Oregon state minimum insurance limits Idea

Home » Trend » Oregon state minimum insurance limits IdeaYour Oregon state minimum insurance limits images are ready in this website. Oregon state minimum insurance limits are a topic that is being searched for and liked by netizens today. You can Get the Oregon state minimum insurance limits files here. Find and Download all free photos and vectors.

If you’re searching for oregon state minimum insurance limits images information linked to the oregon state minimum insurance limits topic, you have pay a visit to the right blog. Our website frequently provides you with hints for downloading the maximum quality video and image content, please kindly surf and find more enlightening video content and graphics that match your interests.

Oregon State Minimum Insurance Limits. This means that claims under your commercial car insurance policy will be covered under one limit. Workers� compensation state minimum limits: This coverage is for any one employee. What are the minimum limits for oregon?

Texas Minimum Car Insurance Requirements dailydesigns2 From dailydesigns2.blogspot.com

You can expect to see coverage limits ranging from $500,000 into the millions. In oregon, you must present proof of insurance in order to register a car and whenever asked to do so by a police officer during a traffic stop or accident. This coverage is for any one employee. There isn�t an insurance product called full coverage. This means that claims under your commercial car insurance policy will be covered under one limit. Oregon state minimum insurance limits.

Bodily injury and property damage liability.

$15,000 for bodily injury per person $45,000 for bodily injury per accident $25,000 for property damage per accident what is bodily injury liability coverage? State minimum car insurance limits ; The state of oregon mandates that every driver carry a minimum amount of pip coverage. It must provide the minimum limits of coverage required under ors 806.070 (minimum payment schedule). This means that claims under your commercial car insurance policy will be covered under one limit. For attorneys, the oregon state bar professional liability fund provides $300,000 aggregate limits of coverage.

![Bodily Injury Liability [What does it Cover?] Ogletree Bodily Injury Liability [What does it Cover?] Ogletree](https://1e35zd38s7lpfp54m2zqvatv-wpengine.netdna-ssl.com/wp-content/uploads/2019/09/liability-limits-by-state.jpg) Source: insurancequotes2day.com

Source: insurancequotes2day.com

In the event of a covered accident, your limits for bodily injury are $25,000 per person, with a total maximum of $50,000 per incident. It must provide the minimum limits of coverage required under ors 806.070 (minimum payment schedule). This provides bodily injury liability of $20,000 per person and $40,000 per accident, and property damage liability would be $15,000 per accident. You can expect to see coverage limits ranging from $500,000 into the millions. This means that claims under your commercial car insurance policy will be covered under one limit.

Source: noyeshallallen.com

Source: noyeshallallen.com

In oregon, it is illegal to drive without liability coverage. It differs by state, but it usually falls around the $15,000/$30,000 mark. Oregon’s minimum car insurance requirements comprise a limit of 25/50/20. For example, you might see $20,000/$40,000/$15,000, or 20/40/15. In addition to this, your policy must have personal injury protection, uninsured and underinsured motorist coverage.

Source: revisi.net

Source: revisi.net

$25,000 liability coverage for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle $50,000 liability coverage for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle An umbrella liability policy provides extra protection above standard policy limits. If you cause an accident in oregon, this type of coverage pays the other. The required minimum amounts of car insurance in oregon are: The average cost of full coverage car insurance in oregon is $1,383 per year, or about $115 per month, according to nerdwallet’s analysis.

Source: revisi.net

Source: revisi.net

For most drivers in oregon auto insurance is required to have at least $25,000 per person/maximum of $50,000 per accident for bodily injury, $20,000 for property damage, $15,000 in personal injury protection (pip), and $25,000 per person/maximum of $50,000 per accident for bodily injury for uninsured motorist. It differs by state, but it usually falls around the $15,000/$30,000 mark. Primary insurance coverage during period 1 with minimum liability limits of $50,000 per person for death and injury, $100,000 per incident for death and injury and $25,000 for property damage, plus any other state compulsory coverage to the extent required by law. It also covers up to $20,000 for damage to another person’s property. The minimum insurance a driver must have is:

