Oriental health insurance claim settlement ratio information

Home » Trending » Oriental health insurance claim settlement ratio informationYour Oriental health insurance claim settlement ratio images are ready in this website. Oriental health insurance claim settlement ratio are a topic that is being searched for and liked by netizens now. You can Find and Download the Oriental health insurance claim settlement ratio files here. Find and Download all free images.

If you’re searching for oriental health insurance claim settlement ratio images information connected with to the oriental health insurance claim settlement ratio keyword, you have come to the ideal site. Our website frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly search and find more enlightening video content and graphics that match your interests.

Oriental Health Insurance Claim Settlement Ratio. 2) icr can be more than 0% and even more than 100%. Oriental health insurance plan covers maximum 7 members of your family with up to 3 children and 4 adults. We can say that the remaining 2% are rejected by that company. Oriental insurance leads with minimal rejection ratio when it.

Best Health Insurance Companies in IndiaBased on IRDA Data From basunivesh.com

Best Health Insurance Companies in IndiaBased on IRDA Data From basunivesh.com

- icr ideal ratio could be 60% to 90%. Oriental health insurance plan covers maximum 7 members of your family with up to 3 children and 4 adults. For example, if a company has settled 98 claims out of the 100 claims that it received, then the claim settlement ratio of that company is 98%. In the financial year of 2019, the insurance company had a claim settlement ratio of above 80%. Enjoy cashless and reimbursement mode of claim settlement of oriental health insurance. 55 crores in settling claims and has earned rs.

What is claim ratio in health insurance?

Claim settlement ratio (csr) is the most important factor to access the credibility of the insurer and its capacity to remit claims. So, if an insurance company settles 95 out of 100 claims made on it in one financial year, its claim settlement ratio would be 95%. For instance, if an insurance provider has paid rs. It would not cross 100. Claims settlement ratio (csr) is referred to as the ratio of the settled claims against the total number of claims made in a financial year. We can say that the remaining 2% are rejected by that company.

Source: relakhs.com

Source: relakhs.com

Enjoy cashless and reimbursement mode of claim settlement of oriental health insurance. It is figured out as the total number of claims received against the total number of claims settled. 3) icr ideal ratio could be 60% to 90%. Oriental health insurance at a glance: Enjoy cashless and reimbursement mode of claim settlement of oriental health insurance.

Source: turtlemint.com

Source: turtlemint.com

It can be found by using the simple formula given below: Find out more about the claim settlement procedure, incurred claim ratio, documents required, etc. For example, if a company has settled 98 claims out of the 100 claims that it received, then the claim settlement ratio of that company is 98%. Claim settlement ratio (csr) = (total claims settled or paid)/ (total claims received+outstanding claims at the beginning of. Hence, the insurer may have recorded a ratio between 90% and 95%, but the claim settlement process may still take as long as four to six months, making it a.

Source: moneymonc.com

Source: moneymonc.com

It can be found by using the simple formula given below: We can say that the remaining 2% are rejected by that company. This is computed for life insurance companies. It can be found by using the simple formula given below: *csr changes from time to time.

Source: comparepolicy.com

Source: comparepolicy.com

Find out more about the claim settlement procedure, incurred claim ratio, documents required, etc. Enjoy cashless and reimbursement mode of claim settlement of oriental health insurance. For instance, if an insurance provider has paid rs. Claims settlement ratio (csr) is referred to as the ratio of the settled claims against the total number of claims made in a financial year. Oriental health insurance versus new india health insurance.

Source: basunivesh.com

Source: basunivesh.com

This health claim ratio determines the insurer’s ability to settle your mediclaim requests. Hence, the insurer may have recorded a ratio between 90% and 95%, but the claim settlement process may still take as long as four to six months, making it a. Oriental health insurance at a glance: Oriental health insurance offers over 10 health insurance policies for individuals, families, senior citizens, corporate groups (employees) and. So, if an insurance company settles 95 out of 100 claims made on it in one financial year, its claim settlement ratio would be 95%.

Source: urbanfoxdesigns.blogspot.com

Source: urbanfoxdesigns.blogspot.com

Claim settlement ratio (csr) = (total claims settled or paid)/ (total claims received+outstanding claims at the beginning of. Hence, the insurer may have recorded a ratio between 90% and 95%, but the claim settlement process may still take as long as four to six months, making it a. Claim settlement ratio is the number of claims paid over the total claims received. *csr changes from time to time. Check oriental health insurance life health insurance claim settlement ratio, process, form at insurancedekho.

Source: globalass.info

Source: globalass.info

In the financial year of 2019, the insurance company had a claim settlement ratio of above 80%. The claim settlement ratio refers to the number of claims filed against the total number of claims received. For example, if a company has settled 98 claims out of the 100 claims that it received, then the claim settlement ratio of that company is 98%. The two insurers topped the list of. Oriental insurance is at top with 92.71% and new india insurance with 91.99% claim settlement ratios.

Source: basunivesh.com

Source: basunivesh.com

55 crores in settling claims and has earned rs. Check oriental health insurance life health insurance claim settlement ratio, process, form at insurancedekho. Oriental insurance leads with minimal rejection ratio when it. Oriental insurance is at top with 92.71% and new india insurance with 91.99% claim settlement ratios. Claim settlement ratio is the percentage of claims settled by the insurance company against the total number of claims made against it.

