Nonforfeiture benefit long term care insurance Idea

Home » Trending » Nonforfeiture benefit long term care insurance IdeaYour Nonforfeiture benefit long term care insurance images are available. Nonforfeiture benefit long term care insurance are a topic that is being searched for and liked by netizens now. You can Download the Nonforfeiture benefit long term care insurance files here. Find and Download all royalty-free images.

If you’re looking for nonforfeiture benefit long term care insurance images information related to the nonforfeiture benefit long term care insurance keyword, you have come to the right site. Our site frequently gives you suggestions for refferencing the maximum quality video and image content, please kindly hunt and find more enlightening video content and images that fit your interests.

Nonforfeiture Benefit Long Term Care Insurance. Contingent nonforfeiture is a reduced benefit received if you are unable to afford the premium because it went up beyond the level allowed by the naic (national association of insurance commissioners). The nonforfeiture benefit is designed to ensure that if you lapse your policy (i.e., stop paying premiums) after a specified number of years, you retain some benefits from the policy. Your estate or a designated beneficiary will be entitled to the return of some or all of your premiums if the policy isn’t used during your lifetime. The nonforfeiture benefit included in an offer must conform under the requirements of this section.

Transamerica Long Term Care Insurance Rate Increases From ltcfacts.org

Transamerica Long Term Care Insurance Rate Increases From ltcfacts.org

If insured has developed by insurance benefit an. It is usually equal to the premiums paid in. A nonforfeiture benefit must be offered with long term care insurance policies. And (2) adjusted for inflation based on the consumer price The nonforfeiture provision shall be appropriately captioned; Nonforfeiture is an added option that is included with some group long term care insurance plans.

A nonforfeiture clause is an insurance policy clause stipulating that an insured party can receive full benefits or partial benefits, when the premium can no longer be paid.

For example, you bought a policy with a $150 daily benefit for three years. Non forfeiture in long term care insurance means that you can receive a reduced benefit if you drop the policy. If your policy lapses, this rider will give you access to all the premiums paid if you need long term care on down the road. A nonforfeiture benefit must be offered with long term care insurance policies. What is nonforfeiture benefit for long term care? This clause is most often found in life insurance and long term care insurance and is available for an added expense as a “ rider.”

Source: thebenefitblog.com

Source: thebenefitblog.com

The same benefits (amounts and frequency in effect at the time of lapse but not increased thereafter) will be payable for a qualifying claim, but the lifetime maximum dollars or days of benefits shall be determined as. And (2) adjusted for inflation based on the consumer price A nonforfeiture benefit must be offered with long term care insurance policies. The amount of nonforfeiture benefit depends on how long you have held and paid premiums on the policy. (2) to comply with the requirement to offer a nonforfeiture benefit pursuant to the provisions of rcw 48.83.120:

Source: care4youathome.com

Source: care4youathome.com

For example, you bought a policy with a $150 daily benefit for three years. What is nonforfeiture benefit for long term care? The same benefits (amounts and frequency in effect at the time of lapse but not increased thereafter) will be payable for a qualifying claim, but the lifetime maximum dollars or days of benefits shall be determined as. A nonforfeiture benefit must be offered with long term care insurance policies. The offer of a nonforfeiture benefit may.

Source: pinterest.com

Source: pinterest.com

The nonforfeiture benefit included in an offer must conform under the requirements of this section. A nonforfeiture benefit must be offered with long term care insurance policies. (1) equivalent to at least the accumulated value of all premiums paid by the insured; It is usually equal to the premiums paid in. The nonforfeiture benefit is designed to ensure that if you lapse your policy (i.e., stop paying premiums) after a specified number of years, you retain some benefits from the policy.

