Omission to insure meaning Idea

Home » Trend » Omission to insure meaning IdeaYour Omission to insure meaning images are available. Omission to insure meaning are a topic that is being searched for and liked by netizens now. You can Get the Omission to insure meaning files here. Get all royalty-free images.

If you’re looking for omission to insure meaning images information linked to the omission to insure meaning interest, you have come to the ideal blog. Our site frequently gives you suggestions for refferencing the highest quality video and picture content, please kindly surf and locate more informative video articles and images that fit your interests.

Omission To Insure Meaning. Insure and also provide a kind of similarity in some cases. This term is often used interchangeably with professional liability insurance, and for the most part, they. Errors and omissions (e&o) clause definition errors and omissions (e&o) clause — a provision, usually in an obligatory reinsurance treaty, stating that an error or omission in reporting a risk that falls within the automatic reinsurance coverage under such treaty shall not invalidate the liability of the reinsurer on such omitted risk. Another term for errors and omission coverage is professional liability insurance (pli), and it is similar to malpractice insurance used in the medical industry.

Crime Of Omission Definition From einvondesign.blogspot.com

Crime Of Omission Definition From einvondesign.blogspot.com

Omission to insure additions, alterations, or extensions: [ 1] the words “punishable by law” means that the act or omission must be defined and punished by the revised penal code and no other law. Without this valuable insurance, a mistake or misrepresentation can cause a loss great enough to put the average small business out of business. Hereof which the insured may erect or acquire or for Irdan155a0012v01201718) the insurance by this policy extends to cover buildings and/or machinery, plant and other contents as defined in columns. Insured means the individual, partnership, corporation, joint venture or other entity named in item 1 of the schedule and any subsidiary and any partner.

This is in contrast to other coverages such as automobile or workers’ compensation, which have frequent minor claims, in addition to an occasional severe claim.

