Oh business insurance Idea

Home » Trending » Oh business insurance IdeaYour Oh business insurance images are available. Oh business insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Oh business insurance files here. Download all royalty-free vectors.

If you’re searching for oh business insurance images information related to the oh business insurance keyword, you have come to the ideal site. Our site always gives you hints for viewing the highest quality video and picture content, please kindly surf and find more enlightening video content and graphics that fit your interests.

Oh Business Insurance. You can also check for additional requirements at the ohio department of job & family services. We provide quality personal and business insurance services for individuals, families, and businesses throughout ohio. General liability insurance , which helps cover property damages or physical injury to other people. If you are getting employees for your business, make sure to report it to the ohio new hire reporting center.

Ohio Mutual Insurance Group Joins NICB National From nicb.org

Ohio Mutual Insurance Group Joins NICB National From nicb.org

It is designed to protect a business against a variety of situations by combining. Business insurance provided by risksource. Broad street, suite f columbus, oh 43213 The first step in finding the right insurance coverage for your company is to know what risk challenges you face. Headquartered in cleveland, ohio, we help local businesses and families to best manage risks in their lives. Cincinnati, ohio business insurance the agency represents 15 competitive insurance companies who can provide insurance coverages, special programs, claims and safety services to meet the needs of any national company with operations throughout the u.s.

We also look at other exposures your business.

Ohio law requires every business with employees to provide workers’ compensation insurance purchased through a state agency. You may have additional requirements for insurance such as workers compensation insurance, before you can operate. Ohio law requires every business with employees to provide workers’ compensation insurance purchased through a state agency. The first step in finding the right insurance coverage for your company is to know what risk challenges you face. Ohio requires any business needing coverage to get it directly through the state. Whether you own a business, drive a car, ride a motorcycle, rent an apartment, own a home (or multiple homes), we’ll not only protect what you have, but we’ll also help you and your business thrive.

Source: bleilerinsurance.com

Source: bleilerinsurance.com

Businesses in ohio are required to have workers� comp insurance if they have one or more employees. At central ohio insurance services, we pride ourselves in evaluating your business insurance needs in pickerington, ohio. Ohio commercial auto insurance requirements. Broad street, suite f columbus, oh 43213 Our ohio business insurance coverage includes business owner’s policy (bop) and homehq sm.

Source: businessjournaldaily.com

Source: businessjournaldaily.com

Our innovative process delves in to every facet of your business, how you operate, your goals, and what keeps you up at night—because you’re more than just a quick transaction to us. Learn more about workers’ compensation in ohio. Ohio commercial auto insurance requirements. Health insurance for small business owners, health insurance options in ohio, small company health plans, cigna small business health insurance, ohio group health insurance, small business health insurance cost, best health insurance for small business, best. Workers’ compensation coverage , which helps cover medical bills and lost wages for employees who get injured on the job.

Source: subiness.blogspot.com

Source: subiness.blogspot.com

At premier insurance associates inc., we pride ourselves in evaluating your business insurance needs in cincinnati, ohio. Headquartered in cleveland, ohio, we help local businesses and families to best manage risks in their lives. Our brokerage specializes in property & casualty insurance. Commercial liability insurance (also called business liability insurance and commercial general liability insurance) protects your ohio business from financial loss resulting from claims of injury or damage cause to others by you or your employees. Business insurance provided by risksource.

