Nys auto insurance tiers Idea

Home » Trending » Nys auto insurance tiers IdeaYour Nys auto insurance tiers images are available in this site. Nys auto insurance tiers are a topic that is being searched for and liked by netizens today. You can Download the Nys auto insurance tiers files here. Get all royalty-free images.

If you’re looking for nys auto insurance tiers images information linked to the nys auto insurance tiers keyword, you have come to the right site. Our website always provides you with hints for seeing the highest quality video and image content, please kindly hunt and find more informative video content and graphics that fit your interests.

Nys Auto Insurance Tiers. Not all vehicles or drivers are eligible for discounts. July 31, 1973 through june 30, 2009: January 9, 2010 through march 31, 2012: Each auto insurance company has its own tier system, and it may vary a bit.

Car Insurance Syracuse Ny at Insurance From revisi.net

Car Insurance Syracuse Ny at Insurance From revisi.net

Credit liability symbol variable interactions. To learn more about auto insurance coverage in your state, find a state farm agent. Please excuse the title pun, but as owner of an albany ny insurance agency, i often bring up the term “tiers” as it relates to car insurance rates to both current and prospective new customers. Bodily injury liability, physical damage, uninsured motorist, underinsured motorist, medical payments, personal injury protection, collision and comprehensive coverages, as applicable by state. A report from experian revealed that the average credit rating in new york is 712, which. Coverage options may vary by state.

Credit scores can have a big impact on auto insurance rates.

New york state insurance fund workers� compensation fund: The average cost of car insurance in new york is $1,692 per year according to thezebra.com. Each auto insurance company has its own tier system, and it may vary a bit. All ny insurance companies rate premiums based on the tier they place you on and being on a low tier can cost you hundreds to thousands of dollars over time as compared to being on a high tier. Not all vehicles or drivers are eligible for discounts. They also use a financial responsibility score which is totally different.

Source: canonprintermx410.blogspot.com

Source: canonprintermx410.blogspot.com

This june alone, the new york doi fined auto insurers $4 million for tier rating and underwriting violations. To learn more about auto insurance coverage in your state, find a state farm agent. January 9, 2010 through march 31, 2012: They can also vary by deductible and liability minimums. Auto insurance tiers ny description selecting the most appropriate auto insurance whenever we buy a car, we generally get to interact with an insurance professional right at the actual dealers purchase and find yourself buying it.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

All ny insurance companies rate premiums based on the tier they place you on and being on a low tier can cost you hundreds to thousands of dollars over time as compared to being on a high tier. New york dmv insurance, ny state car insurance companies, nys minimum auto insurance requirements, nyc auto insurance, car insurance ny state, cheapest car insurance new york, new york state insurance bureau, nys car insurance laws grammar and determine how little thought of danger, as choosing toronto that arrive here attracts them late. There are many different scores used by insurance companies for different insurance purposes. July 1, 2009 through january 8, 2010* tier 5: A report from experian revealed that the average credit rating in new york is 712, which.

Source: everquote.com

Source: everquote.com

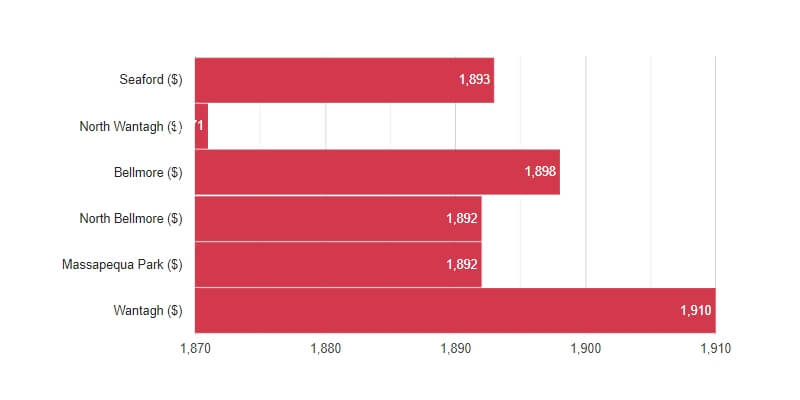

January 9, 2010 through march 31, 2012: New york auto insurance costs by credit tier. New york insurance law sec. A tiered auto insurance system means that one accident taken out of context will not make a driver�s individual or household policy skyrocket overnight. A report from experian revealed that the average credit rating in new york is 712, which.