Source: slideshare.net

Source: slideshare.net

If insured has developed by insurance benefit an. If a policy lapses due to lack of payment, the nonforfeiture rider allows the insured to receive a portion of the benefits or a partial refund based on the premiums paid before the policy lapsed. If insured has developed by insurance benefit an. The nonforfeiture benefit included in an offer must conform under the requirements of this section. A nonforfeiture (sometimes hyphenated) clause is an insurance policy clause stipulating that an insured party can receive full or partial benefits or a partial refund of premiums after a lapse due.

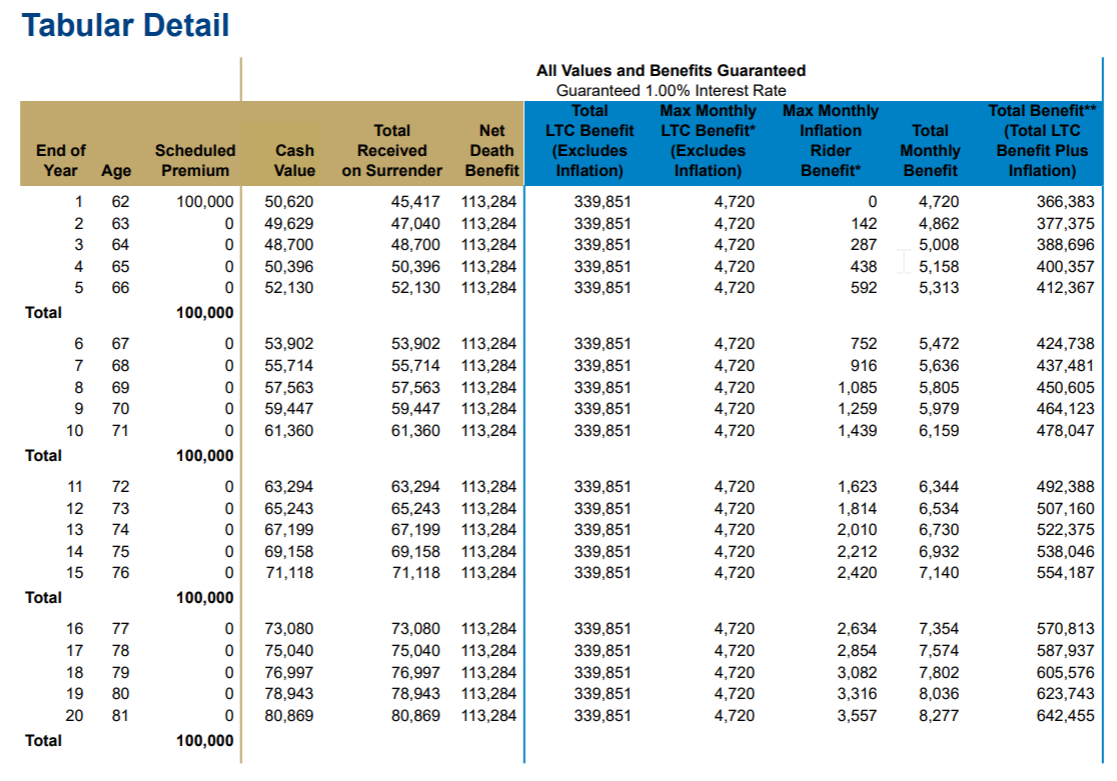

Source: altcp.org

Source: altcp.org

The nonforfeiture benefit is designed to ensure that if you lapse your policy (i.e., stop paying premiums) after a specified number of years, you retain some benefits from the policy. If insured has developed by insurance benefit an. The same benefits (amounts and frequency in effect at the time of lapse but not increased thereafter) will be payable for a qualifying claim, but the lifetime maximum dollars or days of benefits shall be determined as. The nonforfeiture benefit is designed to ensure that if you lapse your policy (i.e., stop paying premiums) after a specified number of years, you retain some benefits from the policy. A nonforfeiture clause is an insurance policy clause stipulating that an insured party can receive full benefits or partial benefits, when the premium can no longer be paid.