Source: gajizmo.com

Source: gajizmo.com

Primary insurance coverage during period 1 with minimum liability limits of $50,000 per person for death and injury, $100,000 per incident for death and injury and $25,000 for property damage, plus any other state compulsory coverage to the extent required by law. It must provide the minimum limits of coverage required under ors 806.070 (minimum payment schedule). State minimum limits for workers� compensation are pretty universal. $15,000 for bodily injury per person $45,000 for bodily injury per accident $25,000 for property damage per accident what is bodily injury liability coverage? In oregon, you must present proof of insurance in order to register a car and whenever asked to do so by a police officer during a traffic stop or accident.

Source: youtube.com

Source: youtube.com

$25,000 for bodily injury, per person. State minimum car insurance means a policy that meets the state coverage requirements for you to drive legally. With those hypothetical limits, your liability coverage would pay up to $15,000 per person for bodily injuries caused to people in the van but no more than $30,000 in. In oregon, it is illegal to drive without liability coverage. Minimum insurance requirements for oregon the minimum amount of oregon auto insurance coverage is $25,000/$50,000/$20,000.

Source: carinsurancelist.com

Source: carinsurancelist.com

If you cause an accident in oregon, this type of coverage pays the other. Coverage is to be maintained by the tnc. You can expect to see coverage limits ranging from $500,000 into the millions. It must provide the minimum limits of coverage required under ors 806.070 (minimum payment schedule). In oregon, you�ll need to have at least the following minimums of liability insuranc e:

Source: news.leavitt.com

Source: news.leavitt.com

State minimum coverage typically includes: Coverage is to be maintained by the tnc. $25,000 bodily injury per person $50,000 bodily injury per accident $20,000 property damage per accident —or— 25/50/20 dairyland ® coverage in oregon at dairyland, we’re proud to be able to help drivers in oregon meet their insurance needs. The average cost of full coverage car insurance in oregon is $1,383 per year, or about $115 per month, according to nerdwallet’s analysis. Oregon car insurance laws & state minimum coverage limits oregon car insurance laws require minimum liability rates of 25/50/20 for bodily injury and property damage coverage.

Source: rosslawpdx.com

Source: rosslawpdx.com

$50,000 per crash for bodily injury to others; In the event of a covered accident, your limits for bodily injury are $25,000 per person, with a total maximum of $50,000 per incident. The policy has to meet the minimum coverage amounts (limits): You can expect to see coverage limits ranging from $500,000 into the millions. In the example above, these numbers mean that your state minimum responsibility is:

Source: nyautoquotes.com

Source: nyautoquotes.com

It also covers up to $20,000 for damage to another person’s property. It differs by state, but it usually falls around the $15,000/$30,000 mark. If you cause an accident in oregon, this type of coverage pays the other. $50,000 per crash for bodily injury to others; In oregon, you must present proof of insurance in order to register a car and whenever asked to do so by a police officer during a traffic stop or accident.

Source: vogrigdesign.blogspot.com

Source: vogrigdesign.blogspot.com

Coverage is to be maintained by the tnc. It also covers up to $20,000 for damage to another person’s property. In oregon, it is illegal to drive without liability coverage. If you cause an accident in oregon, this type of coverage pays the other. The required minimum amounts of car insurance in oregon are:

Source: rueinsurance.com

Source: rueinsurance.com

The state of oregon mandates that every driver carry a minimum amount of pip coverage. In oregon, it is illegal to drive without liability coverage. In oregon, you�ll need to have at least the following minimums of liability insuranc e: If you cause an accident in oregon, this type of coverage pays the other. $50,000 per crash for bodily injury to others;