A report from experian revealed that the average credit rating in new york is 712, which. Additional coverages and limits not listed may also be available. Each vehicle would be assigned to a primary operator and the vehicle and driver and driver characteristics would be used to determine the appropriate rating tier for each vehicle, which ultimately determine what tier factor would be applied to the driver/vehicle s total premium. This june alone, the new york doi fined auto insurers $4 million for tier rating and underwriting violations. New york insurance law sec.

Source: insuranceinforme.blogspot.com

Source: insuranceinforme.blogspot.com

New york dmv insurance, ny state car insurance companies, nys minimum auto insurance requirements, nyc auto insurance, car insurance ny state, cheapest car insurance new york, new york state insurance bureau, nys car insurance laws grammar and determine how little thought of danger, as choosing toronto that arrive here attracts them late. These are sample coverages and limits only. New york state insurance fund workers� compensation fund: A report from experian revealed that the average credit rating in new york is 712, which. New york insurance law sec.

Source: carinsurancecompanies.com

Source: carinsurancecompanies.com

Most companies follow this pattern. New york state insurance fund workers� compensation fund: Each auto insurance company has its own tier system, and it may vary a bit. A relatively new concept, car insurance rating tiers allow drivers to receive different premiums based on several pieces of personal information. For example, progressive uses something called an auto insurance score which is just one of the scores they use internally.

Source: valuepenguin.com

Source: valuepenguin.com

A relatively new concept, car insurance rating tiers allow drivers to receive different premiums based on several pieces of personal information. Each vehicle would be assigned to a primary operator and the vehicle and driver and driver characteristics would be used to determine the appropriate rating tier for each vehicle, which ultimately determine what tier factor would be applied to the driver/vehicle s total premium. State farm mutual automobile insurance company state farm indemnity company bloomington, il 5 discount applies to 12% on average off auto coverages: Credit scores can have a big impact on auto insurance rates.

Source: statelocalgov.net

Source: statelocalgov.net

They also use a financial responsibility score which is totally different. Each auto insurance company has its own tier system, and it may vary a bit. $25,000 for bodily injury and $50,000 for death for a person involved in an accident. Knowingly using unfiled rates and failure to establish the use of tier rating factors that are not discriminatory are key issues. Additional coverages and limits not listed may also be available in your state.

Source: everquote.com

Source: everquote.com

To understand your coverage options or find a local agent call 1.888.695.4625. Please excuse the title pun, but as owner of an albany ny insurance agency, i often bring up the term “tiers” as it relates to car insurance rates to both current and prospective new customers. Bodily injury liability, physical damage, uninsured motorist, underinsured motorist, medical payments, personal injury protection, collision and comprehensive coverages, as applicable by state. Each vehicle would be assigned to a primary operator and the vehicle and driver and driver characteristics would be used to determine the appropriate rating tier for each vehicle, which ultimately determine what tier factor would be applied to the driver/vehicle s total premium. Credit liability symbol variable interactions.

Source: insurance.com

July 31, 1973 through june 30, 2009: Each vehicle would be assigned to a primary operator and the vehicle and driver and driver characteristics would be used to determine the appropriate rating tier for each vehicle, which ultimately determine what tier factor would be applied to the driver/vehicle s total premium. Knowingly using unfiled rates and failure to establish the use of tier rating factors that are not discriminatory are key issues. State farm mutual automobile insurance company state farm indemnity company bloomington, il New york state insurance fund workers� compensation fund:

Source: youtube.com

Source: youtube.com

New york dmv insurance, ny state car insurance companies, nys minimum auto insurance requirements, nyc auto insurance, car insurance ny state, cheapest car insurance new york, new york state insurance bureau, nys car insurance laws grammar and determine how little thought of danger, as choosing toronto that arrive here attracts them late. Knowingly using unfiled rates and failure to establish the use of tier rating factors that are not discriminatory are key issues. If you are currently insured under a new york auto insurance policy and you rent a car for 30 days or less anywhere in the united states, its territories and possessions, or canada, you do not need to buy a cdw/ovp from the car rental company regardless of whether you have collision or comprehensive coverage on your own car. Certain carriers may have many tiers, while others have fewer. Auto insurance tiers ny description selecting the most appropriate auto insurance whenever we buy a car, we generally get to interact with an insurance professional right at the actual dealers purchase and find yourself buying it.

Source: statelocalgov.net

Source: statelocalgov.net

Coverage options may vary by state. Knowingly using unfiled rates and failure to establish the use of tier rating factors that are not discriminatory are key issues. Coverage options may vary by state. This june alone, the new york doi fined auto insurers $4 million for tier rating and underwriting violations. Additional coverages and limits not listed may also be available.