Source: bankbazaar.com

Source: bankbazaar.com

Oriental health insurance claim settlement ratio reflects positively on the insurer’s dependency, which makes it a great choice to buy medical insurance online. The claim settlement ratio refers to the number of claims filed against the total number of claims received. This health claim ratio determines the insurer’s ability to settle your mediclaim requests. Claim settlement ratio is the percentage of claims settled by the insurance company against the total number of claims made against it. *csr changes from time to time.

Source: relakhs.com

Source: relakhs.com

Claim settlement ratio claim settlement ratio is the percentage of claims that an insurance company has paid out in a financial year compared to the number of claims received. What is claim ratio in health insurance? Are highly sought after because of the extensive coverage benefits they provide. Claim settlement ratio claim settlement ratio is the percentage of claims that an insurance company has paid out in a financial year compared to the number of claims received. 2) icr can be more than 0% and even more than 100%.

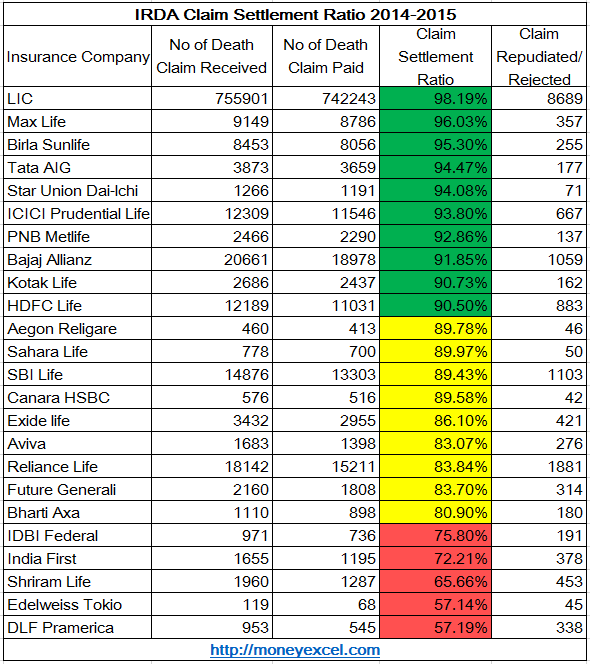

Source: moneyexcel.com

Source: moneyexcel.com

However claim settlement ratio would be between 1% to 100%. Oriental insurance leads with minimal rejection ratio when it. It helps the customers in identifying the ability of the insurer to meet their claim requests. Claim settlement ratio (csr) is the most important factor to access the credibility of the insurer and its capacity to remit claims. Claim settlement ratio is the number of claims paid over the total claims received.

Source: designersfore.blogspot.com

For instance, if an insurance provider has paid rs. Claim settlement ratio is the number of claims paid over the total claims received. 55 crores in settling claims and has earned rs. 66% and 90% are big differences and hence it is important to stick to one mode of calculation when comparing trends. So, if an insurance company settles 95 out of 100 claims made on it in one financial year, its claim settlement ratio would be 95%.

Source: insurancedekho.com

Claim settlement ratio is the percentage of claims settled by the insurance company against the total number of claims made against it. Claims settlement ratio (csr) is referred to as the ratio of the settled claims against the total number of claims made in a financial year. While oriental insurance settled 91.5% of claims that came up for processing, iffco tokio had a settlement ratio of 92.5% for overall claims across segments. So, if an insurance company settles 95 out of 100 claims made on it in one financial year, its claim settlement ratio would be 95%. The claim settlement ratio refers to the number of claims filed against the total number of claims received.

Source: insurancedekho.com

Source: insurancedekho.com

However claim settlement ratio would be between 1% to 100%. You can apply and buy an oriental health insurance policy online from the official website of the company. 29 rows calculating the health insurance claim settlement ratio is not at all difficult. This percentage is regarded to be a reliable metric for determining if an insurer comes to your rescue when the need arises. Check oriental health insurance life health insurance claim settlement ratio, process, form at insurancedekho.

Source: basunivesh.com

Source: basunivesh.com

Claim settlement ratio (csr) = (total claims settled or paid)/ (total claims received+outstanding claims at the beginning of. It is calculated as the. In the financial year of 2019, the insurance company had a claim settlement ratio of above 80%. This percentage is regarded to be a reliable metric for determining if an insurer comes to your rescue when the need arises. The claim settlement ratio refers to the number of claims filed against the total number of claims received.

Source: davidferroviariofotosedocumentos.blogspot.com

Source: davidferroviariofotosedocumentos.blogspot.com

The two insurers topped the list of. For example, if a company has settled 98 claims out of the 100 claims that it received, then the claim settlement ratio of that company is 98%. It can be found by using the simple formula given below: This is computed for life insurance companies. Health insurance policies provided by the new india assurance co.

Source: investify.in

Source: investify.in

- icr can be more than 0% and even more than 100%. Are highly sought after because of the extensive coverage benefits they provide. Oriental health insurance claim settlement ratio reflects positively on the insurer’s dependency, which makes it a great choice to buy medical insurance online. For instance, if an insurance provider has paid rs. You can apply and buy an oriental health insurance policy online from the official website of the company.

Source: financialspeaks.com

Source: financialspeaks.com

- icr ideal ratio could be 60% to 90%. 55 crores in settling claims and has earned rs. We can say that the remaining 2% are rejected by that company. Hence, the insurer may have recorded a ratio between 90% and 95%, but the claim settlement process may still take as long as four to six months, making it a. *csr changes from time to time.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title oriental health insurance claim settlement ratio by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.