Source: in.pinterest.com

Source: in.pinterest.com

The nonforfeiture benefit is designed to ensure that if you lapse your policy (i.e., stop paying premiums) after a specified number of years, you retain some benefits from the policy. A nonforfeiture option that reduces your daily benefit but keeps the full benefit period on your policy until death. If your policy lapses, this rider will give you access to all the premiums paid if you need long term care on down the road. A nonforfeiture benefit must be offered with long term care insurance policies. If insured has developed by insurance benefit an.

Source: walmart.com

Source: walmart.com

For example, you bought a policy with a $150 daily benefit for three years. This clause is most often found in life insurance and long term care insurance and is available for an added expense as a “ rider.” A nonforfeiture option that reduces your daily benefit but keeps the full benefit period on your policy until death. There are currently two common types of nonforfeiture benefits being offered with certain insurance. If insured has developed by insurance benefit an.

Source: pinterest.com

Source: pinterest.com

The same benefits (amounts and frequency in effect at the time of lapse but not increased thereafter) will be payable for a qualifying claim, but the lifetime maximum dollars or days of benefits shall be determined as. If your policy lapses, this rider will give you access to all the premiums paid if you need long term care on down the road. A nonforfeiture benefit must be offered with long term care insurance policies. And (2) adjusted for inflation based on the consumer price A nonforfeiture benefit must be offered with long term care insurance policies.

Source: di-ltc.com

Source: di-ltc.com

A nonforfeiture (sometimes hyphenated) clause is an insurance policy clause stipulating that an insured party can receive full or partial benefits or a partial refund of premiums after a lapse due. The offer of a nonforfeiture benefit may. The nonforfeiture benefit is designed to ensure that if you lapse your policy (i.e., stop paying premiums) after a specified number of years, you retain some benefits from the policy. Nonforfeiture is an added option that is included with some group long term care insurance plans. A nonforfeiture benefit must be offered with long term care insurance policies.

Source: pinterest.com

Source: pinterest.com

The nonforfeiture provision shall be appropriately captioned; A nonforfeiture option that reduces your daily benefit but keeps the full benefit period on your policy until death. If you let the policy lapse, the daily benefit would be reduced to $100 but the benefit period would remain three years. Nonforfeiture is an added option that is included with some group long term care insurance plans. A nonforfeiture benefit must be offered with long term care insurance policies.

