Nps insurance industry Idea

Home » Trend » Nps insurance industry IdeaYour Nps insurance industry images are ready in this website. Nps insurance industry are a topic that is being searched for and liked by netizens today. You can Get the Nps insurance industry files here. Download all free photos and vectors.

If you’re looking for nps insurance industry images information related to the nps insurance industry interest, you have pay a visit to the right blog. Our website always gives you hints for downloading the maximum quality video and image content, please kindly search and find more enlightening video content and graphics that match your interests.

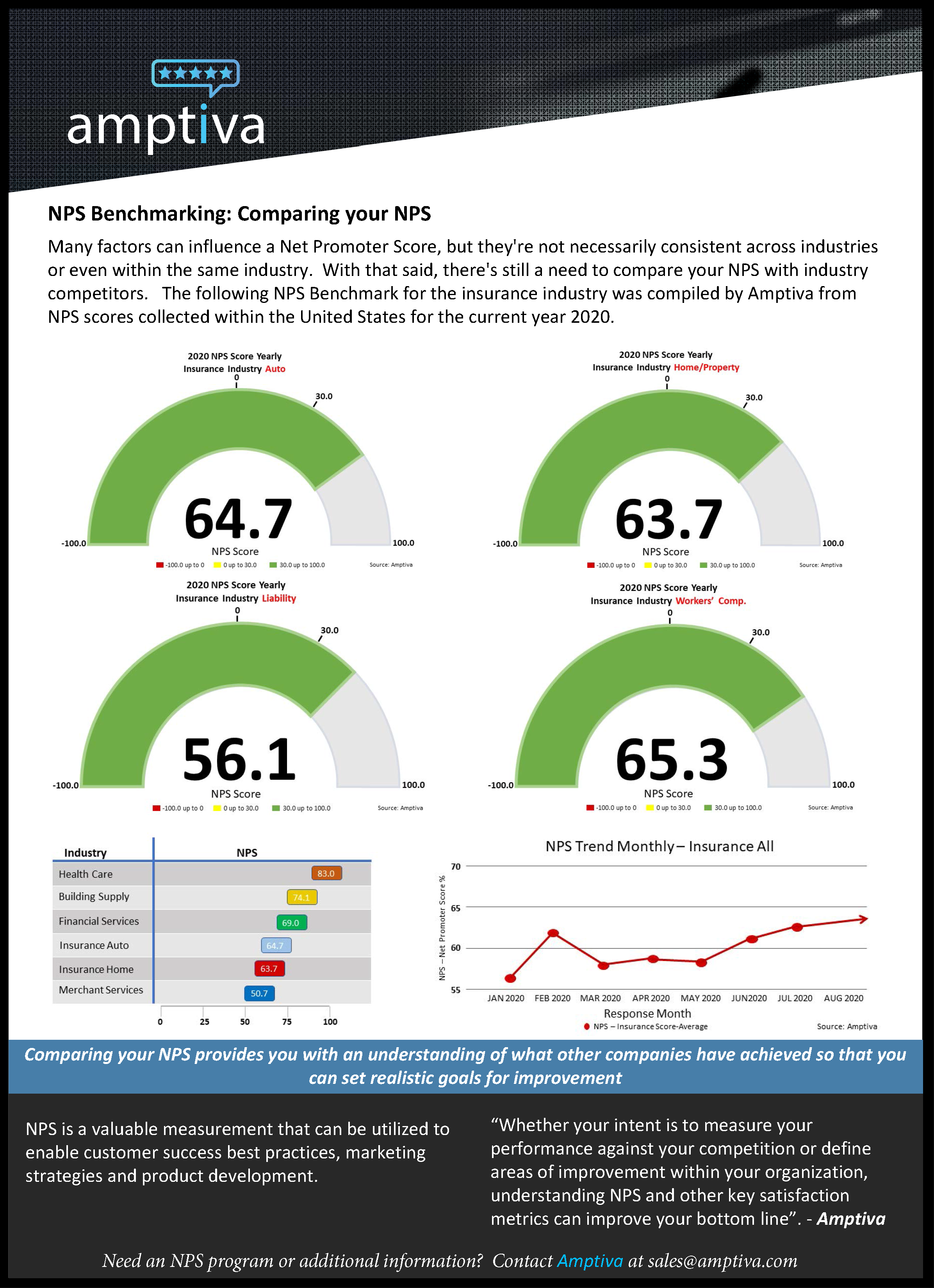

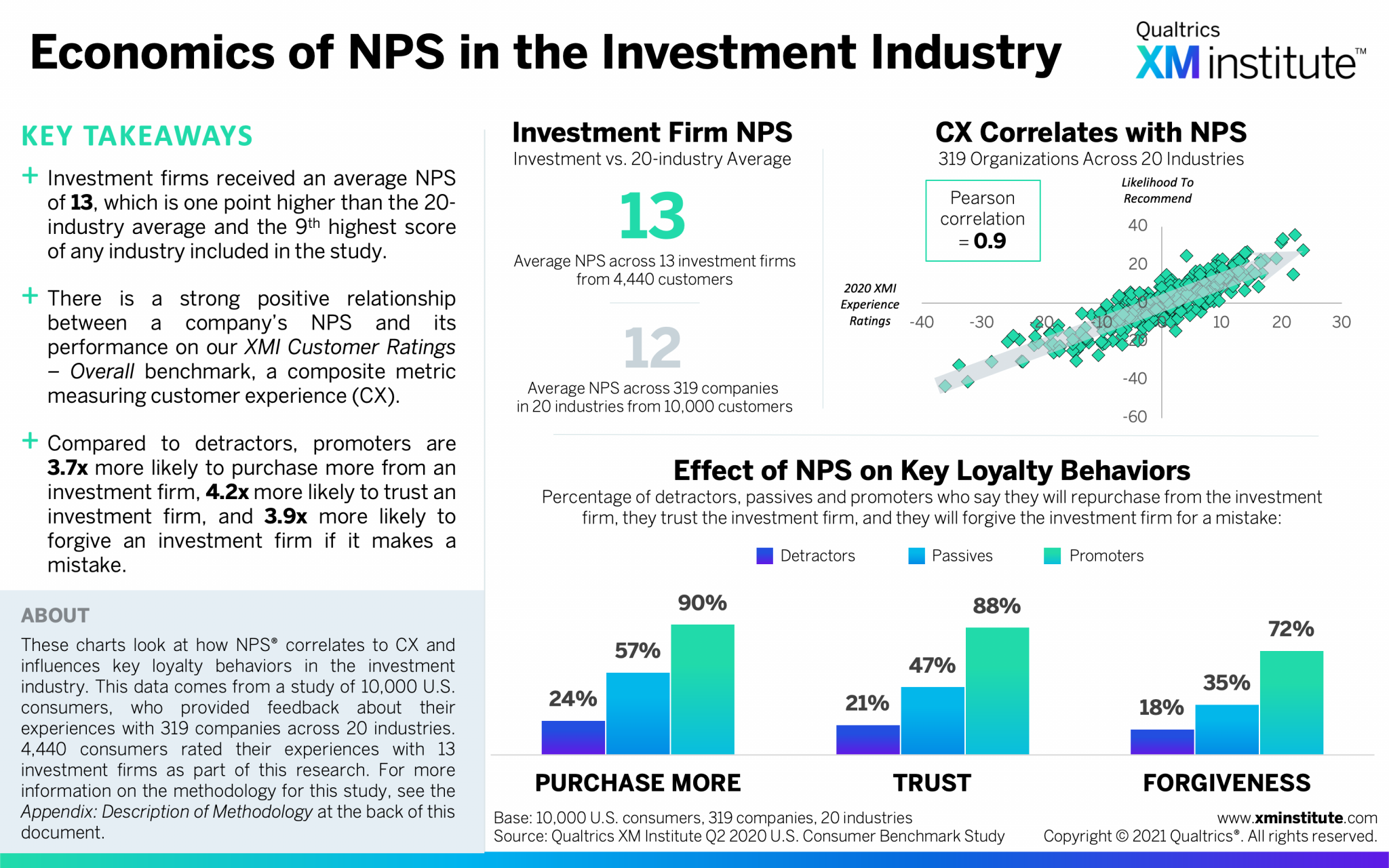

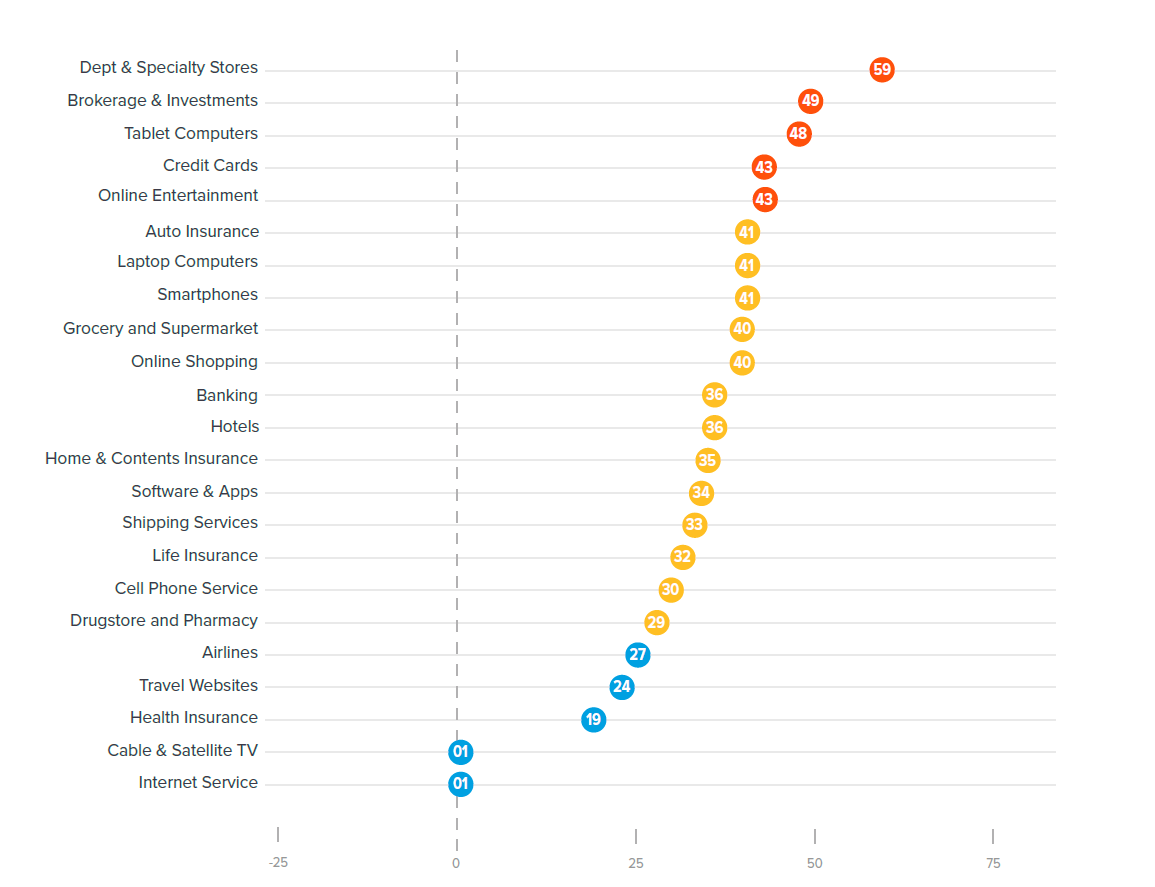

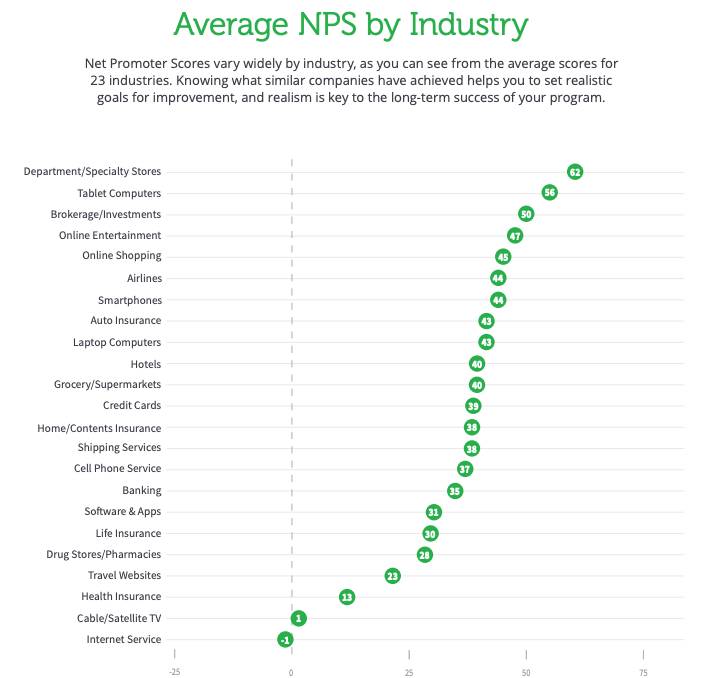

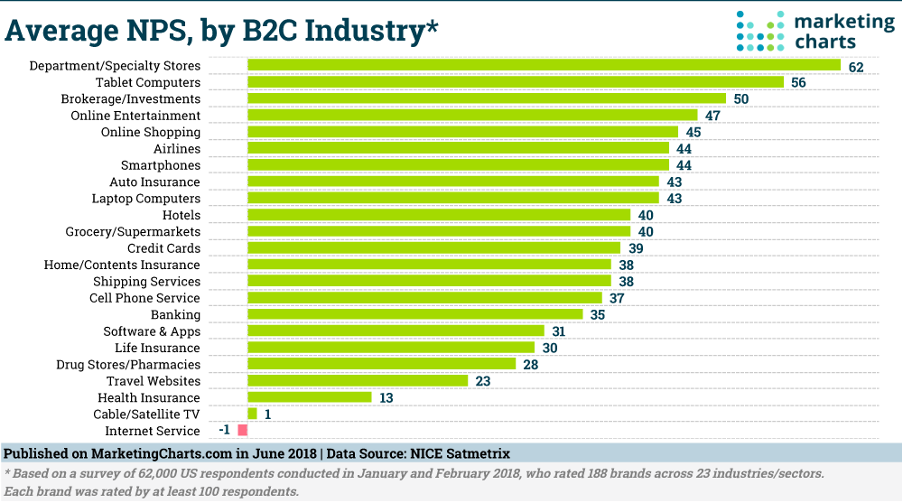

Nps Insurance Industry. The average nps in the auto insurance industry is 44 while the average in the homeowners insurance industry is 42, according to nice satmetrix. In 2021, insurance brokers received a net promoter score (nps) of 34 percent in the united states. The nps scores vary by industry. Nps = % of promoters — % of detractors calculating net promoter score formula the average nps score is 32 based on the ratings from more than 200,000 companies across different industries.