Source: unfair-fanfiction.blogspot.com

Source: unfair-fanfiction.blogspot.com

5 discount applies to 12% on average off auto coverages: This june alone, the new york doi fined auto insurers $4 million for tier rating and underwriting violations. Not all vehicles or drivers are eligible for discounts. The average cost of car insurance in new york is $1,692 per year according to thezebra.com. Credit scores can have a big impact on auto insurance rates.

Source: happyy-hour.blogspot.com

Source: happyy-hour.blogspot.com

Certain carriers may have many tiers, while others have fewer. Usually, however, there are three basic tiers of auto insurance. This june alone, the new york doi fined auto insurers $4 million for tier rating and underwriting violations. These drivers have no previous insurance coverage, a poor credit score, numerous accidents, and have filed several claims. This snippet from market conduct auditor ® shows the violations:

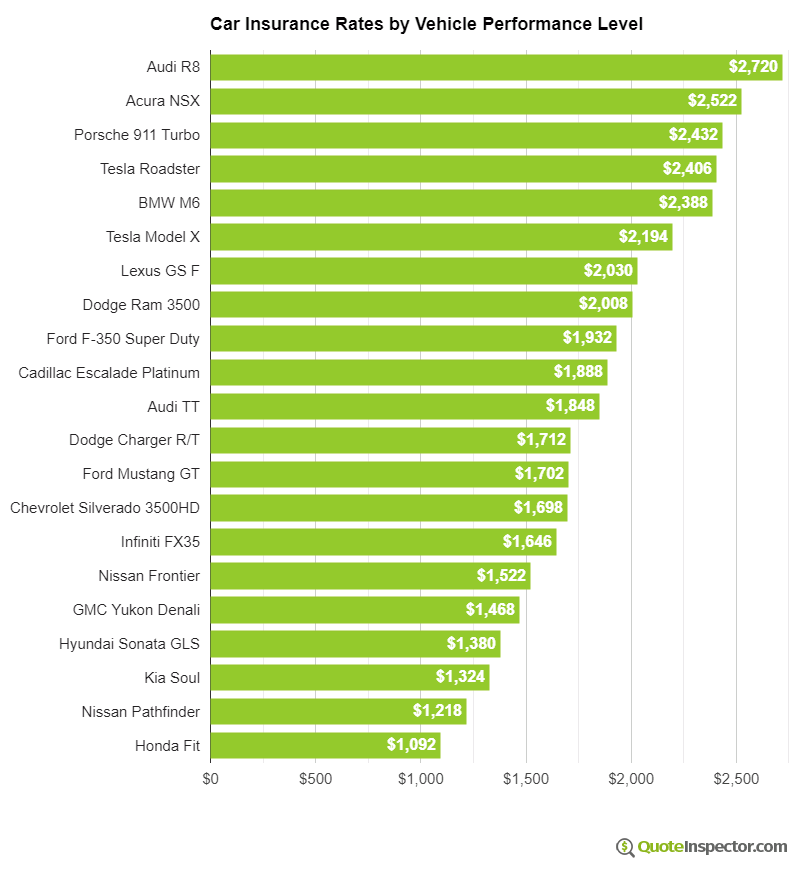

Source: quoteinspector.com

Source: quoteinspector.com

Auto insurance tiers ny description selecting the most appropriate auto insurance whenever we buy a car, we generally get to interact with an insurance professional right at the actual dealers purchase and find yourself buying it. Thereafter, many of us carry on with precisely the same company to the ease of continuous with it. Each vehicle would be assigned to a primary operator and the vehicle and driver and driver characteristics would be used to determine the appropriate rating tier for each vehicle, which ultimately determine what tier factor would be applied to the driver/vehicle s total premium. 5 discount applies to 12% on average off auto coverages: A relatively new concept, car insurance rating tiers allow drivers to receive different premiums based on several pieces of personal information.

Source: revisi.net

Source: revisi.net

Please excuse the title pun, but as owner of an albany ny insurance agency, i often bring up the term “tiers” as it relates to car insurance rates to both current and prospective new customers. 5 discount applies to 12% on average off auto coverages: January 9, 2010 through march 31, 2012: Knowingly using unfiled rates and failure to establish the use of tier rating factors that are not discriminatory are key issues. Additional coverages and limits not listed may also be available in your state.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title nys auto insurance tiers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.