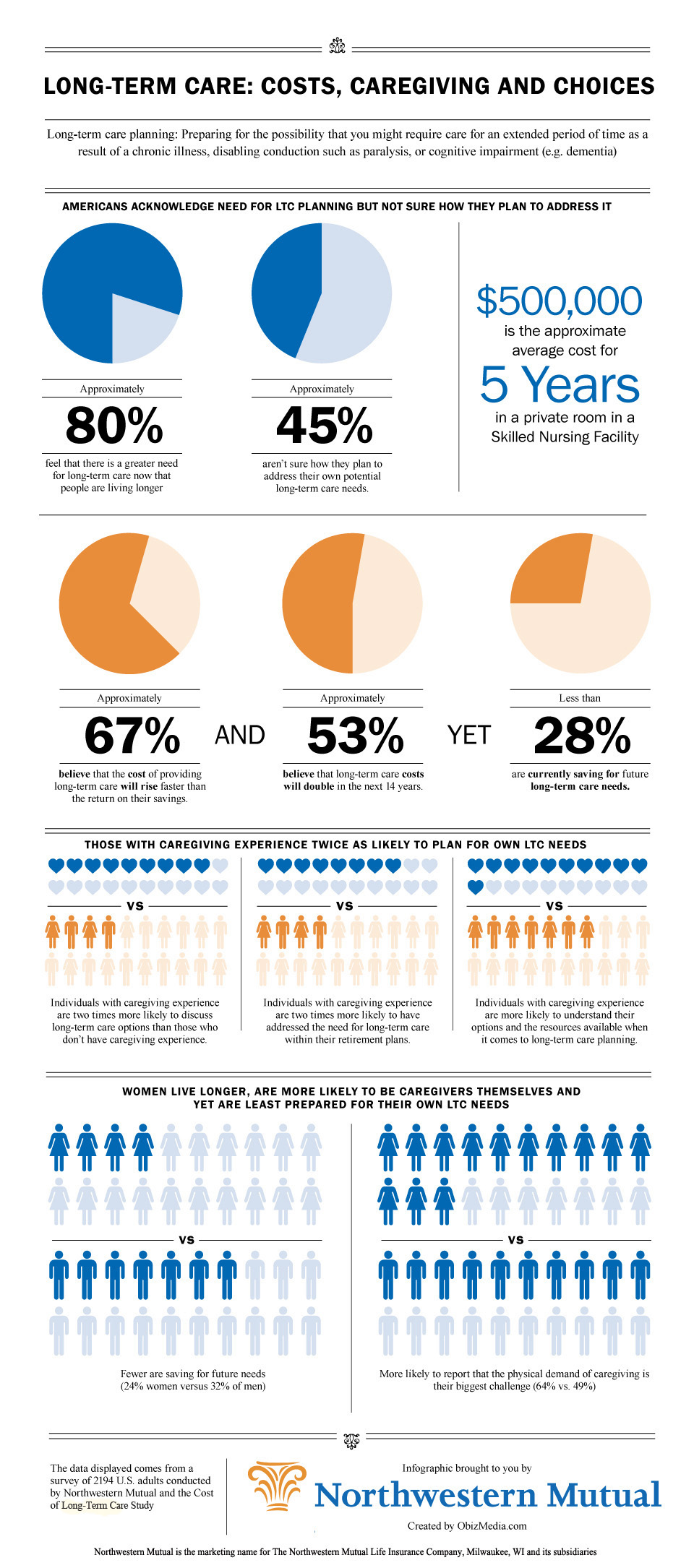

Source: comparelongtermcare.org

Source: comparelongtermcare.org

The offer of a nonforfeiture benefit may. This clause is most often found in life insurance and long term care insurance and is available for an added expense as a “ rider.” The nonforfeiture benefit is designed to ensure that if you lapse your policy (i.e., stop paying premiums) after a specified number of years, you retain some benefits from the policy. For example, you bought a policy with a $150 daily benefit for three years. It is usually equal to the premiums paid in.

Source: pinterest.com

Source: pinterest.com

A nonforfeiture benefit must be offered with long term care insurance policies. A nonforfeiture clause may also become. The nonforfeiture benefit is designed to ensure that if you lapse your policy (i.e., stop paying premiums) after a specified number of years, you retain some benefits from the policy. The nonforfeiture provision shall be appropriately captioned; It is usually equal to the premiums paid in.

