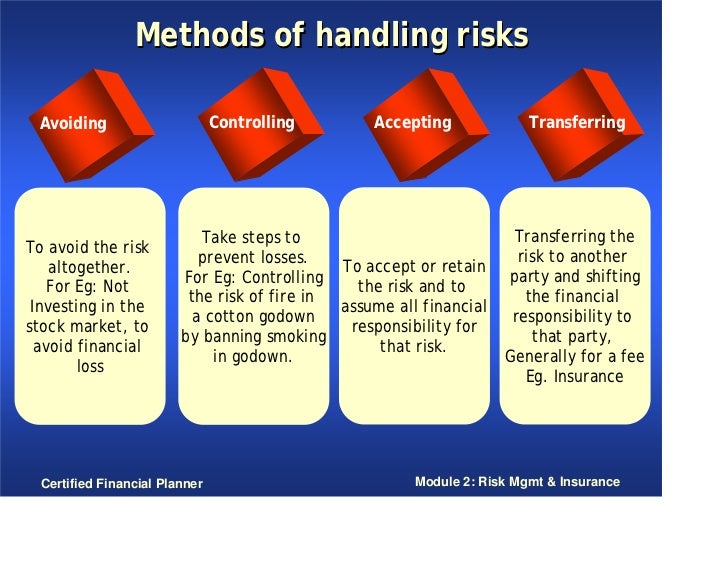

Risk Management and Insurance From slideshare.net

Risk Management and Insurance From slideshare.net

“a pandemic is a very difficult exposure to insure in any meaningful way. For example, if one does not purchase health insurance, one carries the noninsurance risk that an injury will leave one unable to pay one�s medical bills. Transfer of risk from one party to another party other than an insurance company. The more risks your insurance provider agrees to insure, the more comprehensive—and therefore expensive—your policy will be. Large numbers of exposure units. Risk management work typically involves the application of mathematical and.

The premium risk charge is intended to address unexpected losses from insured events that have not occurred , whereas the claims reserve risk charge covers incurred claims , including those that have yet to be reported.

Transfer of risk from one party to another party other than an insurance company. Npi may qualify as a form of credit risk mitigation (a financial guarantee) under the capital requirements regulation provided that the relevant conditions thereunder are satisfied. Thus, a potential loss cannot be calculated so a premium cannot be established. Theoretically, there are different approaches and ways of risk allocation. Market value risk (interest rate risk, exchange prices, equity prices, commodity prices, etc.) When something does go wrong, the result is usually costly time delays and mild to devastating additional material, labor, and damage costs.

Risk management work typically involves the application of mathematical and. Insurance is determined by the risk size of particular risk groups, noting that each risk group is defined by a larger number of individual risks. “a pandemic is a very difficult exposure to insure in any meaningful way. Choice of a car, its brand, color, etc. An example for hoas is sinkholes.

Source: insurancejournal.com

Source: insurancejournal.com

- insurance companies have the expertise to price the risk reasonably due to their considerable experience in the same. Risk management work typically involves the application of mathematical and. For example, if one does not purchase health insurance, one carries the noninsurance risk that an injury will leave one unable to pay one�s medical bills. Serious misconduct, execution risk, key personnel risk, fraud, failing it systems, cyberattacks, data leakage, faulty model assumptions, reputational crises: Examples of insurance risks include the risk of fire, earthquake losses, or even liability when an insured is found responsible for causing bodily injury, death, or property damage to 3rd parties.

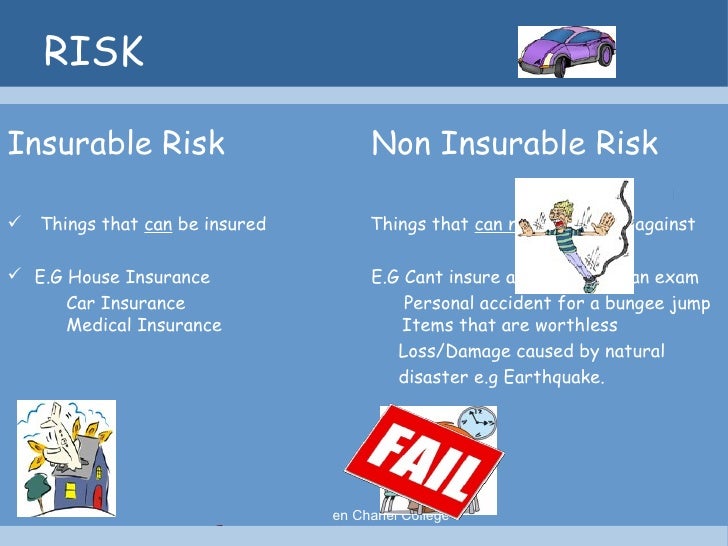

Source: slideshare.net

Source: slideshare.net

This risk management technique usually involves risk transfers by way of hold harmless or indemnity provisions in contracts and is also called “contractual risk transfer.”. 2) insurers also have experts who advise on measures to reduce risks and may offer reasonable premium. For example, if one does not purchase health insurance, one carries the noninsurance risk that an injury will leave one unable to pay one�s medical bills. Theoretically, there are different approaches and ways of risk allocation. Serious misconduct, execution risk, key personnel risk, fraud, failing it systems, cyberattacks, data leakage, faulty model assumptions, reputational crises:

