Ny paid family leave insurance tax information

Home » Trend » Ny paid family leave insurance tax informationYour Ny paid family leave insurance tax images are ready in this website. Ny paid family leave insurance tax are a topic that is being searched for and liked by netizens today. You can Get the Ny paid family leave insurance tax files here. Find and Download all free images.

If you’re looking for ny paid family leave insurance tax images information linked to the ny paid family leave insurance tax keyword, you have visit the ideal blog. Our website frequently provides you with hints for seeking the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

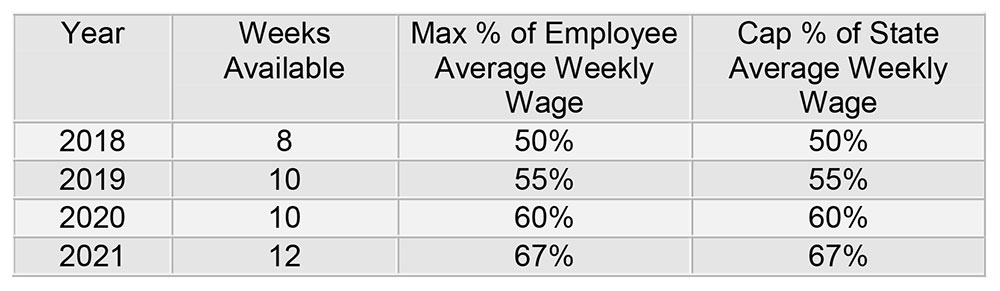

Ny Paid Family Leave Insurance Tax. Bonding with a new child The bill, which requires employers to provide paid family leave benefits to eligible employees as part of the state’s disability insurance program, was signed (21). Each employee’s total remuneration is the amount prior to any deductions, including deductions for the premiums for new york’s paid family leave program. New york designed paid family leave to be easy for employers to implement, with three key tasks:

New York Paid Family Leave Insurance payroll deduction From community.intuit.com

New York Paid Family Leave Insurance payroll deduction From community.intuit.com

The coverage is funded by employee payroll contributions. The maximum weekly benefit for 2022 is $1,068.36. In 2022, employees taking paid family leave will receive 67% of their average weekly wage, up to a cap of 67% of the current statewide average weekly wage of $1,594.57. We have reviewed the new york statute, implementing regulations, and applicable laws,. Paid family leave also provides: State disability needs to be reported separately from the paid family leave in.

The maximum annual contribution for 2022 is $423.71.

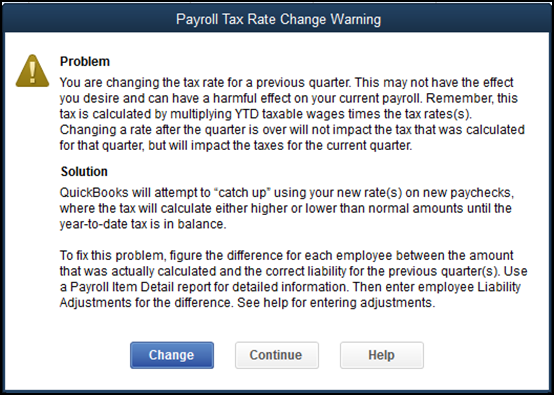

0.511% (maximum of $423.71 per year) none. The new york workers� compensation board announced that the employee contribution rate for paid family leave (pfl) insurance will remain at 0.511% for 2022 up to the current statewide average weekly wage (saww) of $1,594.57, capped at the maximum contribution of $423.71. 2) collect employee contributions to pay for their coverage; Accrued paid sick leave law is enacted the new york department of financial services announced that the 2021 paid family leave (pfl) payroll deduction rate will increase to 0.511% of an employee�s gross wages each pay period, up from 0.270% for 2020. Once a plan has been accepted by the board, the employer(s) must provide administration of these benefits from a licensed nys insurance carrier, or by obtaining the boards approval to administer benefits as a. For employers of 25 or more employees, 60% of medical insurance portion of rate;

Source: pdffiller.com

Source: pdffiller.com

$137,700 (social security wage limit) new jersey 3 : The contribution remains at just over half of one percent of an employee’s gross wages each pay period. In 2022, employees taking paid family leave will receive 67% of their average weekly wage, up to a cap of 67% of the current statewide average weekly wage of $1,594.57. This amount is subject to contributions. New york paid family leave is insurance that may be funded by employees through payroll deductions.

Source: demos.org

Source: demos.org

New york designed paid family leave to be easy for employers to implement, with three key tasks: State disability needs to be reported separately from the paid family leave in. 0.511% (maximum of $423.71 per year) none. Paid family leave also provides: Each employee’s total remuneration is the amount prior to any deductions, including deductions for the premiums for new york’s paid family leave program.

Source: aplos.com

Source: aplos.com

Therefore, a maximum contribution of $7.41 per week per employee in 2021, regardless of age, gender, or For employers of 25 or more employees, 60% of medical insurance portion of rate, otherwise employees pay 100%. We have reviewed the new york statute, implementing regulations, and applicable laws,. The maximum annual contribution for 2022 is $423.71. Most private employers with one or more employees are required to obtain paid family leave insurance.