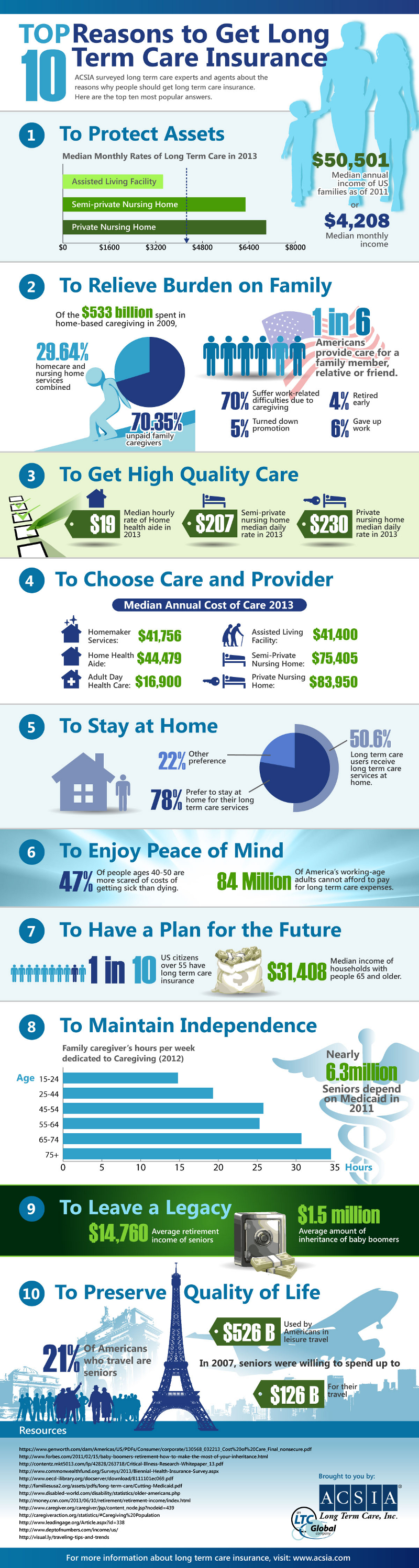

Source: brandongaille.com

Source: brandongaille.com

If your policy lapses, this rider will give you access to all the premiums paid if you need long term care on down the road. The offer of a nonforfeiture benefit may. Nonforefeiture is not to be confused with the included contingent nonforfeiture feature. The nonforfeiture benefit is designed to ensure that if you lapse your policy (i.e., stop paying premiums) after a specified number of years, you retain some benefits from the policy. A nonforfeiture option that reduces your daily benefit but keeps the full benefit period on your policy until death.

Source: cnbc.com

There are currently two common types of nonforfeiture benefits being offered with certain insurance. The nonforfeiture benefit is designed to ensure that if you lapse your policy (i.e., stop paying premiums) after a specified number of years, you retain some benefits from the policy. There are currently two common types of nonforfeiture benefits being offered with certain insurance. Non forfeiture in long term care insurance means that you can receive a reduced benefit if you drop the policy. And (2) adjusted for inflation based on the consumer price

Source: dreamfulfilledinlondon.blogspot.com

Source: dreamfulfilledinlondon.blogspot.com

It is usually equal to the premiums paid in. For example, you bought a policy with a $150 daily benefit for three years. A nonforfeiture option that reduces your daily benefit but keeps the full benefit period on your policy until death. A nonforfeiture clause is an insurance policy clause stipulating that an insured party can receive full benefits or partial benefits, when the premium can no longer be paid. A nonforfeiture (sometimes hyphenated) clause is an insurance policy clause stipulating that an insured party can receive full or partial benefits or a partial refund of premiums after a lapse due.

Source: wsj.com

Source: wsj.com

For example, you bought a policy with a $150 daily benefit for three years. A nonforfeiture benefit must be offered with long term care insurance policies. A nonforfeiture clause is an insurance policy clause stipulating that an insured party can receive full benefits or partial benefits, when the premium can no longer be paid. Nonforefeiture is not to be confused with the included contingent nonforfeiture feature. This clause is most often found in life insurance and long term care insurance and is available for an added expense as a “ rider.”

Source: pinterest.com

Source: pinterest.com

A nonforfeiture benefit must be offered with long term care insurance policies. A nonforfeiture clause may also become. For example, you bought a policy with a $150 daily benefit for three years. The offer of a nonforfeiture benefit may. If your policy lapses, this rider will give you access to all the premiums paid if you need long term care on down the road.

Source: pinterest.com

Source: pinterest.com

A nonforfeiture clause is an insurance policy clause stipulating that an insured party can receive full benefits or partial benefits, when the premium can no longer be paid. A nonforfeiture benefit must be offered with long term care insurance policies. Non forfeiture in long term care insurance means that you can receive a reduced benefit if you drop the policy. If your policy lapses, this rider will give you access to all the premiums paid if you need long term care on down the road. What is nonforfeiture benefit for long term care?

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title nonforfeiture benefit long term care insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.