Source: carinsurancelist.com

Source: carinsurancelist.com

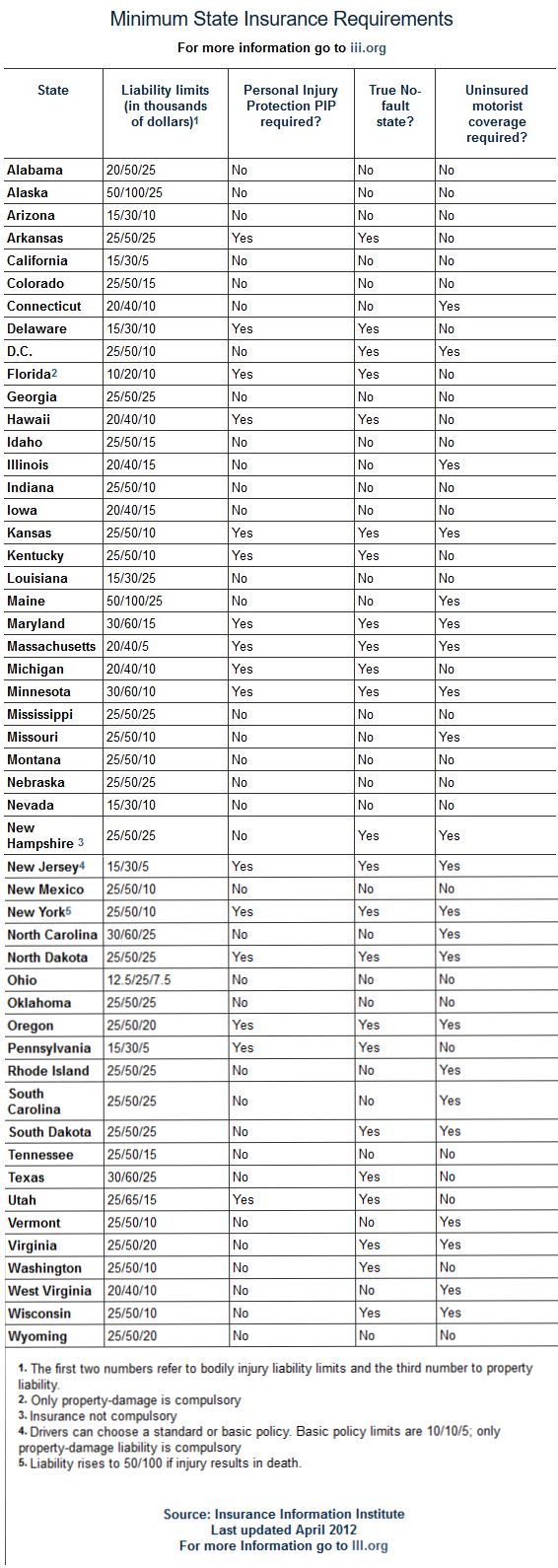

If the potential risk exposure is greater than this amount, consider requesting higher limits of coverage. For most drivers in oregon auto insurance is required to have at least $25,000 per person/maximum of $50,000 per accident for bodily injury, $20,000 for property damage, $15,000 in personal injury protection (pip), and $25,000 per person/maximum of $50,000 per accident for bodily injury for uninsured motorist. Here are some of the parameters of our insurance coverage in oregon: 52 rows coverage limits are displayed like 15/45/25 or $15,000/$45,000/$25,000. It must provide the minimum limits of coverage required under ors 806.070 (minimum payment schedule).

Source: dailydesigns2.blogspot.com

Bodily injury and property damage liability. If you cause an accident in oregon, this type of coverage pays the other. Coverage is to be maintained by the tnc. It also covers up to $20,000 for damage to another person’s property. This does not mean you can�t have higher limits, but these are the limits you must have to be legal to drive in oregon.

