Nonadmitted insurance companies information

Home » Trend » Nonadmitted insurance companies informationYour Nonadmitted insurance companies images are available. Nonadmitted insurance companies are a topic that is being searched for and liked by netizens today. You can Find and Download the Nonadmitted insurance companies files here. Download all free images.

If you’re looking for nonadmitted insurance companies pictures information connected with to the nonadmitted insurance companies keyword, you have pay a visit to the ideal site. Our website frequently provides you with hints for viewing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

Nonadmitted Insurance Companies. Nonadmitted insurer — an insurance company not licensed to do business in a certain state or country. At first glance, it might seem like a risky move to get a policy with an insurer that is not fully approved. The company is likely not in compliance with the state’s insurance laws and regulations. However, it is not required to file its rates with the cdi.

NonAdmitted Insurance in Maine What is It? From noyeshallallen.com

NonAdmitted Insurance in Maine What is It? From noyeshallallen.com

However, there’s been a growing trend to place insurance through nonadmitted, i.e., unlicensed, insurance companies, as this allows taxpayers the ability to better control risk management, mitigate insurance costs and price. However, it is not required to file its rates with the cdi. Traditionally, commercial insurance was provided by insurance companies licensed to write coverage in the taxpayer’s state(s) of operation. It just doesn’t have the same licensing, regulation, or backing. This allows them to issue policies that admitted insurers cannot, but may also come with less security. Some may even allow you to create a customized policy.

Nonadmitted insurance essentially arises when companies/headquarters purchase insurance from insurance companies not licensed in the incorporation/management state.

Nonadmitted insurer — an insurance company not licensed to do business in a certain state or country. Nonadmitted insurer — an insurance company not licensed to do business in a certain state or country. As it sounds, an admitted insurance company is “admitted” to do business as an insurance company in the state. However, there’s been a growing trend to place insurance through nonadmitted, i.e., unlicensed, insurance companies, as this allows taxpayers the ability to better control risk management, mitigate insurance costs and price. At first glance, it might seem like a risky move to get a policy with an insurer that is not fully approved. However, most states have similar qualifications for both of these asset classes.

Source: presidioinsurance.com

Source: presidioinsurance.com

If an insurance company has a higher number of assets, it is usually a good thing. Nonadmitted insurer — an insurance company not licensed to do business in a certain state or country. Jurisdictions, such insurers can nevertheless write coverage through an excess and surplus lines broker licensed in that jurisdiction. However, most states have similar qualifications for both of these asset classes. This allows them to issue policies that admitted insurers cannot, but may also come with less security.

Source: suzannebrownagency.com

Source: suzannebrownagency.com

However, there’s been a growing trend to place insurance through nonadmitted, i.e., unlicensed, insurance companies, as this allows taxpayers the ability to better control risk management, mitigate insurance costs and price. In fact, lloyd�s is not even an insurance company. If an insurance company has a higher number of assets, it is usually a good thing. However, there’s been a growing trend to place insurance through nonadmitted, i.e., unlicensed, insurance companies, as this allows taxpayers the ability to better control risk management, mitigate insurance costs and price. Some may even allow you to create a customized policy.

Source: noyeshallallen.com

Source: noyeshallallen.com

In fact, lloyd�s is not even an insurance company. This allows them to set their own rates, which may make their businesses more profitable overall. If an insurance company has a higher number of assets, it is usually a good thing. It also doesn’t mean the insurance is illegal, nor does it mean it’s bad. However, it is not required to file its rates with the cdi.

Source: ez.insure

Source: ez.insure

If an insurance company has a higher number of assets, it is usually a good thing. The company is likely not in compliance with the state’s insurance laws and regulations. If an insurance company has a higher number of assets, it is usually a good thing. It just doesn’t have the same licensing, regulation, or backing. Helping them to comply with the surplus and reserve requirements in their market.

Source: ez.insure

Source: ez.insure

Just because the insurance carrier isn’t licensed in the state, it doesn’t mean that they’re not allowed to operate in that location. At first glance, it might seem like a risky move to get a policy with an insurer that is not fully approved. However, it is not required to file its rates with the cdi. However, most states have similar qualifications for both of these asset classes. Price is not a good reason to go.

Source: proprofs.com

Source: proprofs.com

This allows them to issue policies that admitted insurers cannot, but may also come with less security. Nonadmitted insurer — an insurance company not licensed to do business in a certain state or country. Helping them to comply with the surplus and reserve requirements in their market. This means they are not obligated to comply with any state insurance regulations. If an insurance company has a higher number of assets, it is usually a good thing.

Source: slideserve.com

Source: slideserve.com

It just doesn’t have the same licensing, regulation, or backing. Has the expertise and track record of helping insurance companies. These nonadmitted insurers are, nevertheless, bona fide, properly licensed insurers that are regulated by administrators in a different state, or perhaps a foreign country; This allows them to set their own rates, which may make their businesses more profitable overall. Some may even allow you to create a customized policy.