34 Net Promoter Score® Case Studies, includes Links to From genroe.com

34 Net Promoter Score® Case Studies, includes Links to From genroe.com

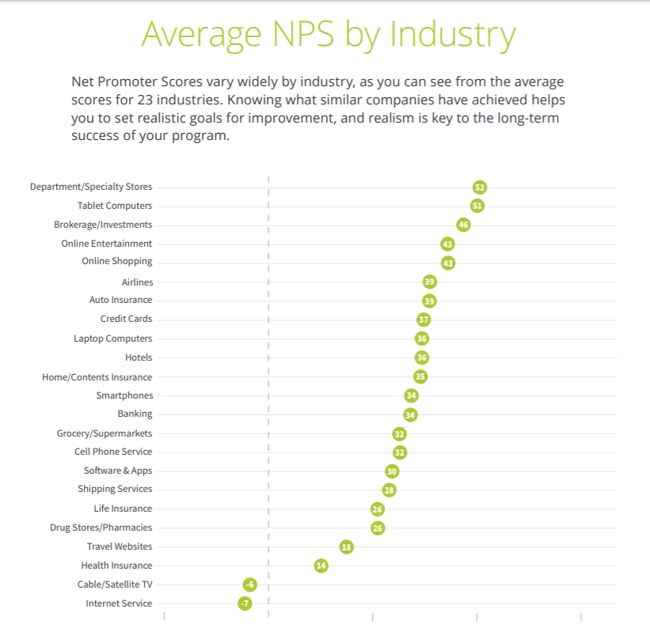

Nps demonstrates policyholder loyalty and measures how likely customers are. How to achieve a better nps as an insurer the key to improving your nps in the insurance industry is much the same as any other: These powerful tools can help you earn the passionate loyalty of your customers while inspiring the energy, enthusiasm and creativity of your employees. On the chart above, you can see the average nps for each industry, as well as their highs (25th percentile) and lows (75th percentile). Net promoter® score (nps) is a client satisfaction and service quality metric based on a single survey question that asks insurance clients how likely they are to recommend your firm to a friend or colleague. Insurance net promoter scores only car and home insurers with at least 150 customer reviews were included in our ranking list, resulting in a ranking of 35 car and 18 homeowners insurance companies.

The only widespread data on nps’s within the insurance industry correlates to p&c direct writers.