Source: linkkinsurancebroker.com

Source: linkkinsurancebroker.com

Examples of insurance risks include the risk of fire, earthquake losses, or even liability when an insured is found responsible for causing bodily injury, death, or property damage to 3rd parties. When something does go wrong, the result is usually costly time delays and mild to devastating additional material, labor, and damage costs. 7 elements of an insurable risk are; Insurance executives know the potential harm these risks can do to their organizations. For example, if one does not purchase health insurance, one carries the noninsurance risk that an injury will leave one unable to pay one�s medical bills.

Source: slideshare.net

Source: slideshare.net

There may be a wrong choice or a wrong decision giving rise to possible discomfort or disliking or embarrassment but not being capable of valuation in money terms. An example for hoas is sinkholes. 2) insurers also have experts who advise on measures to reduce risks and may offer reasonable premium. Theoretically, there are different approaches and ways of risk allocation. Serious misconduct, execution risk, key personnel risk, fraud, failing it systems, cyberattacks, data leakage, faulty model assumptions, reputational crises:

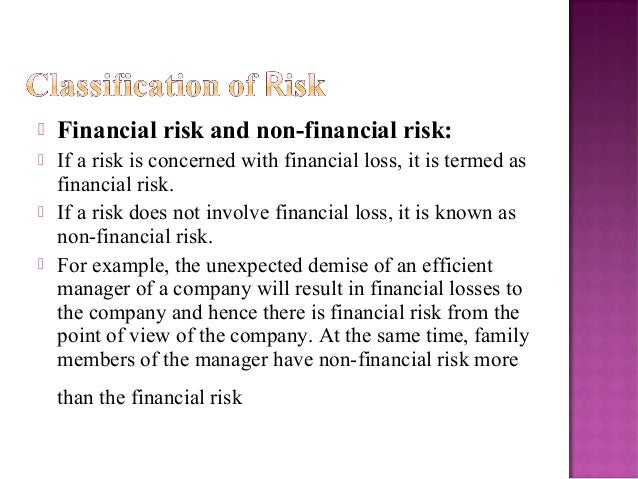

Source: slideshare.net

Source: slideshare.net

Thus, a potential loss cannot be calculated so a premium cannot be established. Thus, a potential loss cannot be calculated so a premium cannot be established. I define financial risk as all risks defined from events in the financial markets that affect all participants. Insurance is determined by the risk size of particular risk groups, noting that each risk group is defined by a larger number of individual risks. Risk management work typically involves the application of mathematical and.

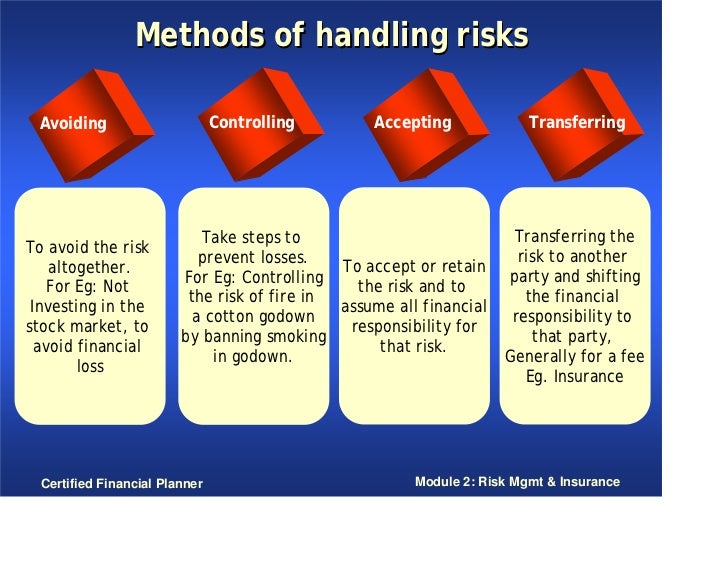

Source: slideshare.net

Source: slideshare.net

Reserve risk concerns the liabilities for insurance policies covering historical years, often simply referred to as the risk in the claims reserve, i.e., the provision for outstanding claims. The premium risk charge is intended to address unexpected losses from insured events that have not occurred , whereas the claims reserve risk charge covers incurred claims , including those that have yet to be reported. Transfer of risk from one party to another party other than an insurance company. Insurance executives know the potential harm these risks can do to their organizations. Examples of insurance risks include the risk of fire, earthquake losses, or even liability when an insured is found responsible for causing bodily injury, death, or property damage to 3rd parties.

Source: youtube.com

Source: youtube.com

Insurance risk management is the assessment and quantification of the likelihood and financial impact of events that may occur in the customer�s world that require settlement by the insurer; 1) insurance companies have the expertise to price the risk reasonably due to their considerable experience in the same. 2) insurers also have experts who advise on measures to reduce risks and may offer reasonable premium. Even if each claim is small, the sheer number. Examples of insurance risks include the risk of fire, earthquake losses, or even liability when an insured is found responsible for causing bodily injury, death, or property damage to 3rd parties.