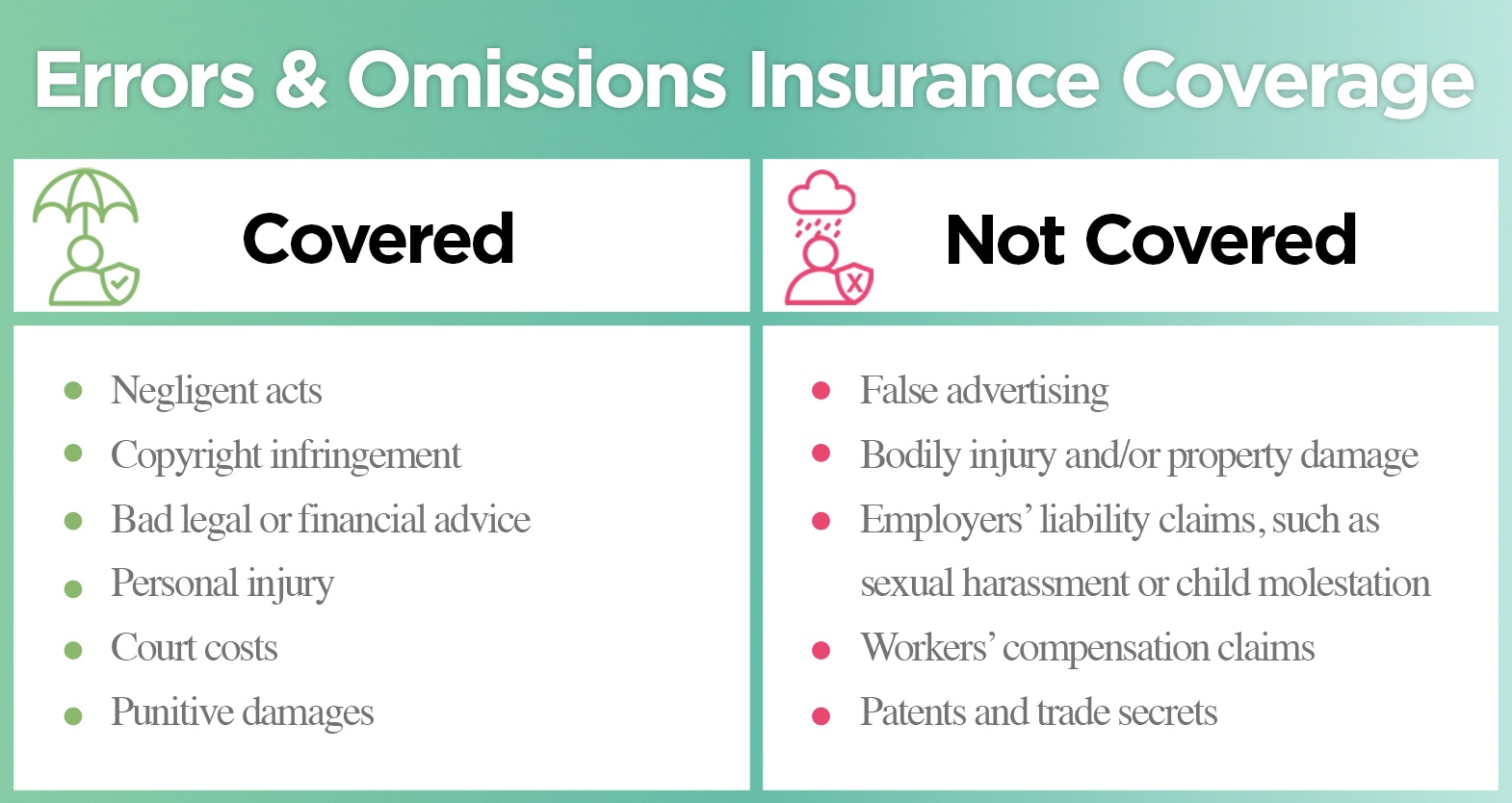

Irdan155a0012v01201718) the insurance by this policy extends to cover buildings and/or machinery, plant and other contents as defined in columns. Errors and omissions (e&o) clause definition errors and omissions (e&o) clause — a provision, usually in an obligatory reinsurance treaty, stating that an error or omission in reporting a risk that falls within the automatic reinsurance coverage under such treaty shall not invalidate the liability of the reinsurer on such omitted risk. Errors and omissions insurance policies usually cover the business owner, both salaried and hourly employees, and subcontractors working on behalf of the business. Insure has a similar secondary meaning, which is the act of taking necessary precautions in the event of uncertainty, although it is uncommon to use outside of the context of using insurance. This is in contrast to other coverages such as automobile or workers’ compensation, which have frequent minor claims, in addition to an occasional severe claim. Errors and omissions insurance provides coverage for:

Source: insurancepm.com

Source: insurancepm.com

Hereof which the insured may erect or acquire or for Insure and also provide a kind of similarity in some cases. A person doing this is said to ‘insure’ his life; Inadvertent omission to insure provisions generally provide limited coverage for physical damage to buildings or locations of an insured that have been left off a declarations or schedule of coverage, but with no intent to mislead the insurer. Insure has a similar secondary meaning, which is the act of taking necessary precautions in the event of uncertainty, although it is uncommon to use outside of the context of using insurance.

Source: slideserve.com

Source: slideserve.com

An instance of such differentiation, when a new word arises, may be found in the word ‘ensure,’ formerly spelled indifferently ‘ensure’ and ‘insure;’ whereas, at present, the latter mode refers properly to the periodical payment of a sum of money during life, in consideration of a larger sum being paid to relatives at death; Errors & omissions insurance (professional liability) is the primary coverage businesses and individuals providing these services purchase to protect from claims of mistake or misrepresentation. Errors and omissions protects you from claims in the event a customer or client sues your service business for negligent acts, errors or omissions occurring during business. How errors and omissions insurance protects your business errors and omissions insurance, also called professional liability insurance, protects your business by covering two major risks: Sometimes, the meaning will remain the.

Source: einvondesign.blogspot.com

Source: einvondesign.blogspot.com

Errors and omissions (e&o) clause definition errors and omissions (e&o) clause — a provision, usually in an obligatory reinsurance treaty, stating that an error or omission in reporting a risk that falls within the automatic reinsurance coverage under such treaty shall not invalidate the liability of the reinsurer on such omitted risk. This term is often used interchangeably with professional liability insurance, and for the most part, they. Errors and omissions (e&o) insurance is a form of insurance that covers business mistakes or undelivered services that caused financial harm to a customer. Irdan155a0012v01201718) the insurance by this policy extends to cover buildings and/or machinery, plant and other contents as defined in columns. Though architects need workers� compensation insurance (protection if an employee slips and falls in the office) and an “office package policy” (if it�s a visitor who tumbles, or there�s a fire or a burglary), the main focus of kumm�s practice is providing errors and omissions coverage—the insurance that covers claims arising from provision of architectural.