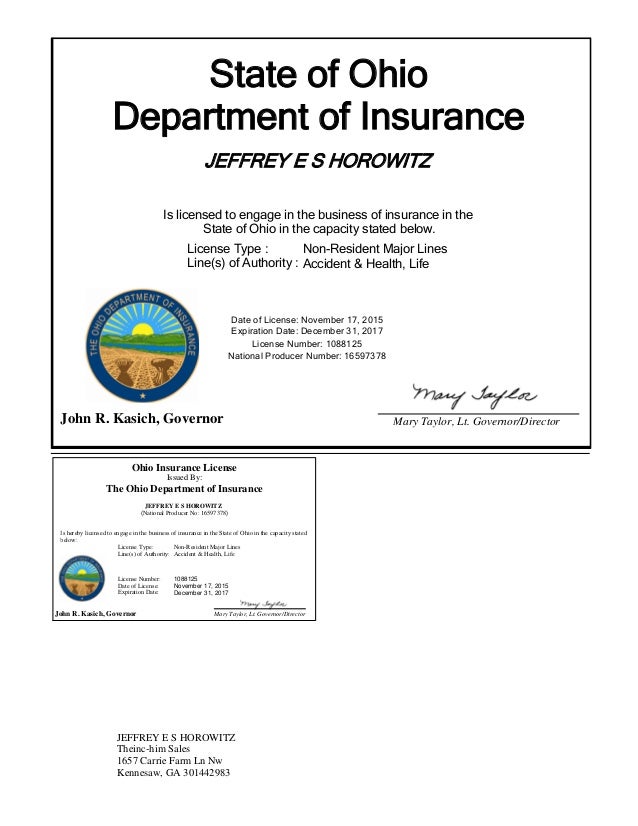

Source: slideshare.net

Source: slideshare.net

A business owner’s policy is often referred to as a bop. It is designed to protect a business against a variety of situations by combining. Errors and omissions liability insurance protects any business that gives advice, makes educated recommendations, designs solutions or represents the needs of others. Headquartered in cleveland, ohio, we help local businesses and families to best manage risks in their lives. Some policies are required to carry higher limits based on the types of vehicles they insure.

Source: kannelinsurance.com

Source: kannelinsurance.com

Learn more about workers’ compensation in ohio. Businesses in ohio are required to have workers� comp insurance if they have one or more employees. We take the time to find out the different challenges your industry may have for insurance concerns and tailor a package that fits your risks. We provide quality personal and business insurance services for individuals, families, and businesses throughout ohio. A business owner’s policy is often referred to as a bop.

Source: nicb.org

Source: nicb.org

We provide quality personal and business insurance services for individuals, families, and businesses throughout ohio. If you are getting employees for your business, make sure to report it to the ohio new hire reporting center. Businesses in ohio are required to have workers� comp insurance if they have one or more employees. You can also check for additional requirements at the ohio department of job & family services. Ohio state law requires all commercial auto policies to have a minimum liability limit of $25,000 per person, $50,000 per accident for bodily injury and $25,000 for property damage (i.e.

Source: pinterest.com

Source: pinterest.com

Our innovative process delves in to every facet of your business, how you operate, your goals, and what keeps you up at night—because you’re more than just a quick transaction to us. Business auto life home health renter disability commercial auto long term care annuity. Our brokerage specializes in property & casualty insurance. Errors and omissions liability insurance protects any business that gives advice, makes educated recommendations, designs solutions or represents the needs of others. Ohio law requires every business with employees to provide workers’ compensation insurance purchased through a state agency.

Source: qbusini.blogspot.com

Source: qbusini.blogspot.com

Ohio law requires every business with employees to provide workers’ compensation insurance purchased through a state agency. Our ohio business insurance coverage includes business owner’s policy (bop) and homehq sm. Learn more about workers’ compensation in ohio. Our brokerage specializes in property & casualty insurance. Our innovative process delves in to every facet of your business, how you operate, your goals, and what keeps you up at night—because you’re more than just a quick transaction to us.

Source: pitoninsurance.com

Source: pitoninsurance.com

A business owner’s policy is often referred to as a bop. We also look at other exposures your business. It also provides disability benefits for injured ohio workers. Learn more about our coverage options to find a policy suited for your business: We take the time to find out the different challenges your industry may have for insurance concerns and tailor a package that fits your risks.