Source: community.intuit.com

Source: community.intuit.com

The coverage is funded by employee payroll contributions. In 2021, the contribution is 0.511% of an employee’s gross wages each pay period. $137,700 (social security wage limit) new jersey 3 : New employers pay 0.5% of taxable wages if in state plan; For employers of 25 or more employees, 60% of medical insurance portion of rate;

Source: colliganlaw.com

Source: colliganlaw.com

New york family leave insurance ( fli ), or paid family leave ( pfl ), is a state mandated coverage for most private employers. The coverage can be used for wage replacement and job protection to employees who need time off due to: Paid family leave also provides: State disability needs to be reported separately from the paid family leave in. Assist loved ones when a spouse, domestic partner, child or parent is deployed abroad on active military service.

Source: intuitiveaccountant.com

For employers of 25 or more employees, 60% of medical insurance portion of rate, otherwise employees pay 100%. In 2021, the contribution is 0.511% of an employee’s gross wages each pay period. The contribution remains at just over half of one percent of an employee’s gross wages each pay period. Balance of costs over employee contributions necessary to provide benefits. For employers of 25 or more employees, 60% of medical insurance portion of rate, otherwise employees pay 100%.

Source: intuitiveaccountant.com

The contribution remains at just over half of one percent of an employee’s gross wages each pay period. New york designed paid family leave to be easy for employers to implement, with three key tasks: Most private employers with one or more employees are required to obtain paid family leave insurance. The coverage can be used for wage replacement and job protection to employees who need time off due to: Balance of costs over employee contributions necessary to provide benefits.

Source: paychex.com

Source: paychex.com

Voice your opinion this site requires you to register. Each employee’s total remuneration is the amount prior to any deductions, including deductions for the premiums for new york’s paid family leave program. For other employers, experience rates range from 0.1% to 0.75%. Voice your opinion this site requires you to register. Are the premiums paid under the paid family leave program through employee payroll deduction considered remuneration for unemployment insurance purposes?

Source: allstateustax.com

Source: allstateustax.com

The bill, which requires employers to provide paid family leave benefits to eligible employees as part of the state’s disability insurance program, was signed (21). New york state paid family leave is insurance that may be funded by employees through payroll deductions. $142,800 (social security wage limit) new jersey 3 : New york announces 2021 paid family and medical leave insurance deduction and benefit limits; Do you have a tax or a leave amount?

Source: paidfamilyleave.ny.gov

Source: paidfamilyleave.ny.gov

The bill, which requires employers to provide paid family leave benefits to eligible employees as part of the state’s disability insurance program, was signed (21). New employers pay 0.5% of taxable wages if in state plan; Do you have a tax or a leave amount? New york paid family leave premiums will be deducted from each employee’s after tax wages. New york state paid family leave is insurance that may be funded by employees through payroll deductions.

Source: bronskyandcompany.com

Source: bronskyandcompany.com

State disability needs to be reported separately from the paid family leave in. The coverage is funded by employee payroll contributions. State disability needs to be reported separately from the paid family leave in. Balance of costs over employee contributions necessary to provide benefits. The maximum annual contribution is $385.34.

Source: community.intuit.com

Source: community.intuit.com

Bonding with a new child New york state paid family leave is insurance that may be funded by employees through payroll deductions. We have reviewed the new york statute, implementing regulations, and applicable laws,. State disability needs to be reported separately from the paid family leave in. New york paid family leave is insurance that may be funded by employees through payroll deductions.

Source: gtm.com

Source: gtm.com

New york paid family leave is insurance that may be funded by employees through payroll deductions. This amount is subject to contributions. New york family leave insurance ( fli ), or paid family leave ( pfl ), is a state mandated coverage for most private employers. The coverage can be used for wage replacement and job protection to employees who need time off due to: New york designed paid family leave to be easy for employers to implement, with three key tasks:

Source: aplos.com

Source: aplos.com

We have reviewed the new york statute, implementing regulations, and applicable laws,. For other employers, experience rates range from 0.1% to 0.75%. State disability needs to be reported separately from the paid family leave in. Paid family leave also provides: The maximum weekly benefit for 2022 is $1,068.36.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

We have reviewed the new york statute, implementing regulations, and applicable laws,. For other employers, experience rates range from 0.1% to 0.75%. New york paid family leave premiums will be deducted from each employee’s after tax wages. For employers of 25 or more employees, 60% of medical insurance portion of rate, otherwise employees pay 100%. Please visit the state paid family leave website for a list of.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

New york paid family leave is insurance that may be funded by employees through payroll deductions. The bill, which requires employers to provide paid family leave benefits to eligible employees as part of the state’s disability insurance program, was signed (21). Bonding with a new child The coverage can be used for wage replacement and job protection to employees who need time off due to: The maximum annual contribution for 2022 is $423.71.

Source: gop-waysandmeans.house.gov

Source: gop-waysandmeans.house.gov

The state partners with a vendor carrier, new york state insurance company, to administer dbl and paid family leave benefits. Are the premiums paid under the paid family leave program through employee payroll deduction considered remuneration for unemployment insurance purposes? $137,700 (social security wage limit) new jersey 3 : Assist loved ones when a spouse, domestic partner, child or parent is deployed abroad on active military service. The new york workers� compensation board announced that the employee contribution rate for paid family leave (pfl) insurance will remain at 0.511% for 2022 up to the current statewide average weekly wage (saww) of $1,594.57, capped at the maximum contribution of $423.71.

Source: camlife.com

Source: camlife.com

New york state paid family leave is insurance that may be funded by employees through payroll deductions. New york paid family leave premiums will be deducted from each employee’s after tax wages. Bonding with a new child Paid family leave also provides: New york designed paid family leave to be easy for employers to implement, with three key tasks:

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title ny paid family leave insurance tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.