Source: prepoty.blogspot.com

Source: prepoty.blogspot.com

Errors and omissions insurance, also known as e&o insurance and professional liability insurance, helps protect you from lawsuits claiming you made a mistake in your professional services. Omission to insure additions, alteration or extensions clause (uin no: Insure has a similar secondary meaning, which is the act of taking necessary precautions in the event of uncertainty, although it is uncommon to use outside of the context of using insurance. Without this valuable insurance, a mistake or misrepresentation can cause a loss great enough to put the average small business out of business. Irdan155a0012v01201718) the insurance by this policy extends to cover buildings and/or machinery, plant and other contents as defined in columns.

Source: insurancesamadhan.com

Source: insurancesamadhan.com

Then you put the word ‘ensure,’ now you may feel, the sentences are now proper. If a dissatisfied client sues your business over a work mistake, errors and omissions (e&o) insurance can cover your legal expenses, including the cost of a settlement or judgment. What does e&o insurance cover? Or omission or any willful violation or breach of any law or regulation by such insured, if any judgment, determination or other final adjudication establishes such a deliberate conflict of interest, dishonest, deliberately fraudulent or deliberately criminal act or omission or willful violation or breach; How errors and omissions insurance protects your business errors and omissions insurance, also called professional liability insurance, protects your business by covering two major risks:

Source: snipe.fm

Source: snipe.fm

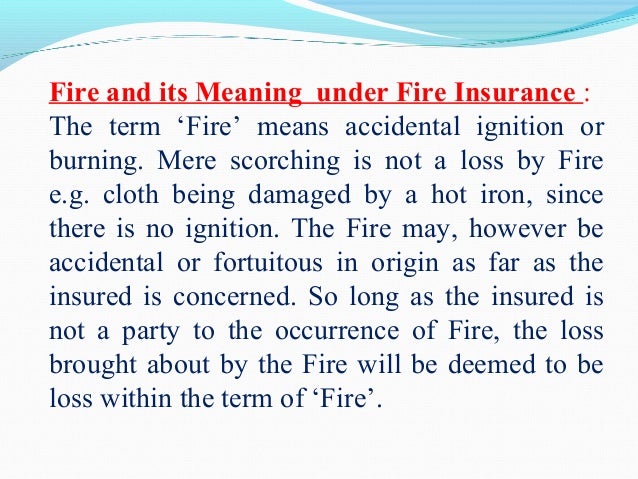

This term is often used interchangeably with professional liability insurance, and for the most part, they. Another term for errors and omission coverage is professional liability insurance (pli), and it is similar to malpractice insurance used in the medical industry. An escalation clause or phrase in a fire insurance contract effectively allows for an increase in the sum insured to cover any unexpected costs which may arise from fluctuations. Hereof which the insured may erect or acquire or for Errors and omissions (e&o) insurance is a form of insurance that covers business mistakes or undelivered services that caused financial harm to a customer.

Source: slideshare.net

Source: slideshare.net

Errors and omissions (e&o) clause definition errors and omissions (e&o) clause — a provision, usually in an obligatory reinsurance treaty, stating that an error or omission in reporting a risk that falls within the automatic reinsurance coverage under such treaty shall not invalidate the liability of the reinsurer on such omitted risk. If a dissatisfied client sues your business over a work mistake, errors and omissions (e&o) insurance can cover your legal expenses, including the cost of a settlement or judgment. This term is often used interchangeably with professional liability insurance, and for the most part, they. What does e&o insurance cover? Work mistakes and oversights accusations of negligence

Source: oregonrestoration.com

Source: oregonrestoration.com

Errors and omissions insurance policies usually cover the business owner, both salaried and hourly employees, and subcontractors working on behalf of the business. When you put the word ‘insure,’ it may look awkward and also sound wrong. Errors & omissions insurance (professional liability) is the primary coverage businesses and individuals providing these services purchase to protect from claims of mistake or misrepresentation. Errors and omissions insurance policies usually cover the business owner, both salaried and hourly employees, and subcontractors working on behalf of the business. Insured means the individual, partnership, corporation, joint venture or other entity named in item 1 of the schedule and any subsidiary and any partner.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Assure, cover, hedge, safeguard, shield, cinch, ensure, guarantee, secure. Errors and omissions insurance can be customized to meet your specific needs,. Insure has a similar secondary meaning, which is the act of taking necessary precautions in the event of uncertainty, although it is uncommon to use outside of the context of using insurance. E&o insurance — also known as errors and omissions insurance — covers the costs of legal claims or alleged damage caused to a customer by errors or unintentional omissions from your work (hence, the “errors and omissions” title). This is in contrast to other coverages such as automobile or workers’ compensation, which have frequent minor claims, in addition to an occasional severe claim.