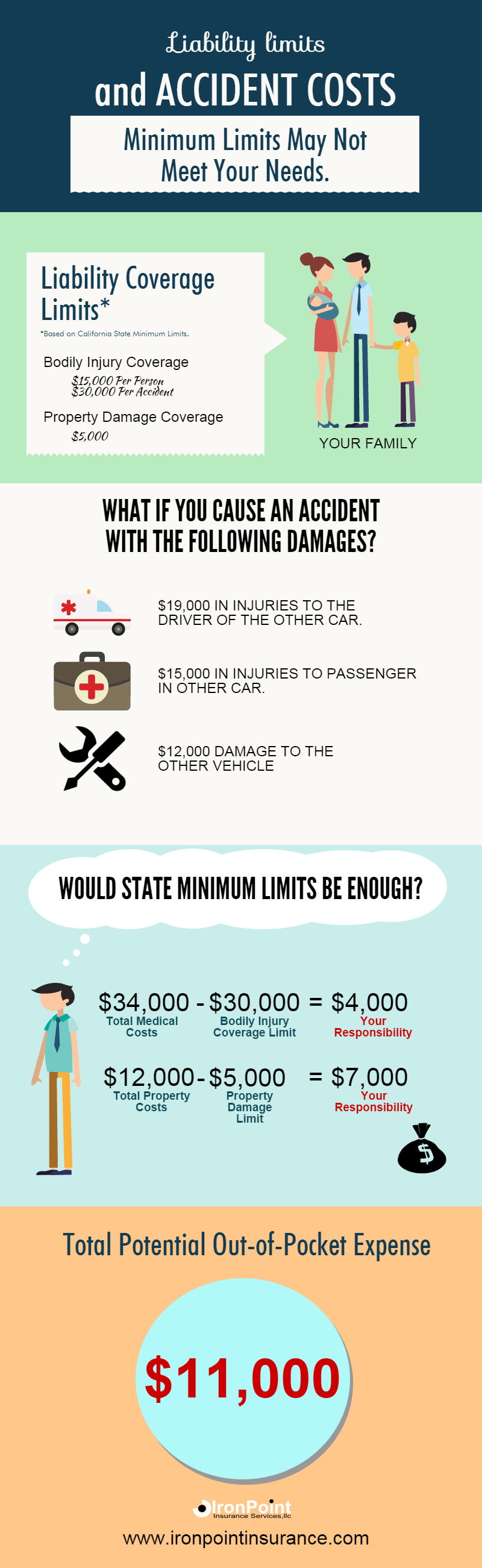

Source: ironpointinsurance.com

Source: ironpointinsurance.com

If you cause an accident in oregon, this type of coverage pays the other party�s medical bills and repair costs — up to $25,000 for each person injured. With those hypothetical limits, your liability coverage would pay up to $15,000 per person for bodily injuries caused to people in the van but no more than $30,000 in. This type of insurance will cover you and your passenger(s) medical bills following an accident. Many people insist on minimum limits. This means that claims under your commercial car insurance policy will be covered under one limit.

Source: carinsurancelist.com

Source: carinsurancelist.com

Participation in this program is mandatory for all attorneys engaged in private practice whose principal office is in oregon. $25,000 for bodily injury, per person. This provides bodily injury liability of $20,000 per person and $40,000 per accident, and property damage liability would be $15,000 per accident. $25,000 bodily injury per person “to abide by state law, oregon drivers must purchase the following amounts of coverage: $15,000 for bodily injury per person $45,000 for bodily injury per accident $25,000 for property damage per accident what is bodily injury liability coverage?

Source: kirkendallinsurance.com

Source: kirkendallinsurance.com

Types of commercial car insurance Liability insurance helps cover costs incurred by injuries to another person or by property damage in an accident that you cause. $15,000 for bodily injury per person $45,000 for bodily injury per accident $25,000 for property damage per accident what is bodily injury liability coverage? Oregon state minimum insurance limits. With those hypothetical limits, your liability coverage would pay up to $15,000 per person for bodily injuries caused to people in the van but no more than $30,000 in.

Source: carinsurancelist.com

Source: carinsurancelist.com

$25,000 bodily injury per person $50,000 bodily injury per accident $20,000 property damage per accident —or— 25/50/20 dairyland ® coverage in oregon at dairyland, we’re proud to be able to help drivers in oregon meet their insurance needs. Coverage is to be maintained by the tnc. If you cause an accident in oregon, this type of coverage pays the other party�s medical bills and repair costs — up to $25,000 for each person injured. An umbrella liability policy provides extra protection above standard policy limits. The state of oregon mandates that every driver carry a minimum amount of pip coverage.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title oregon state minimum insurance limits by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.