Source: seminar-bagus.com

Source: seminar-bagus.com

Insurance executives know the potential harm these risks can do to their organizations. “a pandemic is a very difficult exposure to insure in any meaningful way. Insurance risk management is the assessment and quantification of the likelihood and financial impact of events that may occur in the customer�s world that require settlement by the insurer; Reserve risk concerns the liabilities for insurance policies covering historical years, often simply referred to as the risk in the claims reserve, i.e., the provision for outstanding claims. Transfer of risk from one party to another party other than an insurance company.

Source: slideshare.net

Source: slideshare.net

Risk management work typically involves the application of mathematical and. Choice of a car, its brand, color, etc. This risk management technique usually involves risk transfers by way of hold harmless or indemnity provisions in contracts and is also called “contractual risk transfer.”. This risk management technique usually involves risk transfers by way of hold harmless, indemnity, and insurance provisions in contracts and is also called contractual risk transfer. And the ability to spread the risk of these events occurring across other insurance underwriter�s in the market.

Source: foxbyrd.com

Source: foxbyrd.com

Definition noninsurance risk transfer — the transfer of risk from one party to another party other than an insurance company. “a pandemic is a very difficult exposure to insure in any meaningful way. Definition noninsurance risk transfer — the transfer of risk from one party to another party other than an insurance company. Premium should be economically feasible. Even if each claim is small, the sheer number.

Source: fadata.eu

Source: fadata.eu

This risk management technique usually involves risk transfers by way of hold harmless or indemnity provisions in contracts and is also called “contractual risk transfer.”. Premium should be economically feasible. “a pandemic is a very difficult exposure to insure in any meaningful way. For example, if one does not purchase health insurance, one carries the noninsurance risk that an injury will leave one unable to pay one�s medical bills. Insurance executives know the potential harm these risks can do to their organizations.

Source: slideshare.net

Source: slideshare.net

Transfer of risk from one party to another party other than an insurance company. Npi may qualify as a form of credit risk mitigation (a financial guarantee) under the capital requirements regulation provided that the relevant conditions thereunder are satisfied. The national bank of serbia has classified all risks under the following seven risk groups2: 7 elements of an insurable risk are; Reserve risk concerns the liabilities for insurance policies covering historical years, often simply referred to as the risk in the claims reserve, i.e., the provision for outstanding claims.

Source: youngsinsurance.ca

Source: youngsinsurance.ca

An example for hoas is sinkholes. This risk management technique usually involves risk transfers by way of hold harmless, indemnity, and insurance provisions in contracts and is also called contractual risk transfer. Insurance executives know the potential harm these risks can do to their organizations. Risk management work typically involves the application of mathematical and. And the ability to spread the risk of these events occurring across other insurance underwriter�s in the market.

Source: tcs.com

Source: tcs.com

Insurance is determined by the risk size of particular risk groups, noting that each risk group is defined by a larger number of individual risks. The premium risk charge is intended to address unexpected losses from insured events that have not occurred , whereas the claims reserve risk charge covers incurred claims , including those that have yet to be reported. Market value risk (interest rate risk, exchange prices, equity prices, commodity prices, etc.) 2) insurers also have experts who advise on measures to reduce risks and may offer reasonable premium. 7 elements of an insurable risk are;

Source: slideserve.com

Source: slideserve.com

When something does go wrong, the result is usually costly time delays and mild to devastating additional material, labor, and damage costs. Insurance is determined by the risk size of particular risk groups, noting that each risk group is defined by a larger number of individual risks. Insurance executives know the potential harm these risks can do to their organizations. You can do some work around it, but it’s a very, very difficult risk to insure and no one really insures it,” said john mclaughlin, managing director of the higher education practice at arthur j. I define financial risk as all risks defined from events in the financial markets that affect all participants.

Source: insurancehexareportsblog.blogspot.com

Source: insurancehexareportsblog.blogspot.com

Serious misconduct, execution risk, key personnel risk, fraud, failing it systems, cyberattacks, data leakage, faulty model assumptions, reputational crises: Examples of insurance risks include the risk of fire, earthquake losses, or even liability when an insured is found responsible for causing bodily injury, death, or property damage to 3rd parties. Reserve risk concerns the liabilities for insurance policies covering historical years, often simply referred to as the risk in the claims reserve, i.e., the provision for outstanding claims. “a pandemic is a very difficult exposure to insure in any meaningful way. Large numbers of exposure units.

Source: riskandinsurance.com

Source: riskandinsurance.com

Transfer of risk from one party to another party other than an insurance company. I define financial risk as all risks defined from events in the financial markets that affect all participants. Insurance executives know the potential harm these risks can do to their organizations. Transfer of risk from one party to another party other than an insurance company. There may be a wrong choice or a wrong decision giving rise to possible discomfort or disliking or embarrassment but not being capable of valuation in money terms.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title non insurance risk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.