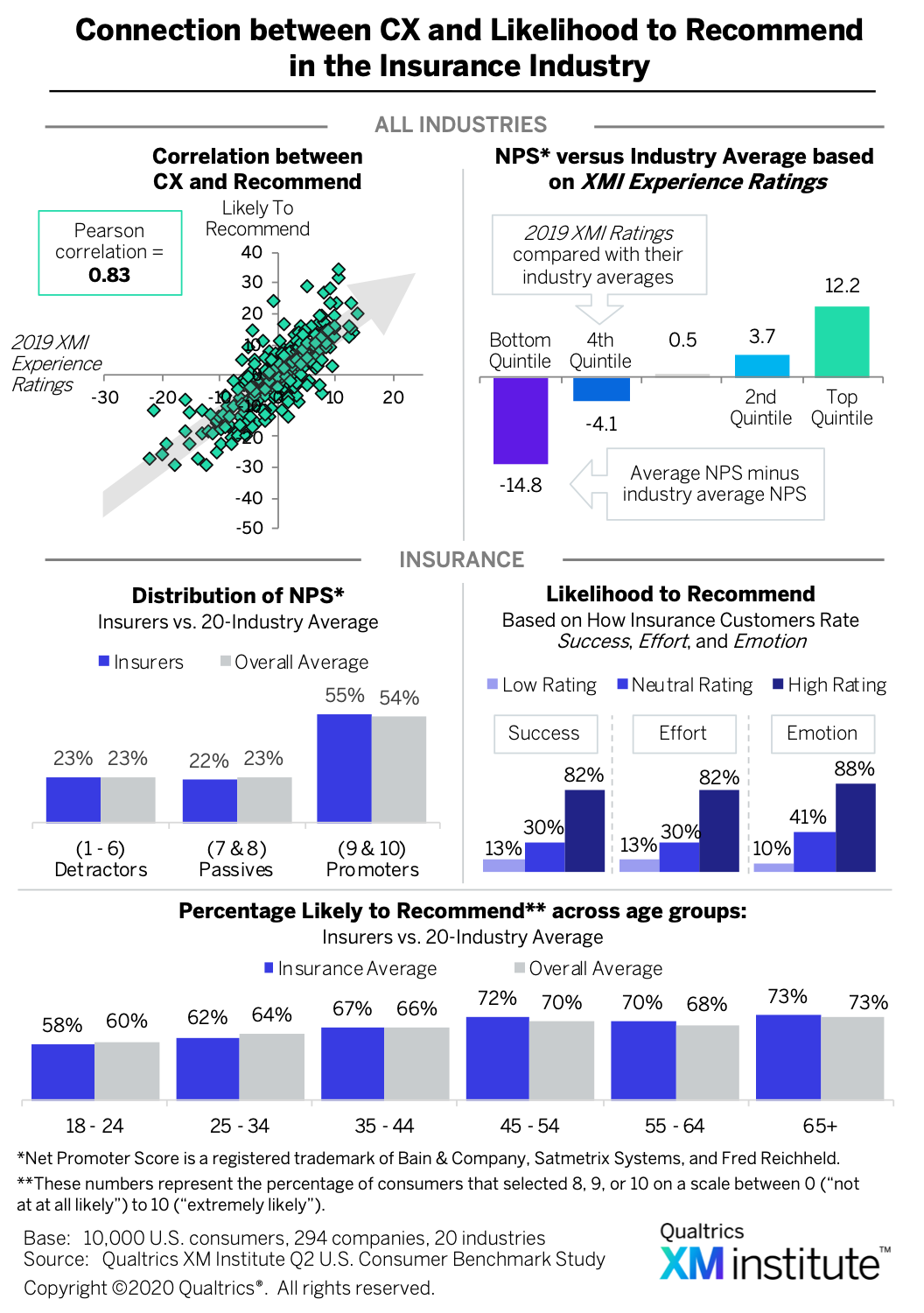

The only widespread data on nps’s within the insurance industry correlates to p&c direct writers. The data in the benchmark comes from xm institute’s q2 2020 consumer benchmark study, which was conducted in may 2020. Whereas, the highest nps® score for credit cards is 68. In the prescribed range, the equity portion will reduce by 2.5% every year starting from the year in which the investors will turn 50 years old. Nps = % of promoters — % of detractors calculating net promoter score formula the average nps score is 32 based on the ratings from more than 200,000 companies across different industries. How to achieve a better nps as an insurer the key to improving your nps in the insurance industry is much the same as any other:

Source: genroe.com

Source: genroe.com

In 2021, insurance brokers received a net promoter score (nps) of 34 percent in the united states. Property and casualty (stock) net promoter score 2022 benchmarks. The 2021 insurance industry nps benchmark is 34%. Nps benchmarking calculator compare your net promoter score against your industry. The data in the benchmark comes from xm institute’s q2 2020 consumer benchmark study, which was conducted in may 2020.

Source: pinterest.com

Source: pinterest.com

Net promoter® score (nps) is a client satisfaction and service quality metric based on a single survey question that asks insurance clients how likely they are to recommend your firm to a friend or colleague. The data in the benchmark comes from xm institute’s q2 2020 consumer benchmark study, which was conducted in may 2020. For example, the lowest nps® score for online entertainment is 57. Look to service leaders across industries. Whereas, the highest nps® score for credit cards is 68.

Source: blog.hubspot.com

Source: blog.hubspot.com

And, interestingly—yet not surprisingly—as a whole, they scored significantly lower than users of rocket referrals which are composed chiefly of independent agencies. The only widespread data on nps’s within the insurance industry correlates to p&c direct writers. If yours is a saas business, you should not compare your nps score with an insurance company’s score. Nps benchmarks by industry explore and compare nps benchmarks for 20 industries. Currently, on equity exposures of the nps scheme a cap between the range of 75% to50% exists.

Source: insurance-prop2.blogspot.com

Source: insurance-prop2.blogspot.com

Here are the detailed results of our 2021 nps benchmark study. Brands are always trying their best to get and stay consistent with a good score. Here are the detailed results of our 2021 nps benchmark study. Nps benchmarks by industry explore and compare nps benchmarks for 20 industries. • usaa, which provides coverage to members of the us military and their families, remains a customer favorite in property and casualty insurance (see figure 4).