Source: investopedia.com

Source: investopedia.com

Error and omissions coverage ensures financial losses due to perceived errors or oversights of the insured party. Insured means the individual, partnership, corporation, joint venture or other entity named in item 1 of the schedule and any subsidiary and any partner. Errors and omissions (e&o) insurance is a form of insurance that covers business mistakes or undelivered services that caused financial harm to a customer. Errors and omissions insurance provides coverage for: The insured having intended to insure all property insured within the geographical limits in which the insured is interested and it being the insured’s belief that all such property is insured ( for the avoidance of doubt, this extension shall not apply where the insured deliberately or recklessly omitted the property ), if hereafter any such.

Source: rethority.com

Source: rethority.com

An instance of such differentiation, when a new word arises, may be found in the word ‘ensure,’ formerly spelled indifferently ‘ensure’ and ‘insure;’ whereas, at present, the latter mode refers properly to the periodical payment of a sum of money during life, in consideration of a larger sum being paid to relatives at death; Errors and omissions insurance provides coverage for: Work mistakes and oversights accusations of negligence Irdan155a0012v01201718) the insurance by this policy extends to cover buildings and/or machinery, plant and other contents as defined in columns. Omission to insure additions, alteration or extensions clause (uin no:

Source: errorsandomissions.ca

Source: errorsandomissions.ca

An instance of such differentiation, when a new word arises, may be found in the word ‘ensure,’ formerly spelled indifferently ‘ensure’ and ‘insure;’ whereas, at present, the latter mode refers properly to the periodical payment of a sum of money during life, in consideration of a larger sum being paid to relatives at death; An escalation clause or phrase in a fire insurance contract effectively allows for an increase in the sum insured to cover any unexpected costs which may arise from fluctuations. Errors and omissions insurance policy means an errors and omissions insurance policy maintained by the master servicer, the special servicer, the trustee, the custodian or the certificate administrator, as the case may be, in accordance with section 8.2, section 9.2 and section 7.17, respectively. Omission to insure additions, alterations, or extensions: How errors and omissions insurance protects your business errors and omissions insurance, also called professional liability insurance, protects your business by covering two major risks:

Source: myplatinumresign.blogspot.com

Source: myplatinumresign.blogspot.com

If a dissatisfied client sues your business over a work mistake, errors and omissions (e&o) insurance can cover your legal expenses, including the cost of a settlement or judgment. Though architects need workers� compensation insurance (protection if an employee slips and falls in the office) and an “office package policy” (if it�s a visitor who tumbles, or there�s a fire or a burglary), the main focus of kumm�s practice is providing errors and omissions coverage—the insurance that covers claims arising from provision of architectural. Irdan155a0012v01201718) the insurance by this policy extends to cover buildings and/or machinery, plant and other contents as defined in columns. The insured having intended to insure all property insured within the geographical limits in which the insured is interested and it being the insured’s belief that all such property is insured ( for the avoidance of doubt, this extension shall not apply where the insured deliberately or recklessly omitted the property ), if hereafter any such. E&o insurance — also known as errors and omissions insurance — covers the costs of legal claims or alleged damage caused to a customer by errors or unintentional omissions from your work (hence, the “errors and omissions” title).

Source: wallstreetmojo.com

Source: wallstreetmojo.com

What does e&o insurance cover? Though architects need workers� compensation insurance (protection if an employee slips and falls in the office) and an “office package policy” (if it�s a visitor who tumbles, or there�s a fire or a burglary), the main focus of kumm�s practice is providing errors and omissions coverage—the insurance that covers claims arising from provision of architectural. What does errors and omissions insurance cover? This is in contrast to other coverages such as automobile or workers’ compensation, which have frequent minor claims, in addition to an occasional severe claim. Claim means a demand for monetary compensation, a legal proceeding in a court seeking monetary damages, and includes an arbitration proceeding.