Source: slideshare.net

Source: slideshare.net

Ohio requires any business needing coverage to get it directly through the state. You may have additional requirements for insurance such as workers compensation insurance, before you can operate. Ohio law requires every business with employees to provide workers’ compensation insurance purchased through a state agency. Ohio commercial auto insurance requirements. You can also check for additional requirements at the ohio department of job & family services.

Source: slideshare.net

Source: slideshare.net

The england insurance agency is an independent insurance agency located in pickerington, ohio. Businesses in ohio are required to have workers� comp insurance if they have one or more employees. The annual report of ohio health insurance business is an annual health insurance report required by the ohio department of insurance. Ohio law requires every business with employees to provide workers’ compensation insurance purchased through a state agency. We also look at other exposures your business.

Source: connect2local.com

Source: connect2local.com

At central ohio insurance services, we pride ourselves in evaluating your business insurance needs in pickerington, ohio. If you are getting employees for your business, make sure to report it to the ohio new hire reporting center. Business insurance in ohio typically comes in a package that could include the following coverage: Whether you own a business, drive a car, ride a motorcycle, rent an apartment, own a home (or multiple homes), we’ll not only protect what you have, but we’ll also help you and your business thrive. We take the time to find out the different challenges your industry may have for insurance concerns and tailor a package that fits your risks.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Ohio requires any business needing coverage to get it directly through the state. We take the time to find out the different challenges your industry may have for insurance concerns and tailor a package that fits your risks. It also provides disability benefits for injured ohio workers. Headquartered in cleveland, ohio, we help local businesses and families to best manage risks in their lives. It is designed to protect a business against a variety of situations by combining.

Source: slideshare.net

Source: slideshare.net

It also provides disability benefits for injured ohio workers. Learn more about workers’ compensation in ohio. We provide quality personal and business insurance services for individuals, families, and businesses throughout ohio. Our ohio business insurance coverage includes business owner’s policy (bop) and homehq sm. The annual report of ohio health insurance business is an annual health insurance report required by the ohio department of insurance.

Source: citadelinsuranceassociates.com

Source: citadelinsuranceassociates.com

If you are getting employees for your business, make sure to report it to the ohio new hire reporting center. Our brokerage specializes in property & casualty insurance. Ohio law requires every business with employees to provide workers’ compensation insurance purchased through a state agency. Commercial liability insurance (also called business liability insurance and commercial general liability insurance) protects your ohio business from financial loss resulting from claims of injury or damage cause to others by you or your employees. You may have additional requirements for insurance such as workers compensation insurance, before you can operate.

Source: slideshare.net

Source: slideshare.net

Explore the business services offered at first insurance group in ohio including business insurance solutions, risk management, employee benefits and more. You can also check for additional requirements at the ohio department of job & family services. We provide quality personal and business insurance services for individuals, families, and businesses throughout ohio. Business auto life home health renter disability commercial auto long term care annuity. At premier insurance associates inc., we pride ourselves in evaluating your business insurance needs in cincinnati, ohio.

Source: flinsco.com

Source: flinsco.com

Ohio state law requires all commercial auto policies to have a minimum liability limit of $25,000 per person, $50,000 per accident for bodily injury and $25,000 for property damage (i.e. It is designed to protect a business against a variety of situations by combining. Ohio requires any business needing coverage to get it directly through the state. At central ohio insurance services, we pride ourselves in evaluating your business insurance needs in pickerington, ohio. We provide quality personal and business insurance services for individuals, families, and businesses throughout ohio.

Source: haudenschildagency.com

Source: haudenschildagency.com

We take the time to find out the different challenges your industry may have for insurance concerns and tailor a package that fits your risks. Some policies are required to carry higher limits based on the types of vehicles they insure. Business insurance in ohio typically comes in a package that could include the following coverage: The first step in finding the right insurance coverage for your company is to know what risk challenges you face. Commercial liability insurance (also called business liability insurance and commercial general liability insurance) protects your ohio business from financial loss resulting from claims of injury or damage cause to others by you or your employees.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title oh business insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.