Source: blog.hubspot.com

Source: blog.hubspot.com

Nps demonstrates policyholder loyalty and measures how likely customers are to recommend their. If yours is a saas business, you should not compare your nps score with an insurance company’s score. Here are the detailed results of our 2021 nps benchmark study. The leader of the group is the retail industry, with an average nps of 48. Net promoter® score (nps) is a client satisfaction and service quality metric based on a single survey question that asks insurance clients how likely they are to recommend your firm to a friend or colleague.

Source: xminstitute.com

Source: xminstitute.com

Property and casualty (stock) net promoter score 2022 benchmarks. Insurance net promoter scores only car and home insurers with at least 150 customer reviews were included in our ranking list, resulting in a ranking of 35 car and 18 homeowners insurance companies. The 2021 insurance industry nps benchmark is 34%. Nps benchmarking calculator compare your net promoter score against your industry. The most exciting digitization technology making waves in the industry today is the quoting api, which boosts.

Source: insurance-prop2.blogspot.com

Source: insurance-prop2.blogspot.com

Currently, on equity exposures of the nps scheme a cap between the range of 75% to50% exists. Nps demonstrates policyholder loyalty and measures how likely customers are. The chart below shows published nps scores for brands across industries. Each row shows the high, low, and average nps in each industry along with the companies in the benchmark. Low high average auto dealers gm, bmw, honda, cadillac, and 16 more gm, bmw, honda, cadillac, ford, buick, chevrolet, nissan, volkswagen, hyundai, audi, chrysler,

Source: insurance-prop2.blogspot.com

Source: insurance-prop2.blogspot.com

In the prescribed range, the equity portion will reduce by 2.5% every year starting from the year in which the investors will turn 50 years old. Nps demonstrates policyholder loyalty and measures how likely customers are. For government employees, this cap is 50%. Each row shows the high, low, and average nps in each industry along with the companies in the benchmark. Here are the detailed results of our 2021 nps benchmark study.

Source: amptiva.com

Source: amptiva.com

The most exciting digitization technology making waves in the industry today is the quoting api, which boosts. Net promoter® score (nps) is a client satisfaction and service quality metric based on a single survey question that asks insurance clients how likely they are to recommend your firm to a friend or colleague. In the consumer goods sector as a whole, the average net promoter score (nps) is 41 (customergauge study, 2020). Whereas, the highest nps® score for credit cards is 68. These powerful tools can help you earn the passionate loyalty of your customers while inspiring the energy, enthusiasm and creativity of your employees.

Source: qualtrics.com

Source: qualtrics.com

Research on the net promoter score methodology has also shown that companies with a high nps grow faster, retain more customers and are more successful than their peers. Here are the detailed results of our 2021 nps benchmark study. Net promoter® score (nps) is a client satisfaction and service quality metric based on a single survey question that asks insurance clients how likely they are to recommend your firm to a friend or colleague. And, interestingly—yet not surprisingly—as a whole, they scored significantly lower than users of rocket referrals which are composed chiefly of independent agencies. Net promoter® score (nps) is a client satisfaction and service quality metric based on a single survey question that asks insurance clients how likely they are to recommend your firm to a friend or colleague.

Source: bigdata-madesimple.com

Source: bigdata-madesimple.com

If yours is a saas business, you should not compare your nps score with an insurance company’s score. The chart below shows published nps scores for brands across industries. How to achieve a better nps as an insurer the key to improving your nps in the insurance industry is much the same as any other: Currently, on equity exposures of the nps scheme a cap between the range of 75% to50% exists. Low high average auto dealers gm, bmw, honda, cadillac, and 16 more gm, bmw, honda, cadillac, ford, buick, chevrolet, nissan, volkswagen, hyundai, audi, chrysler,

Source: xminstitute.com

Source: xminstitute.com

Nps benchmarks by industry explore and compare nps benchmarks for 20 industries. Net promoter® score (nps) is a client satisfaction and service quality metric based on a single survey question that asks insurance clients how likely they are to recommend your firm to a friend or colleague. The only widespread data on nps’s within the insurance industry correlates to p&c direct writers. Insurance net promoter scores only car and home insurers with at least 150 customer reviews were included in our ranking list, resulting in a ranking of 35 car and 18 homeowners insurance companies. • usaa, which provides coverage to members of the us military and their families, remains a customer favorite in property and casualty insurance (see figure 4).