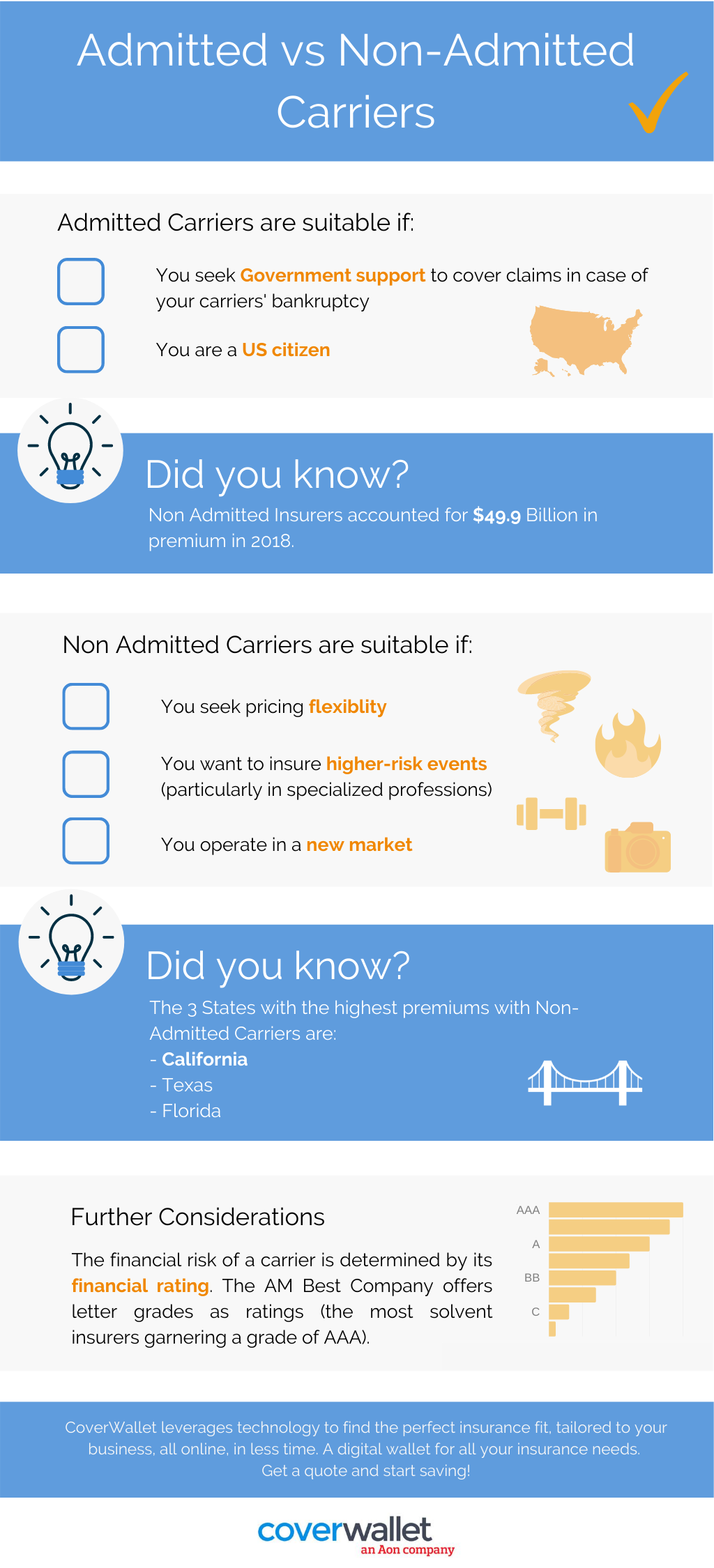

Source: coverwallet.com

Source: coverwallet.com

They are just not licensed by or. Claims to the company may not be paid if the insurer goes insolvent. However, there’s been a growing trend to place insurance through nonadmitted, i.e., unlicensed, insurance companies, as this allows taxpayers the ability to better control risk management, mitigate insurance costs and price. These nonadmitted insurers are, nevertheless, bona fide, properly licensed insurers that are regulated by administrators in a different state, or perhaps a foreign country; It just doesn’t have the same licensing, regulation, or backing.

Source: elliotwhittier.com

An admitted policy is the best option for an agent to place you with in the majority of cases. In fact, lloyd�s is not even an insurance company. Price is not a good reason to go. They are just not licensed by or. This allows them to set their own rates, which may make their businesses more profitable overall.

Source: security.naifa.org

Price is not a good reason to go. Jurisdictions, such insurers can nevertheless write coverage through an excess and surplus lines broker licensed in that jurisdiction. They are just not licensed by or. Has the expertise and track record of helping insurance companies. However, it is not required to file its rates with the cdi.