Source: einvondesign.blogspot.com

Source: einvondesign.blogspot.com

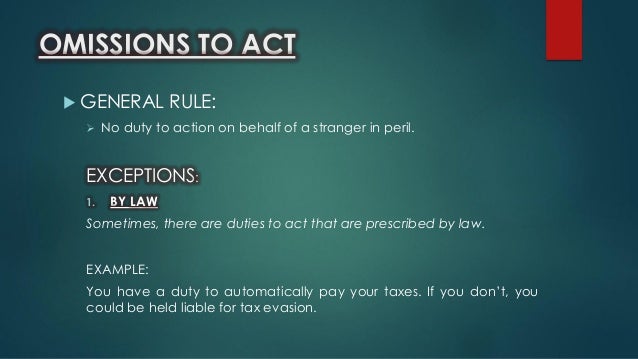

Errors & omissions insurance (professional liability) is the primary coverage businesses and individuals providing these services purchase to protect from claims of mistake or misrepresentation. This is in contrast to other coverages such as automobile or workers’ compensation, which have frequent minor claims, in addition to an occasional severe claim. [ 1] the words “punishable by law” means that the act or omission must be defined and punished by the revised penal code and no other law. Sometimes, the meaning will remain the. Or omission or any willful violation or breach of any law or regulation by such insured, if any judgment, determination or other final adjudication establishes such a deliberate conflict of interest, dishonest, deliberately fraudulent or deliberately criminal act or omission or willful violation or breach;

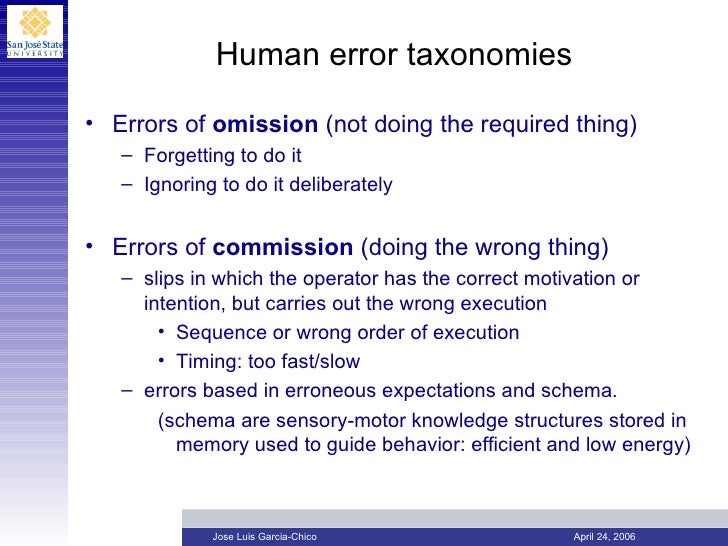

Errors and omissions protects you from claims in the event a customer or client sues your service business for negligent acts, errors or omissions occurring during business. Work mistakes and oversights accusations of negligence Felony is defined under the code as an act or omission punishable by law, committed through culpa or dolo. This term is often used interchangeably with professional liability insurance, and for the most part, they. When you put the word ‘insure,’ it may look awkward and also sound wrong.

Source: imbillionaire.net

Source: imbillionaire.net

Act or omission punishable by law under the penal code. What does e&o insurance cover? Errors and omissions insurance provides coverage for: Errors and omissions insurance policy means an errors and omissions insurance policy maintained by the master servicer, the special servicer, the trustee, the custodian or the certificate administrator, as the case may be, in accordance with section 8.2, section 9.2 and section 7.17, respectively. An escalation clause or phrase in a fire insurance contract effectively allows for an increase in the sum insured to cover any unexpected costs which may arise from fluctuations.

Source: reddit.com

Source: reddit.com

Error and omissions coverage ensures financial losses due to perceived errors or oversights of the insured party. E&o insurance — also known as errors and omissions insurance — covers the costs of legal claims or alleged damage caused to a customer by errors or unintentional omissions from your work (hence, the “errors and omissions” title). Errors and omissions insurance, also known as e&o insurance and professional liability insurance, helps protect you from lawsuits claiming you made a mistake in your professional services. What does errors and omissions insurance cover? Felony is defined under the code as an act or omission punishable by law, committed through culpa or dolo.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title omission to insure meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.