Source: genroe.com

Source: genroe.com

On the chart above, you can see the average nps for each industry, as well as their highs (25th percentile) and lows (75th percentile). And, interestingly—yet not surprisingly—as a whole, they scored significantly lower than users of rocket referrals which are composed chiefly of independent agencies. Score updated january 11, 2022. In 2021, insurance brokers received a net promoter score (nps) of 34 percent in the united states. Nps benchmarks by industry explore and compare nps benchmarks for 20 industries.

Source: statenational.com

Source: statenational.com

In 2021, auto insurance was the insurance branch with the highest average net promoter score (nps) in the united states. In 2021, auto insurance was the insurance branch with the highest average net promoter score (nps) in the united states. Currently, on equity exposures of the nps scheme a cap between the range of 75% to50% exists. Nps demonstrates policyholder loyalty and measures how likely customers are to recommend their. Insurance net promoter scores only car and home insurers with at least 150 customer reviews were included in our ranking list, resulting in a ranking of 35 car and 18 homeowners insurance companies.

Source: getfeedback.com

Source: getfeedback.com

Nps demonstrates policyholder loyalty and measures how likely customers are to recommend their. Each row shows the high, low, and average nps in each industry along with the companies in the benchmark. Currently, on equity exposures of the nps scheme a cap between the range of 75% to50% exists. In 2021, insurance brokers received a net promoter score (nps) of 34 percent in the united states. Low high average auto dealers gm, bmw, honda, cadillac, and 16 more gm, bmw, honda, cadillac, ford, buick, chevrolet, nissan, volkswagen, hyundai, audi, chrysler,

Source: surveysparrow.com

Source: surveysparrow.com

Currently, on equity exposures of the nps scheme a cap between the range of 75% to50% exists. On the chart above, you can see the average nps for each industry, as well as their highs (25th percentile) and lows (75th percentile). In 2021, auto insurance was the insurance branch with the highest average net promoter score (nps) in the united states. Although the industries present in the benchmark enjoy a high average nps score, the majority have experienced a decline in their numbers over the past year, the most affected being logistics and transportation (from 29 to 3), ecommerce (from 62 to 45), and insurance (from 70 to 57). Property and casualty (stock) net promoter score 2022 benchmarks.

Source: happysignals.com

The leader of the group is the retail industry, with an average nps of 48. On the chart above, you can see the average nps for each industry, as well as their highs (25th percentile) and lows (75th percentile). And, interestingly—yet not surprisingly—as a whole, they scored significantly lower than users of rocket referrals which are composed chiefly of independent agencies. In 2021, insurance brokers received a net promoter score (nps) of 34 percent in the united states. Net promoter® score (nps) is a client satisfaction and service quality metric based on a single survey question that asks insurance clients how likely they are to recommend your firm to a friend or colleague.

![Net Promoter Score Industry Benchmarks SurveySensum [2020] Net Promoter Score Industry Benchmarks SurveySensum [2020]](https://www.surveysensum.com/wp-content/uploads/2020/04/Bird%e2%80%99s-eye-view-of-NPS-benchmarks-across-industries-Revised.jpg) Source: surveysensum.com

Source: surveysensum.com

Nps = % of promoters — % of detractors calculating net promoter score formula the average nps score is 32 based on the ratings from more than 200,000 companies across different industries. The chart below shows published nps scores for brands across industries. And, interestingly—yet not surprisingly—as a whole, they scored significantly lower than users of rocket referrals which are composed chiefly of independent agencies. Download our annual nps benchmarks report here to compare your nps score to others in the consumer goods industry. State farm had the highest net promoter score among life insurers, while the kaiser foundation health plan california was the top health insurer.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title nps insurance industry by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.