.png “The Difference Between Admitted and NonAdmitted Insurance”) Source: security.naifa.org

An admitted policy is the best option for an agent to place you with in the majority of cases. The company is likely not in compliance with the state’s insurance laws and regulations. This allows them to issue policies that admitted insurers cannot, but may also come with less security. If an insurance company has a higher number of assets, it is usually a good thing. An admitted policy is the best option for an agent to place you with in the majority of cases.

Source: ez.insure

Source: ez.insure

However, there’s been a growing trend to place insurance through nonadmitted, i.e., unlicensed, insurance companies, as this allows taxpayers the ability to better control risk management, mitigate insurance costs and price. An admitted policy is the best option for an agent to place you with in the majority of cases. Has the expertise and track record of helping insurance companies. Just because the insurance carrier isn’t licensed in the state, it doesn’t mean that they’re not allowed to operate in that location. In fact, lloyd�s is not even an insurance company.

Source: youtube.com

Source: youtube.com

In fact, lloyd�s is not even an insurance company. Helping them to comply with the surplus and reserve requirements in their market. Nonadmitted insurer — an insurance company not licensed to do business in a certain state or country. It also doesn’t mean the insurance is illegal, nor does it mean it’s bad. As it sounds, an admitted insurance company is “admitted” to do business as an insurance company in the state.

Source: slideserve.com

Source: slideserve.com

Helping them to comply with the surplus and reserve requirements in their market. However, it is not required to file its rates with the cdi. The company is likely not in compliance with the state’s insurance laws and regulations. It just doesn’t have the same licensing, regulation, or backing. This means they are not obligated to comply with any state insurance regulations.

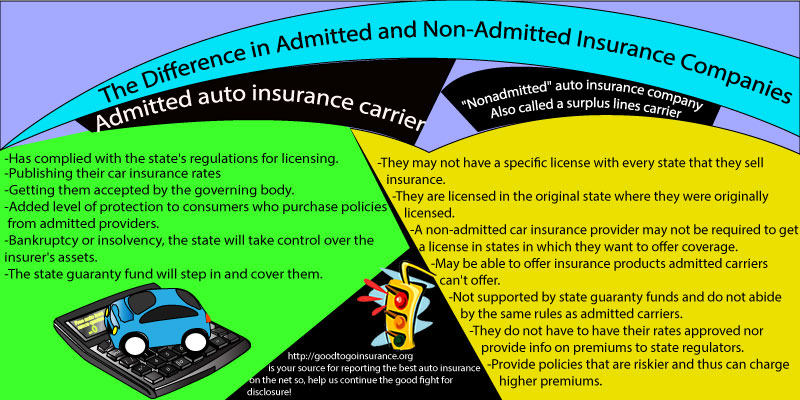

Source: goodtogoinsurance.org

Source: goodtogoinsurance.org

The company is likely not in compliance with the state’s insurance laws and regulations. As it sounds, an admitted insurance company is “admitted” to do business as an insurance company in the state. This allows them to issue policies that admitted insurers cannot, but may also come with less security. Nonadmitted insurance essentially arises when companies/headquarters purchase insurance from insurance companies not licensed in the incorporation/management state. This allows them to set their own rates, which may make their businesses more profitable overall.

Source: campbellriskmanagement.com

Source: campbellriskmanagement.com

They are just not licensed by or. Just because the insurance carrier isn’t licensed in the state, it doesn’t mean that they’re not allowed to operate in that location. Traditionally, commercial insurance was provided by insurance companies licensed to write coverage in the taxpayer’s state(s) of operation. Has the expertise and track record of helping insurance companies. This means they are not obligated to comply with any state insurance regulations.

![let’s talk INSURANCE [ADMITTED vs NONADMITTED] ERIN KELLY let’s talk INSURANCE [ADMITTED vs NONADMITTED] ERIN KELLY](https://i0.wp.com/erinkelly.org/wp-content/uploads/2019/06/Screen-Shot-2019-06-18-at-5.43.41-PM.png?resize=825%2C400&ssl=1) Source: erinkelly.org

Source: erinkelly.org

Most policies are admitted policies. Most policies are admitted policies. However, most states have similar qualifications for both of these asset classes. Nonadmitted insurer — an insurance company not licensed to do business in a certain state or country. However, there’s been a growing trend to place insurance through nonadmitted, i.e., unlicensed, insurance companies, as this allows taxpayers the ability to better control risk management, mitigate insurance costs and price.

Source: elliotwhittier.com

Source: elliotwhittier.com

However, most states have similar qualifications for both of these asset classes. Helping them to comply with the surplus and reserve requirements in their market. Nonadmitted insurance essentially arises when companies/headquarters purchase insurance from insurance companies not licensed in the incorporation/management state. Traditionally, commercial insurance was provided by insurance companies licensed to write coverage in the taxpayer’s state(s) of operation. However, most states have similar qualifications for both of these asset classes.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title nonadmitted insurance companies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.